What happens when one of the most talked-about market educators in India comes under the scanner of the country’s top regulator? The Avadhut Sathe penalty has sparked intense debate across the trading community.

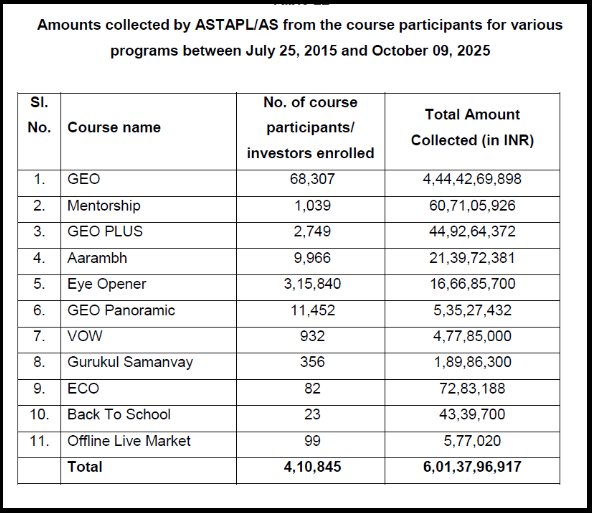

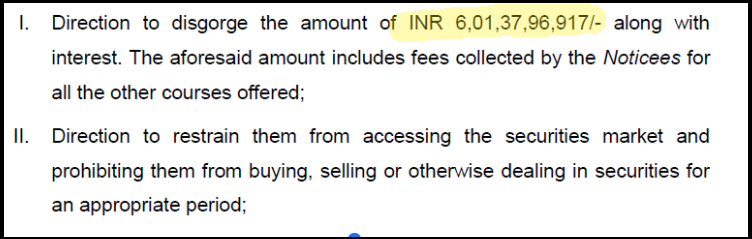

SEBI reportedly imposed a massive ₹6,01,37,96,917 action against entities linked to him, raising serious questions about compliance, advisory practices, and the boundaries of financial education.

For thousands who followed his methods, this wasn’t just another regulatory update; it was a wake-up call.

In this blog, we break down what the SEBI order says, why such a hefty penalty was reportedly imposed, and what it means for traders, investors, and the broader financial ecosystem.

Avadhut Sathe

Avadhut Sathe has long been a well-known name in India’s stock market education space.

Through his platform, the Avadhut Sathe Trading Academy (ASTA), he built a large following of aspiring traders who were drawn to his structured programs, community-driven learning style, and high-energy mentorship approach.

For many, ASTA was not just a training institute; it was a complete ecosystem.

But this very ecosystem has now come under scrutiny in light of the recent SEBI order, which questions the nature of the services offered and whether they crossed the line from education into unregistered advisory activities.

Avadhut Sathe Courses

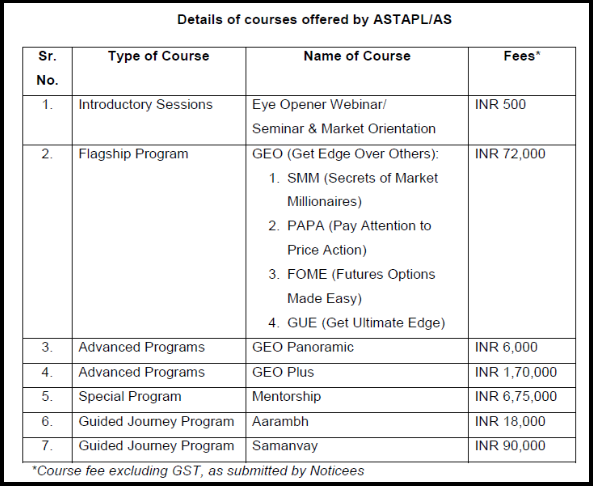

ASTAPL developed a tiered learning system designed to cater to beginners, intermediate learners, and advanced traders. Programs spanned from foundational webinars to high-ticket mentorship cycles:

These offerings created a strong and loyal learner base, supported through online sessions, recorded modules, and WhatsApp community groups.

However, SEBI’s allegations now put these programs under the microscope, raising questions about whether some of these paid services, especially premium mentorship and strategy-driven discussions, constituted investment advice without proper registration.

