If you’ve ever followed a “jackpot stock call” on Telegram and ended up stuck in a dud trade, this one’s for you.

Because what SEBI just uncovered in the Darshan Orna Limited (DOL) case is not just another market scam. It’s a blueprint of how Telegram tips + insider trading + fake volumes = retail investor trap.

And the scary part? It worked.

Let’s break down the whole case.

What’s the Scam?

A group of 11 people (mostly family and friends) accumulated shares of an illiquid company called Darshan Orna Ltd. They:

- Traded among themselves (synchronized trades)

- Created artificial price and volume

- Used Telegram messages to lure retail investors

- Cashed out when the price spiked

In simple terms, pump the stock price and then dump it, trapping retail traders in it. Only this time, SEBI caught them red-handed.

The Role of Telegram

Let’s talk about the biggest red flag here — Telegram tips.

Just before the stock peaked, channels started posting messages like:

“DELIVERY BUY CALL JACKPOT… DARSHAN ORNA… BUY HUGE QTY FOR BIG PROFIT… 1ST TARGET 200”

This wasn’t a coincidence. These messages were deliberately planted.

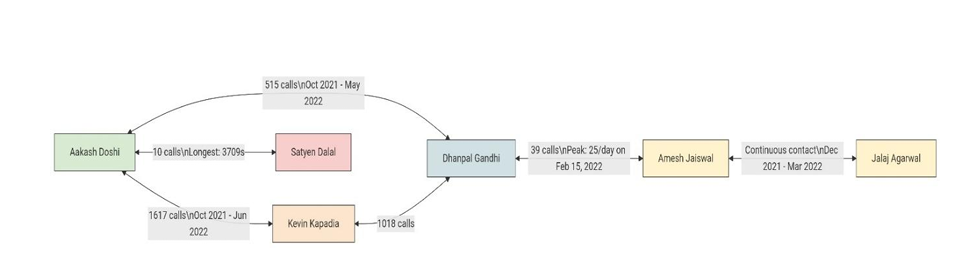

SEBI traced the flow:

- Group members coordinated trades to inflate price

- Fake tips were posted on Telegram to attract the public

- The public started buying at high prices

- The group quietly exited

In 6 trading days, volumes spiked, price surged from ₹126 to ₹146. Retail jumped in.

By April, the stock collapsed to ₹78. Eventually it hit ₹4.35

So, Who Made the Money?

Here’s what the key players earned from this circus:

| Name | Profit (₹) |

|---|---|

| Dilip Doshi | ₹91.72 Lakh |

| Aakash Doshi | ₹64.66 Lakh |

| Richi Doshi | ₹31.79 Lakh |

| Kruti Kevin Kapadia | ₹38.43 Lakh |

| Dhanpal Gandhi | ₹12.07 Lakh |

| Darshan Gandhi | ₹6.93 Lakh |

| Jalpa Gandhi | ₹5.44 Lakh |

| Total | ₹2.51 crores |

And retail investors?

They were left holding a stock that had no real value and no exit.

SEBI’s Action: Heavy Penalties

Here’s the full list of penalties imposed under Section 15HA of the SEBI Act:

| Noticee Name | Penalty (₹) |

|---|---|

| Aakash Doshi | ₹90,00,000 |

| Kevin Kapadia | ₹10,00,000 |

| Dilip Doshi | ₹1,20,00,000 |

| Richi Doshi | ₹45,00,000 |

| Kruti Kapadia | ₹50,00,000 |

| Dhanpal Gandhi | ₹20,00,000 |

| Jalpa Gandhi | ₹10,00,000 |

| Darshan Gandhi | ₹12,00,000 |

| Amesh Jaiswal | ₹10,00,000 |

| Jalaj Agarwal | ₹10,00,000 |

| Satyen Dalal (Merchant Banker) | ₹10,00,000 |

Total Penalty: ₹3.87 crore+

SEBI made it clear: If you manipulate markets using fake trades and social media? You’re getting hit. Hard.

The Details You Shouldn’t Miss

- Circular Trading: The group used accounts of father, son, wife, and in-laws—buying from one another to fake demand.

- Telegram Front: Messages were timed to create FOMO. Nothing about the company had changed fundamentally.

- Funding Trail: Transactions were masked using bank accounts of unrelated entities and even cash.

- Merchant Banker Involved: One of the accused (Noticee 9) was a director of a SEBI-registered Merchant Banker who had also handled DOL’s SME IPO.

The Impact on Retail Traders

- Public shareholding increased by 335% in a single quarter.

- Price jumped from ₹77 to ₹146 in 60 days.

- Then collapsed to ₹40… and kept falling.

- Most retail traders bought at the top and are still stuck.

If you’ve ever been stuck in a stock that pumped and dumped, you’ve probably seen this movie before. Only this time, you have the full script.

The Lesson Here Isn’t Just About One Stock

This is about a pattern that’s being repeated every day:

- Unknown stock suddenly becomes “hot”

- Telegram tip goes viral

- Volumes spike

- Insiders dump

- Price crashes

- Retail cries

SEBI can’t chase every Telegram channel. But you can choose who you listen to.

Before You Follow That Telegram Tip…

Ask yourself:

- Does this stock have any real business news?

- Who’s behind this “tip”?

- Why would anyone give a jackpot trade for free?

If you can’t answer those, don’t press buy.

Conclusion

Markets aren’t a casino. But some treat it like one—especially those who run these so-called “Telegram jackpot channels.”

This time, they got caught.

But next time, the only thing protecting your capital is your awareness.

Stay sharp. Trade smart.