In today’s world where there are more scams when it comes to investment, trusting anyone is almost difficult.

However, some try to build trust by showing fake identity and credibility.

This eventually results in the financial loss of victims they had never thought of.

This is similar to what happened to Amit, a passionate learner of the stock market who hoped to secure his financial future but got trapped in the fake advisory scam and lost ₹1 lakh.

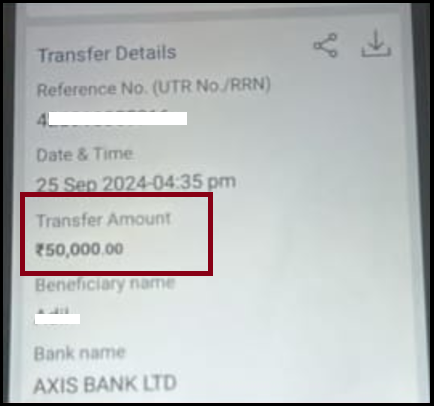

However, with the right efforts and assistance from our team recovered ₹95,000 in 2 installments. Below is the screenshot with refund details of ₹50,000.

Here is the complete story of how Amit got trapped and finally how our team helped him in recovering the lost amount.

Amit’s Hope for a Better Investment Journey

Amit, like many others, wanted to earn some extra income from stock market trading. He spent time learning the basics, understanding trends, and keeping a close eye on the market.

In his journey of learning he came across Prakash (name changed) who changed his life drastically. Prakash called Amit and claimed to be a SEBI registered Research Analyst (RA).

To give assurance he also provided a link to his company’s website having complete details of the SEBI registration number, years of services, and investment advisory plans.

Amit felt he had found someone trustworthy to guide him through the complexities of trading and investment and soon showed his interest to avail his services.

The Red Flags Amit Missed

To begin services, Amit made a payment to Prakash.

But this is where Amit’s trust turned into a costly mistake. While transferring money he missed that the bank account is registered with the name of an individual and not a company.

This wasn’t a one-time occurrence. Each time Amit needed to make a payment he was given a different UPI ID. Unfortunately, Amit didn’t realize that this was the first of many warning signs.

From Promising Tips to Financial Disaster

Initially, things seemed to work out. The tips Prakash provided were yielding profits, and Amit was optimistic about his investment journey. However, due to his busy work schedule, Amit sometimes missed taking the trades on time.

Noticing this, Prakash came up with an offer: “Why don’t you share your account details? I can take the trades on your behalf.”

Trusting Prakash even further, Amit handed over his account information, a decision that marked the beginning of a nightmare.

It didn’t take long for Amit to start losing his money.

Within weeks, he had lost more than ₹1 lakh.

Amit tried to reach out to Prakash for support, but he got an unsatisfactory response and Prakash asked him to add more capital to recover his losses. But Amit had already invested his entire savings.

Soon after, Prakash vanished. He blocked Amit, leaving him not only financially drained but also filled with regret.

The Road to Recovery: How Our Team Helped Amit in Getting ₹95,000 Back?

With lots of doubts, Amit reached out to our team. But soon he saw a ray of hope.

He discussed the whole case with our team and shared evidence of his bank transactions.

Upon examining the SEBI registration number on the portal, it appeared genuine. However, a deeper investigation revealed that the bank details Amit had been using for payments were not associated with the registered company.

Amit had fallen victim to a well-crafted scam of a fake advisory.

Our team immediately guided Amit and helped him to file a complaint against stock advisory. Also, we advised him to send an official email to the regulatory body. A few days later, Amit received an unexpected phone call from Prakash.

Initially, Prakash tried to manipulate him, but the strong determination and support of our team didn’t let him fall into his trap again. Finally, Prakash agreed to return ₹95,000 to Amit.

And in this way, one more victim got justice and a trading scam recovery with our support.

Lessons from Amit’s Experience

Amit’s story is a cautionary tale for anyone navigating the world of investments. While it’s easy to fall for the promises of fake advisors, there are critical lessons to be learned:

- Verify All Payment Details: Always ensure that payments are made to the official bank account of a registered entity. If someone is giving you personal UPI IDs, consider it a red flag.

- Cross-Check Credentials: While SEBI registration numbers may seem legitimate, do more than just check the company’s existence. Verify the full details, including the advisor’s name, credibility, and payment processes.

- Avoid Sharing Account Details: Never share your trading account details with anyone. Even if they seem trustworthy, managing your trades protects you from potential manipulation.

- Act Quickly on Suspicion: If something feels off, don’t hesitate to seek help. Learn the process of how to complaint cyber frauds in India and take timely action to mitigate losses.

Amit’s story could have ended in a total financial loss, but thanks to swift action and expert guidance, he was able to recover a significant portion of his funds.

Let this be a reminder that in the world of investments, trust is earned through proper analysis and validation, not just impressive websites or fancy credentials.

Stay cautious and invest smartly.