Avadhut Sathe SEBI Order

On the surface, Avadhut Sathe’s academy looked like a place where people could learn trading.

But once SEBI dug into how these courses actually worked, a very different story emerged.

For years, Sathe built his programs around the promise of “education,” but inside the sessions, he went far beyond teaching concepts.

Participants weren’t just learning theory; they were receiving direct, actionable trading instructions.

1. Live Market Tips Disguised as Lessons

During live online classes, Sathe regularly:

- Pointed out specific stocks to buy,

- Gave entry and exit prices,

- Announced stop-loss levels,

- Predicted immediate market movement, and

- Shared his own trades in real time to influence participants’ decisions.

This wasn’t education anymore. It was a full-blown investment advisory activity, just delivered under the label of a “course.”

2. WhatsApp Groups Functioned Like Tip Channels

Each paid batch came with WhatsApp groups where Sathe and his team:

- Sent out daily stock recommendations,

- Posted strategy alerts, and

- Continued advising the classroom.

Participants relied on these messages the way they would rely on a stock advisor—not a teacher.

3. Marketing Based on Fake Success Stories

To attract new customers, the academy shared videos of “students” claiming they’d made huge profits after joining the courses.

But SEBI checked the actual trades of these individuals and found they were mostly in losses, some of them significant.

So the testimonials weren’t reflections of reality—they were part of a carefully curated marketing strategy to bring in more paying customers.

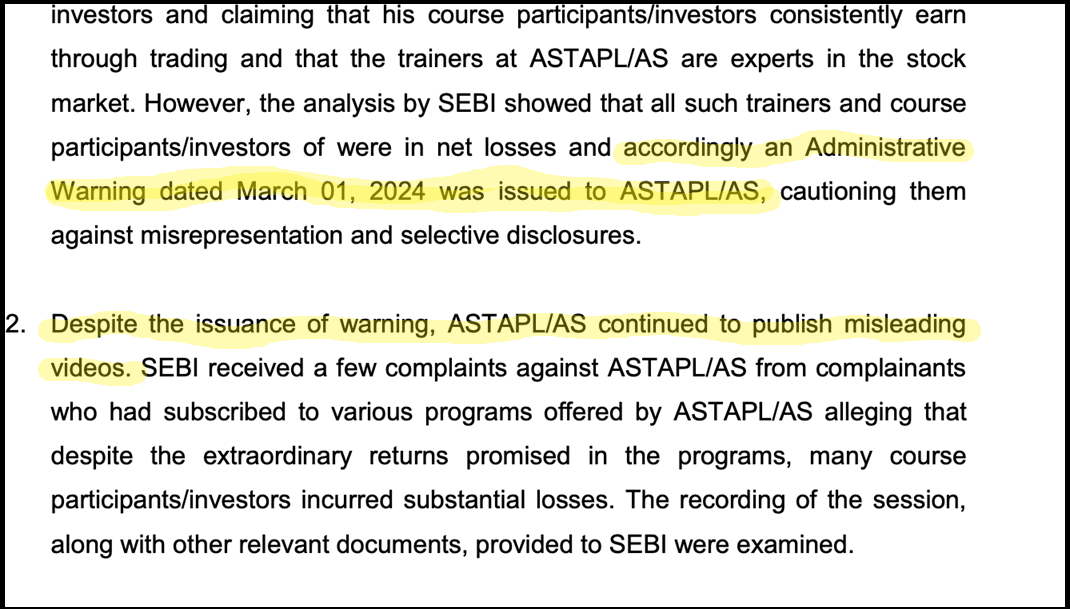

4. All This Continued Even After SEBI’s Warning

SEBI had already warned Sathe in March 2024 to stop giving stock-specific advice and to stop making profit claims.

But the pattern didn’t stop.

- The courses continued the same way.

- The groups continued the same way.

- The promotions continued the same way.

5. The Scale Was Massive

Between 2015 and 2025, more than 3.37 lakh people signed up for these courses.

The academy collected over ₹601 crore, all while engaging in activities that require SEBI registration but without holding any such registration.

Avadhut Sathe SEBI Order Noticees

The order names three key parties, collectively called the “Noticees”:

- Avadhut Sathe Trading Academy Private Limited (ASTAPL): The corporate entity was incorporated in January 2020.

