Scammers never run out of tricks, do they?

This time, they went after something as basic as a gas connection!

A woman in Kalyanpur lost ₹59,000 after calling what she thought was a legit service provider. To her surprise, it wasn’t. Here’s how the fraud unfolded and how you can avoid falling into the same trap.

How the Scam Happened

The fake gas connection scam started with a single phone call.

According to reports, the victim, Rani Katiyar, received a call on the afternoon of March 22, 2025, from someone claiming to be a Central UP Gas Limited (CUGL) official. The caller inquired about her interest in a PNG gas connection and convinced her by offering exclusive benefits.

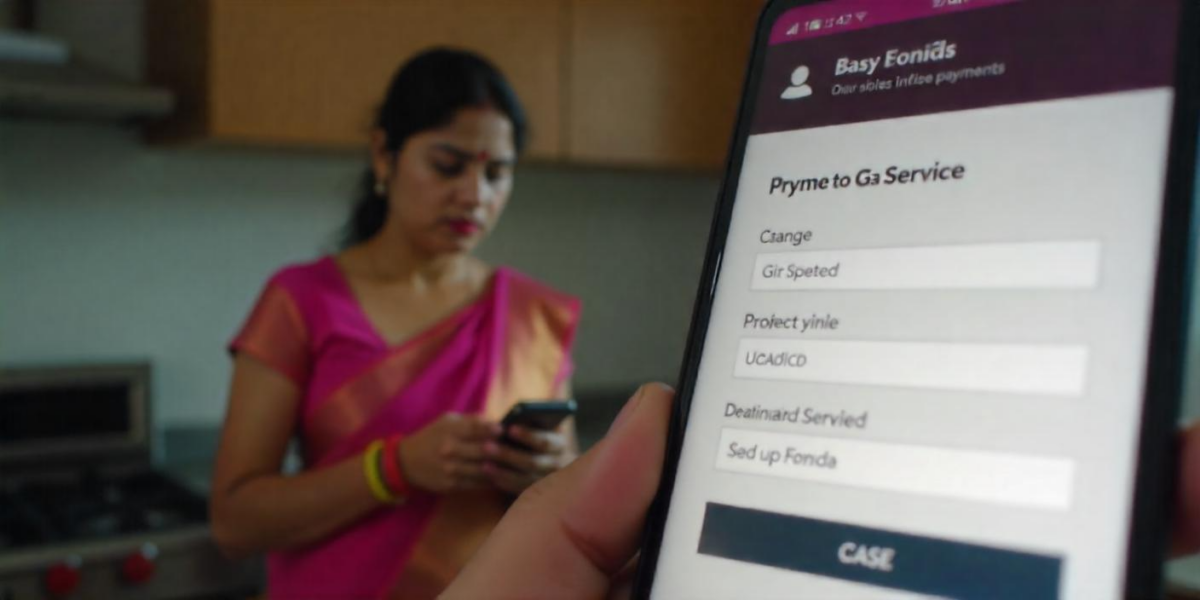

Trusting the offer, Rani expressed interest. The scammer then sent her a registration link, asking her to fill in some basic details. To complete the process, he instructed her to make a small ₹10 payment to generate a bill.

However, the moment she clicked on the link, her phone froze. Within minutes, she received two shocking bank notifications—one for ₹48,000 and another for ₹11,000, totaling ₹59,000 stolen from her account.

Realizing she had been scammed, she immediately reported the incident to the police.

Why Did This Scam Work?

Scammers are getting smarter, and this case highlights how easily they manipulate victims using psychological tricks and technology. Here’s why this scam was so effective:

1. Trust in Authority

The scammer pretended to be a CUGL official, a legitimate and well-known gas service provider. Most people wouldn’t question a call from a seemingly official representative, making it easier for fraudsters to gain trust.

2. Small Payment Trap

By requesting a ₹10 payment, the scammer made the transaction seem harmless. Victims often let their guard down when the amount is small, not realizing that the real goal is to gain access to their banking details.

3. Fake Payment Link

Clicking on the fraudulent link likely led to a phishing website or malware installation, allowing scammers to steal banking credentials or remotely control the phone.

4. Urgency & Persuasion

Scammers often create a sense of urgency or offer exclusive benefits, making the victim act without double-checking the details. In this case, the scammer convinced Rani by offering benefits and guiding her through the process smoothly.

5. Tech-Based Fraud

The moment she clicked the link, her phone froze, preventing her from reacting immediately. This delay gave the fraudsters enough time to complete the unauthorized transactions before she could stop them.

How to Report Online Frauds in India?

No doubt it is sometimes difficult to identify frauds like the one fake gas connection scam in the first instance. It is therefore important to ask for some time before making a decision. Don’t fall into the pressure tactics of scammers.

However, if you have been unfortunate, there’s still a way forward.

Register with us now, our recovery team will contact you and provide one-on-one support to help you regain control.

Stay Alert, Stay Safe

Cybercriminals are getting smarter, but being informed is your best defense. Whether it’s gas connections, bank calls, or investment schemes, always double-check before making any payments.

If something feels too easy or too urgent, take a step back.

Scammers rely on rushing you into decisions. Stay cautious, and don’t let fraudsters turn your simple service request into a financial nightmare!

In case you have been scammed in any such scam, fill in the form below. Our team will call you and assist you in filing a complaint online to the respective authorities.