“Sir, do you trade?” Sanjeev (name changed) received a call from a SEBI-registered RA one day.

“Yes, I do,” Sanjeev replied.

“Oh, great! Are you profitable?” the RA asked.

“Yes, I am. I make around ₹400-500 profit per day,” Sanjeev responded.

“That’s nice, but my tips and services can help you grow your daily profit to ten times,” said the RA.

“I’m not interested,” Sanjeev said.

“Sir, I’ve shared a tip on your WhatsApp. Please take this free trial. I assure you high profits,” the RA insisted, trying to lure Sanjeev.

“Okay, I’ll check,” Sanjeev replied before disconnecting the call.

How many of you have received similar calls?

Probably many of you, especially after opening a demat account. Generally, such calls usually come from fake advisories, this time it was from a SEBI-registered RA.

RA tried to lure Sanjeev and used high-pressure tactics to sell his services and later wiped off entire capital from his account. Sanjeev realized his mistake and reached out to us to avail help in filing a complaint.

Finally, with the help of our team, he got a recovery of ₹30,000.

Here’s the complete story of how Sanjeev got trapped and later fought for the trading scam recovery with our assistance.

How Sanjeev Got Trapped in the Financial Scam of RA?

Sanjeev used to do regular trading with small position sizing and had enough knowledge that he was able to earn a profit of ₹400 to ₹500 per day.

In all, his trades were providing him with satisfactory profit. One day he was watching a video on YouTube and came across a Telegram Channel ad. He clicked on it out of curiosity but on finding call tips and PnL screenshots he didn’t pay much attention.

After a few days, he received a call from a random number. It was from one of the employees of the SEBI-registered RA office. The caller on the other side told Sanjeev about his trading plans and how Sanjeev could grow his profit to 10 times by taking their services.

However, Sanjeev didn’t fall for it and disconnected the call.

But the calls didn’t stop and every other day Sanjeev got a call from one or the other employees of the same RA. One day he received a call, where the caller asked him to check his WhatsApp where he had shared one call tip.

Sanjeev was trading at that time and checked the tip and tracked the movement of the stock. The tip worked but Sanjeev had not taken the position in it.

In the evening, he received a call from the same person and Sanjeev again told him that he checked his tip but was not interested in taking his call.

Now, Sanjeev was not following it because he was not interested, unaware of the fact that no registered RA can provide any kind of tips or advisory services to their clients.

The following day, Sanjeev received a call again, and this time he thought of using it.

The tip worked and he made a profit of ₹800 that day. As expected he received a call again.

Th caller pitched him the one-year plan of ₹2,67,000/- where he would get complete guidance, how to use the profit earned, and other support from them.

Sanjeev didn’t accept their services as he did not have that much funds. The caller then insisted he use a 1-week plan of ₹3,000.

On this Sanjeev agreed but the services gave the mixed result as Sanjeev earned profit in 2 out of 4 trades.

RA didn’t stop there and Sanjeev got a continuous call from one or the other employee to buy the plan.

When Sanjeev told them about the shortage of funds, they asked him to withdraw 10,000 from the demat account and they would soon help him earn the same within a month.

Sanjeev agreed and bought their 3-month plan for ₹20,000 by borrowing money from his friend. But things turned south as after buying the plan he made a consistent loss.

Disappointed Sanjeev stopped using their call tips.

However, RA was not done yet.

One day he received a call from a person named Hussain from the RA office. Hussain seemed to be knowledgeable and experienced person.

Eventually he succeeded in gaining Sanjeev’s trust back.

He suggested trading only in stocks under his guidance.

However, for this, he asked for another ₹30,000. But Sanjeev, who had already lost everything in paying fees and other services, refused his offer initially.

But at the same time, Sanjeev also wanted to recover his losses and took an instant loan of ₹60,000 out of which he paid ₹20,000 to his friend and another 30,000 to the RA to use his one-to-one services.

It didn’t work as well and Sanjeev was now in a loss of around ₹80,000.

Devasted and finding it difficult to pay a monthly EMI he decided to take action against the RA. Fortunately, he reached out to us.

How We Assisted the Client in Recovery?

Sanjeev narrated the whole incident to our team. Determined to bring this case to light, our team immediately sent an email to the RA’s team.

Their response was shocking. Instead of offering a solution, they threatened the client, citing their “no refund policy” and insisting he continue with their services.

Recognizing the aggressive and unethical behavior of the RA, we advised the client to report the case to SEBI.

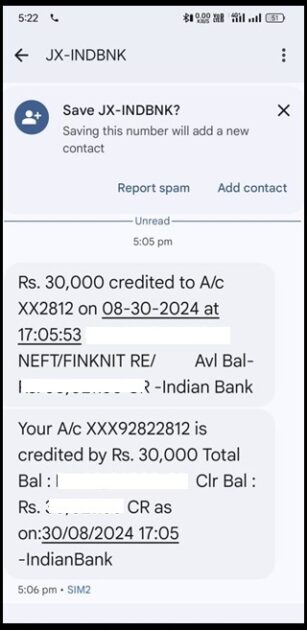

This move triggered an aggressive response from the RA. They reached out again, first, they tried to threaten a client but finally agreed to refund ₹30,000.

Although there was a chance that the client would get a whole refund of around ₹1,20,000 due to a shortage of funds he agreed to settle it at ₹30,000 with RA.

While this was a partial victory, it serves as a reminder of the importance of regulatory vigilance and staying strong when dealing with unethical practices.

What Can You Learn from this Incident?

Sanjeev although didn’t fall into the high-profit services of RA fell into the trap after seeing little profit in the trial session which led him to face losses and fall into debt.

However, on recognizing the evil intention of RA he took no time to reach out for help and get around 30% of his lost amount back. Here are a few lessons that you can learn from his story.

- Don’t Fall for Demos

- Stay Informed About Your Rights

- Seek Professional Help