- Avadhut Dinkar Sathe (AS): The main trainer, founder, and director. He was also the sole proprietor of the earlier proprietorship firm.

- Gouri Avadhut Sathe (GS): Director of ASTAPL and spouse of AS. She is also an Authorised Person of a registered stockbroker.

A critical fact established by SEBI is that none of these entities holds SEBI registration as an Investment Adviser or a Research Analyst, which is mandatory for providing such services.

The Real Operating Pattern Behind Avadhut Sathe’s Courses

Avadhut Sathe’s training ecosystem wasn’t just about teaching charts or market theory.

As SEBI uncovered, the way his programs were structured created a seamless flow from “learning” to taking real-time trading actions based directly on his cues.

The entire setup, live sessions, WhatsApp groups, marketing funnels, and mentorship layers, worked together like a coordinated engine that quietly delivered stock advice under the label of education.

Here’s how that operating pattern unfolded in practice:

Step 1: Build an Audience

Used YouTube, Instagram, and flashy reels to attract followers with charismatic, simplified market content.

Step 2: Offer a Low-Cost Entry Point

Invited followers into ₹500 “Eye Opener” webinars that blended basic education with impressive, pre-planned trade demonstrations.

Step 3: Create the Illusion of Success

Concluded initial sessions with a specific stock pick and scheduled a follow-up to showcase its performance, building false credibility.

Step 4: Upsell to Expensive Programs

Once hooked, participants were guided into tiered, high-fee courses like GEO (₹72,000) and eventually the premium Mentorship (₹6.75 Lakhs).

Step 5: Deliver “Education” as Live Advisory

In paid sessions, trainers used live market data, shared their own trades, and gave specific entry and exit levels for stocks, blurring the line between teaching and advising.

Step 6: Foster a Closed Community

Enrolled participants were added to exclusive, paid WhatsApp groups where stock signals and analysis were regularly shared, creating a continuous cycle of engagement.

Step 7: Lock Them In

Implemented strict no-refund policies and used “alumni” and “family” branding to foster loyalty and discourage participants from exiting the system.

Step 8: Scale Through Repetition

The same stock recommendations were broadcast simultaneously across multiple paid WhatsApp groups, reaching thousands of paying members at once to maximize reach and fees.

How Avadhut Sathe Misled Thousands of Investors?

Many people who signed up for Avadhut Sathe’s programs weren’t looking for shortcuts; they were simply hoping to gain clarity in a confusing market.

But the way the courses were packaged and promoted created expectations that didn’t match reality.

Investors were drawn in by confident claims, polished success stories, and the promise of a proven method, only to discover later that the information they relied on wasn’t as transparent or reliable as it appeared.

Here’s how that gap between expectation and reality was created:

1. Stock Advice Disguised as Education in Live Sessions

ASTAPL conducted sessions like GEO, GEO Plus, Mentorship, and Eye Opener where trainer Avadhut Sathe (AS):

- Shared his live trading positions and Mark-to-Market gains.

- Gave specific stock calls with price targets, stop-losses, and risk-reward ratios.

- Encouraged participants to invest their savings or FD money into specific stocks for “higher returns.”

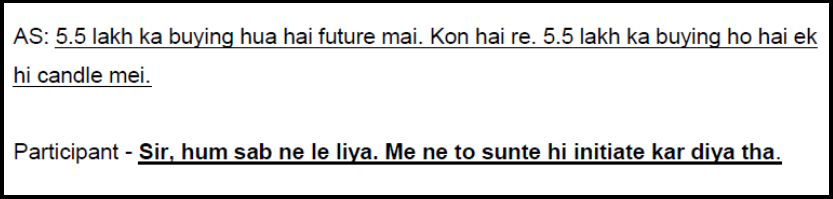

Example from a session transcript (April 28, 2025):

Avadhut Sathe: “Power Finance Corporation… if this range breaks then target is 354… I have bought futures… you can also buy.”

Participant: “Sir, we have also taken the position.”

