Dabba trading is illegal, and many people know about it still end up losing money in the greed of earning a huge profit. Every other day, we receive multiple dabba trading complaints, where victims have lost from a few thousand to lakhs.

In most cases, those victims don’t lose money in the market but in the fraud done by dabba traders.

Recently, we got one such case of Arjun (name changed), who lost the money in one such scam by trusting the wrong people, and later, when he asked for a refund, he got a threatening call.

However, at the right time, he registered his complaint with us and, with the proper protocol and process, got a 100% refund of the money he lost to the dabba trader.

Let’s get into the details to understand it more clearly.

What is Dabba Trading?

Now, let’s begin with an understanding of how dabba trading works.

In simple terms, it is an illegal way where a dabba trader do trades outside the official stock market (like NSE or BSE).

These trades are not recorded anywhere. Dabba traders use their own software or apps, and the money never really goes into the market.

This makes it easy for them to cheat.

They show fake profits, offer huge leverage (like 500x), and attract people by promising quick money.

Arjun’s Story: A Costly Mistake

This case is about Arjun, who lives in Africa, and his brother Naveen, who lives in India.

Arjun (on call): “Bhai, I found a trader who gives 500x leverage. I sent him ₹50,000 to start.”

Naveen: “500x? That sounds risky. Which platform are you using?”

Arjun: “He has his app, looks just like Zerodha.”

At first, the dabba trader showed some profits on the app. Arjun thought he had made a smart move.

The Trap: Fake Losses and Threats

One day, Arjun called the trader to ask for his profits.

Trader: “Sir, we took a trade of ₹30 lakh on your behalf. It hit the stop loss. Now you owe us ₹30 lakh.”

Arjun (shocked): “But I only gave you ₹50,000! How can I lose ₹30 lakh?”

Trader: “It’s leverage. You have to pay.”

This made no sense. Arjun called his brother.

Naveen: “This is fake. No real trading happens in dabba trading. They’re trying to scare you.”

Naveen then called the dabba trader to question him, but instead of answering, the trader started threatening him and his family.

How to Report Dabba Trading?

Initiall,y after losing money in the scam, his mind stops working. He was bombarded with lots of questions like, will he ever get his money back, How to get scammed money back, etc.

But soon he controlled his emotions and reached out to us, and our team, without wasting much time, collected all the evidence and filed a complaint on his behalf on the respective portals.

Along with that, our team asked him to file a complaint at the local police station against that dabba trader.

Fortunately, the right & timely follow-ups by our team provided a quick result, and soon Arjun got a call from Dabba Trader.

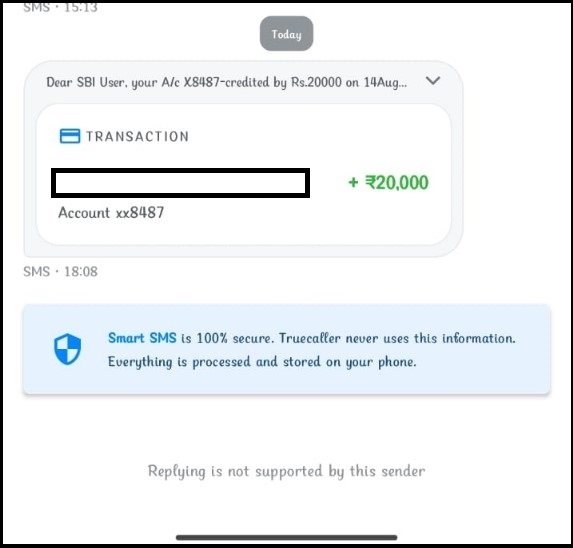

Trader (now scared): “Let’s settle this. I’ll return ₹20,000 if you take the complaint back.”

But Arjun was smart.

Arjun: “Return the full ₹50,000 first. Only then will I think about it.”

In the end, the trader returned the full amount. But the stress they went through was something no one should face.

Say NO to Dabba Trading

Dabba traders will continue cheating people as long as they find clients. Don’t fall into the trap of quick money. Arjun was lucky to get his money back — many others don’t.

Always trade through legal and SEBI-approved platforms. And if you ever face such fraud, don’t stay silent. Raise your voice and file a complaint.

If you have faced a similar problem or want help with a dabba trading complaint, feel free to reach out to our team. We’ve helped many victims get justice, and we’re here to help you too.