Have you ever wondered why the number of trading and investment scams is rising sharply?

The obvious reason is not the lack of knowledge but the greed to earn quick profits. A look at the victim lists reveals that they include graduates, qualified doctors, retired army officers, and more.

Among various trading scams, reports of fake IPO investments are increasing rapidly.

Here is another such case, where the victim Aarav (name changed) lost around ₹1,00,000 in the scam. Fortunately, with the help of our team, we made the recovery of ₹55,000.

Unfolding IPO Scam

Scammers often initiate IPO scams by adding victims to WhatsApp groups, either through referrals or without their knowledge.

The first thing they encounter is high-return PnL screenshots, alongside glowing comments from other users. Unaware that both the PnL and comments are fake, they follow the group blindly.

The scammer takes advantage of this trust by providing a link that redirects to a fake app, mimicking the steps involved in opening a demat account with a legitimate broker.

However, instead of transferring funds to a trading account, the money goes directly into the scammer’s account. This should raise a significant red flag. Isn’t it alarming when a scammer asks for a direct transfer to their bank account?

Now let’s come back to our previous statement, the financial knowledge.

Do you think that to identify the scam, one needs specific subject knowledge? Isn’t it a red flag when a scammer asks you to transfer money to their personal bank account? Shouldn’t you question why

Even if one is not completely aware of this, it could be easily validated through details available on different platforms.

But who bothers right? The group, that PnL, and lots of comments were enough for many people.

The scammer tries every possible way to gain trust.

How?

By allowing victims to withdraw some funds initially.

Victims on see high returns add more funds. And finally, the day comes when the scammer tells them about the IPO allotment.

They display fake IPO allotments the value of which is almost 10 times or more of their initial investment.

Tempted by huge returns, victims transfer more money to the scammers’ accounts.

In case, some victim shows insufficient funds, scammers offer loans (fake amounts displayed in the app) to trap people. Eventually, most of the victims transfer funds either by borrowing money or taking loans.

Now what made them do this?

Well, the hope of earning more than a 100% return on investment.

Unfortunately, when the victim tries to withdraw that fund, the transaction fails. On this scammer asks them to pay a tax and other charges to unlock payment.

Some got trapped in that too and transferred more funds to unlock the entire payment. This continues until the victim realizes that he has been scammed.

Case Study: How Aarav Got Scammed and How Our Team Helped Him in Recovering ₹55,000?

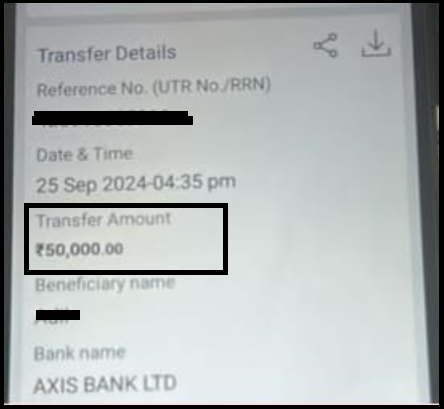

A similar case happened with Aarav, who joined not one but three different groups and made multiple payments in all the links ranging from ₹10,000 to ₹50,000 incurring a loss of more than ₹1,00,000.

He then reached out to us.

Our team first helped him with the case he filed himself in which the loss amount was around ₹30,000 by doing a proper follow-up and also filed a fresh complaint against the second scammer where he lost around ₹55,000.

We collected all the documents and drafted a complaint on the respective platform.

After 15 days of filing a complaint, Aarav received a call and got a confirmation of recovery of loss.

And finally, after a few days, Aarav received the payment of ₹55,000 in his bank account.

This was the case that our team filed. We are still following up on the first case that Aarav filed himself and hoping to get a positive result on that as well.

Aarav joined three different groups and downloaded three separate fake IPO apps. It took him months to realize that those investments were scams.

What was Aarav’s mistake? Was it joining the group and being tempted by PnL screenshots, or blindly investing in the fake app without thorough research?

Conclusion

Aarav’s experience highlights the importance of becoming more aware and doing proper verification before investing in any platform.

Further, it is important to control greed and invest smartly by expecting realistic returns.

One must raise questions about anything that seems to be suspicious.

While his eventual recovery of ₹55,000 is a positive outcome, it underscores the necessity of proper documentation and persistence when dealing with such scams.

In the fast-paced world of trading, staying informed and questioning everything is the key to protecting your hard-earned money from fraudsters.

To take timely action in such cases, it becomes important to be more aware and learn how to file a SEBI Complaint IPO Refund online, ensuring that your grievances are properly registered and tracked.