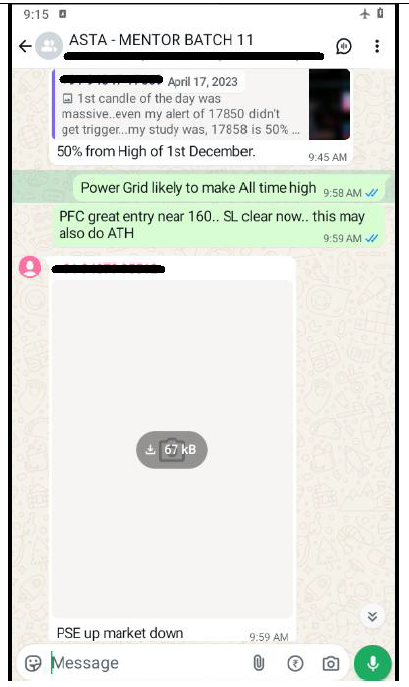

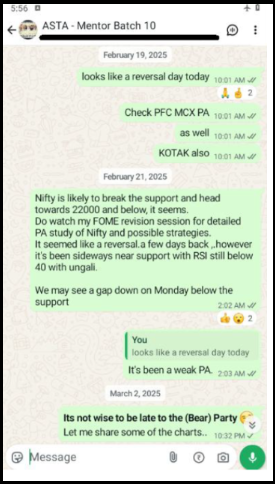

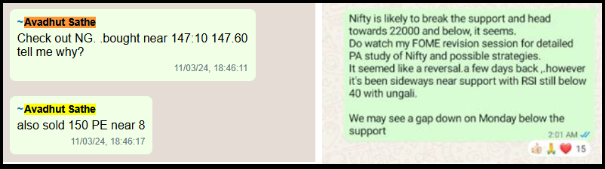

2. WhatsApp Groups: The Hidden Advisory Channel

ASTAPL ran exclusive paid WhatsApp groups like:

- ASTA – Mentor Batch 12 (148 members, fee: ₹6.75 lakhs)

- ASTA: VOW 25-26 (490 members, fee: ~₹30,000/year)

In these groups, AS regularly sent:

- Stock recommendations (e.g., “Buy PFC near 160, SL clear, can make new highs”)

- Nifty index predictions

- His own trade updates to induce followers

Examples from chats:

- “Power Grid likely to make All time high”

- “PFC great entry near 160.. SL clear now..”

- “Nifty likely to break the support…”

- “ITC – fill it, shut it, forget it.”

3. Investors Followed the Advice and Suffered Losses

SEBI matched trading records of participants to AS’s recommendations.

- Participants placed trades immediately after receiving advice.

- In many cases, AS himself did not take those trades, proving the advice was meant for participants, not for education.

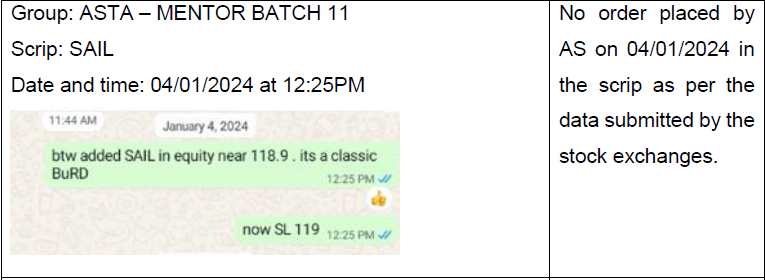

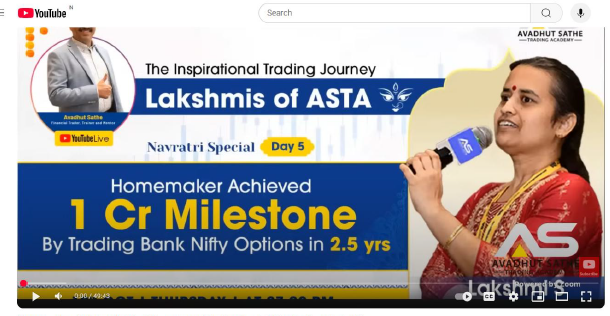

4. False Testimonials

ASTAPL published video testimonials claiming investors made huge profits. SEBI verified their actual trading accounts, all were in LOSS.

| Investor Claim in Video | Actual SEBI Finding |

| Lakshmi Sreenivasan – “Made ₹1 Cr in 2.5 yrs” | Only ₹4.17 lakh profit |

| Smruti Apte – “Earning more than salary” | Loss of ₹1.38 lakh |

| Akash Warpe – “Turned ₹1.8L to ₹45L” | Loss of ₹5.58 lakh |

| Rehan Shaikh – “Bought bike from profits” | Loss of ₹13,256 |

5. Huge Money Collection

ASTAPL had massive scale:

- ₹601.37 (6,01,37,96,917rs.) Crore collected (2015–2025)

- 4,10,845 enrollments across courses

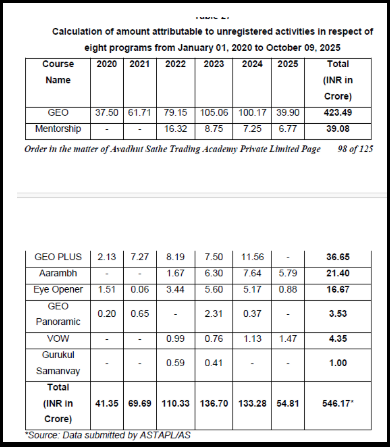

- ₹546.16 Crore attributed to unregistered advisory activity (2020–2025)

6. Illusion Of Profit and Student Loss

The company published fabricated testimonials claiming students made huge profits (e.g., turning ₹1.8 lakhs into ₹45 lakhs).

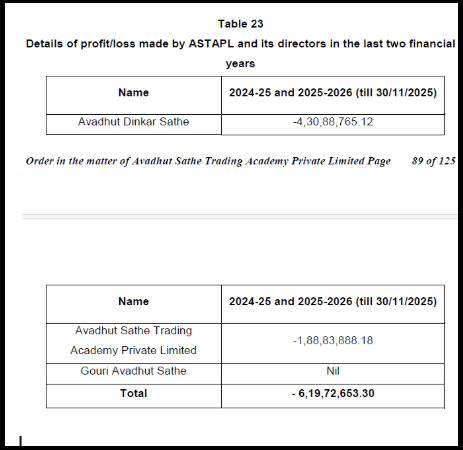

An analysis of the trading accounts of Avadhut Sathe and his company, ASTAPL, revealed a combined net loss of ₹6.19 Crores over the last two financial years (FY 2024-25 and 2025-26 till November) and even the students were facing the losses.

ASTAPL Profit’s Reality:

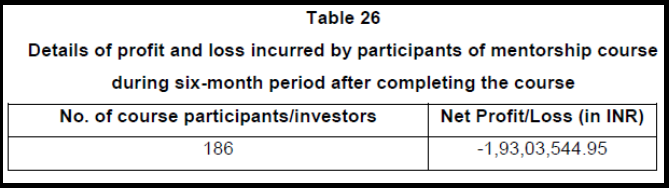

Not only was Avadhut Sathe himself facing a loss of around ₹6 crore, but his own students collectively lost over ₹1.93 crore within just six months of completing the mentorship course, showing that the system wasn’t working even for those who followed it closely.

ASTAPL Violations Identified by SEBI

Avadhut Sathe SEBI raid in August and post-investigation didn’t just highlight loose ends in ASTAPL’s operations; it uncovered a consistent pattern of actions that directly breached India’s securities laws.

What was presented as education often crossed into unregistered advisory activity, and the marketing practices used to attract investors were found to be misleading and deceptive.

These findings led SEBI to flag several serious violations that formed the core of its case against the academy.

A. Operating Without Registration

The Violation

- Section 12(1) of the SEBI Act

- Regulation 3 of IA Regulations

- Regulation 3 of RA Regulations

“From perusal of clauses (a), (b) and (c) of section 12A of the SEBI Act… these provisions prohibit the following:

i. Buying, selling or fraudulently dealing in securities;

ii. Use of or employment of any manipulative or deceptive device or contrivance…”

B. Use of Manipulative & Deceptive Devices

The Violation

- Section 12A(a), 12A(b), 12A(c) of the SEBI Act

How ASTAPL Violated This

- False Testimonials

- Selective Showcasing

One of the tactics SEBI highlighted was selective showcasing. In the early sessions, Avadhut Sathe would end the class with a specific stock pick and then hold a follow-up session to show how well that pick performed.

But this was a carefully controlled setup. By choosing only those examples that were likely to work, he created the illusion that his predictions were consistently accurate.

New participants, impressed by these hand-picked success stories, were then encouraged, often subconsciously, to sign up for more expensive programs, believing the same accuracy would continue in real trading conditions.

- Live Trading Illusion

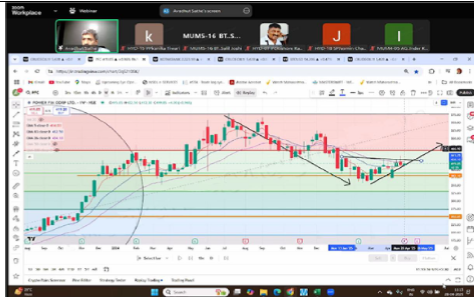

In his LIVE sessions, he used to pull up a live chart and highlight specific breakout zones, often marking the exact range where he believed a stock was about to move.

He would then draw targets on the chart and explain why the price was “likely” to jump from that point.

For participants, this felt like receiving a real-time trade tip rather than a neutral educational example.

The visual setup, showing the chart, marking entries, and projecting targets, created a strong impression that following these cues could lead to quick gains, blurring the line between teaching and actionable stock recommendations.

C. Fraudulent & Unfair Trade Practices

The Violation

- PFUTP Regulations 3 & 4(1)

- Regulations 4(2)(k), 4(2)(o), 4(2)(s)

SEBI found that Avadhut Sathe’s team repeatedly showcased videos promising unusually high returns, creating the impression that anyone joining their programs could achieve the same results.

These exaggerated claims weren’t just marketing; they were designed to convince unsuspecting investors to sign up for more courses.

And the strategy worked: the academy collected more than ₹601 crore from participants over the years.

SEBI noted that these inflated return projections were not just misleading but part of a deliberate pattern to boost the academy’s income, amounting to fraudulent inducement under securities laws.

In addition to the SEBI findings, we have shared supporting evidence with SEBI highlighting some of Avadhut Sathe’s unfair practices.

This includes email communications and correspondence that clearly show how participants were misled and advised without proper registration.

D. Personal Liability of Directors

- Section 27 of the SEBI Act

Under Section 27 of the SEBI Act, when a company violates securities laws, its directors can also be held personally responsible, not just the company itself.

SEBI applied this principle in the case of ASTAPL because both Avadhut Sathe and Gauri Sathe were directly involved in running the academy’s operations, approving programs, handling finances, and shaping the content delivered to investors.

This means that the misconduct wasn’t something that happened “in the background” or without their knowledge.

SEBI concluded that the violations occurred with their full awareness and active participation, making them individually accountable.

As a result, they face the same consequences as the company, restrictions, disgorgement, and potential penalties, because the illegal advisory activities were carried out under their direction and control.

SEBI’s Immediate Directives (Interim Order)

- Cease & Desist – ASTAPL must stop all unregistered advisory activities immediately.

- Freeze & Impound – ₹546.16 Crore to be impounded jointly from ASTAPL & Avadhut Sathe.

- Asset Freeze – Bank & demat accounts of Noticees frozen.

- Market Ban – Noticees barred from dealing in securities until further notice.

- Withdraw Ads – All misleading advertisements, videos, and testimonials to be taken down.

Show Cause Notice: What Happens Next?

Noticees have 21 days to respond. They must explain why SEBI should not:

- Order disgorgement of ₹601.37 Crores (INR 6,01,37,96,917/-)

- Permanently debar them from securities markets

- Impose monetary penalties

Key Takeaways for Investors

SEBI emphasizes that genuine financial education is welcome, but unregistered and fraudulent practices will face strict action to protect investors and market integrity.

Here is what you can learn from Avadhut Sathe case:

- Always check SEBI registration before taking stock advice

- Education explains concepts; advisory gives stock tips

- Testimonials are often misleading

- No one can guarantee profits

Conclusion

SEBI’s regulatory actions serve as important reminders for all market participants about the importance of compliance and investor protection.

While the specifics of each case vary, several universal principles remain constant for investors.

The securities market evolves constantly, and regulatory frameworks adapt to ensure investor protection. By staying informed, asking the right questions, and using available resources, investors can navigate the market with confidence and security.

Legitimate financial education is widely available and encouraged. The key is distinguishing between genuine learning platforms and services that require regulatory compliance. When in doubt, seek clarity or assistance from qualified professionals or regulatory resources.