Clean energy is the future.”

“EV + Solar + Government contracts? This one’s a no-brainer.”

“Look at that stock! ₹100 to ₹1100 in a year!”

This is how Gensol Engineering Ltd was pitched across WhatsApp groups, Twitter spaces, and finfluencer videos.

It looked perfect on paper, a solar company evolving into a full-blown EV ecosystem player, backed by strong revenues and government-aligned themes.

But behind the scenes? Something very different was playing out.

By April 2025, SEBI had launched a full-scale investigation into Gensol.

During the investigation, what emerged was a case study of how numbers can lie, and how easily public money can be repurposed for private gains.

Let’s get into the detail of how Gensol engineering scam exposed by SEBI.

Where the Numbers Started Cracking

Between FY17 and FY24, Gensol’s revenues shot up from ₹61 crore to ₹1,297 crore.

That alone was enough to catch market attention.

The company borrowed close to ₹978 crore from public institutions like IREDA and PFC to procure 6,400 electric vehicles—vehicles it claimed were leased to BluSmart, a related company in the EV space.

But when the dust settled, only 4,704 EVs had been delivered. And the cost? ₹567 crore.

That left a huge gap of around ₹260 crore unaccounted for.

This was the first crack in Gensol’s green empire. SEBI traced the loan money, and what followed read more like financial fiction than a balance sheet.

The Trail That Led to a Luxury Apartment

Let’s break down one example.

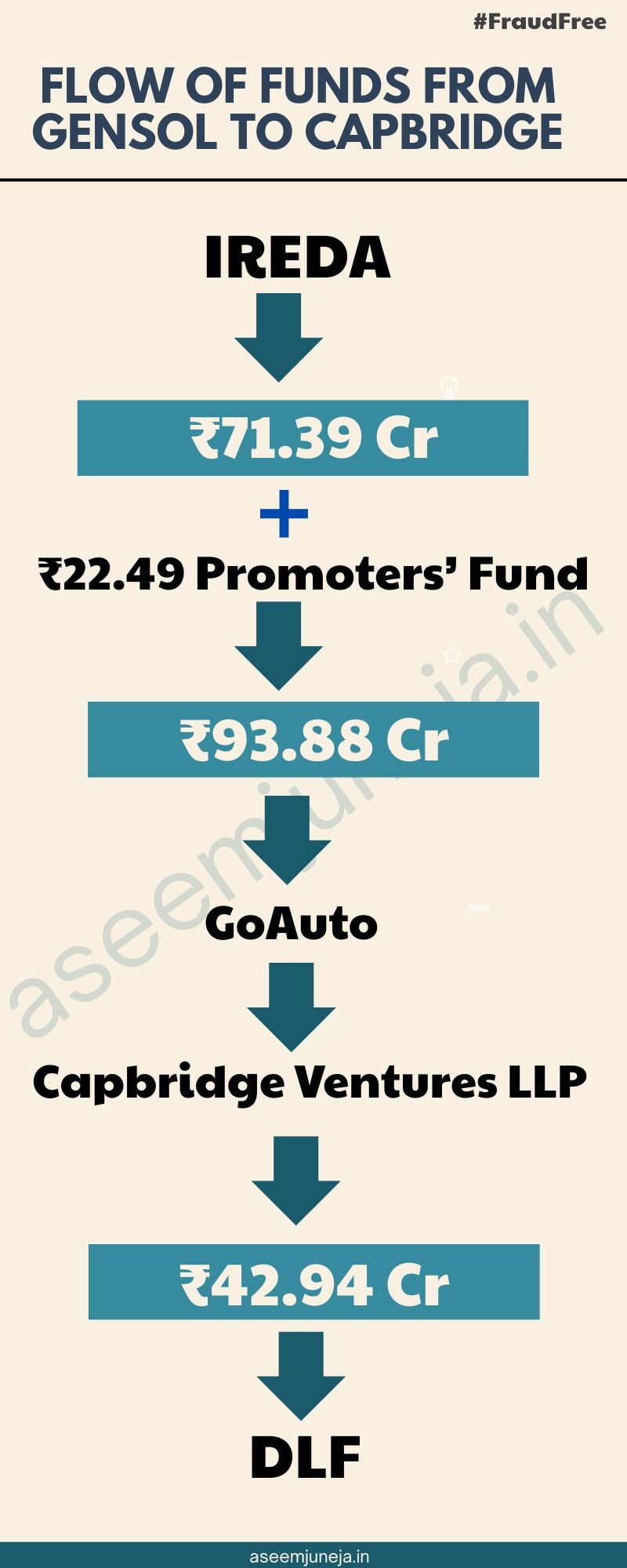

Gensol received ₹71.39 crore from IREDA in September 2022. On the same day, it moved ₹93.88 crore (including promoter’s own contribution) to Go-Auto.

From Go-Auto, ₹50 crore was immediately transferred to Capbridge Ventures LLP—a firm owned by Gensol’s promoters. That same week, Capbridge paid ₹42.94 crore to DLF for a luxury apartment in The Camellias, Gurgaon—initially booked in the name of the promoter’s mother.

Buying the Hype—Literally

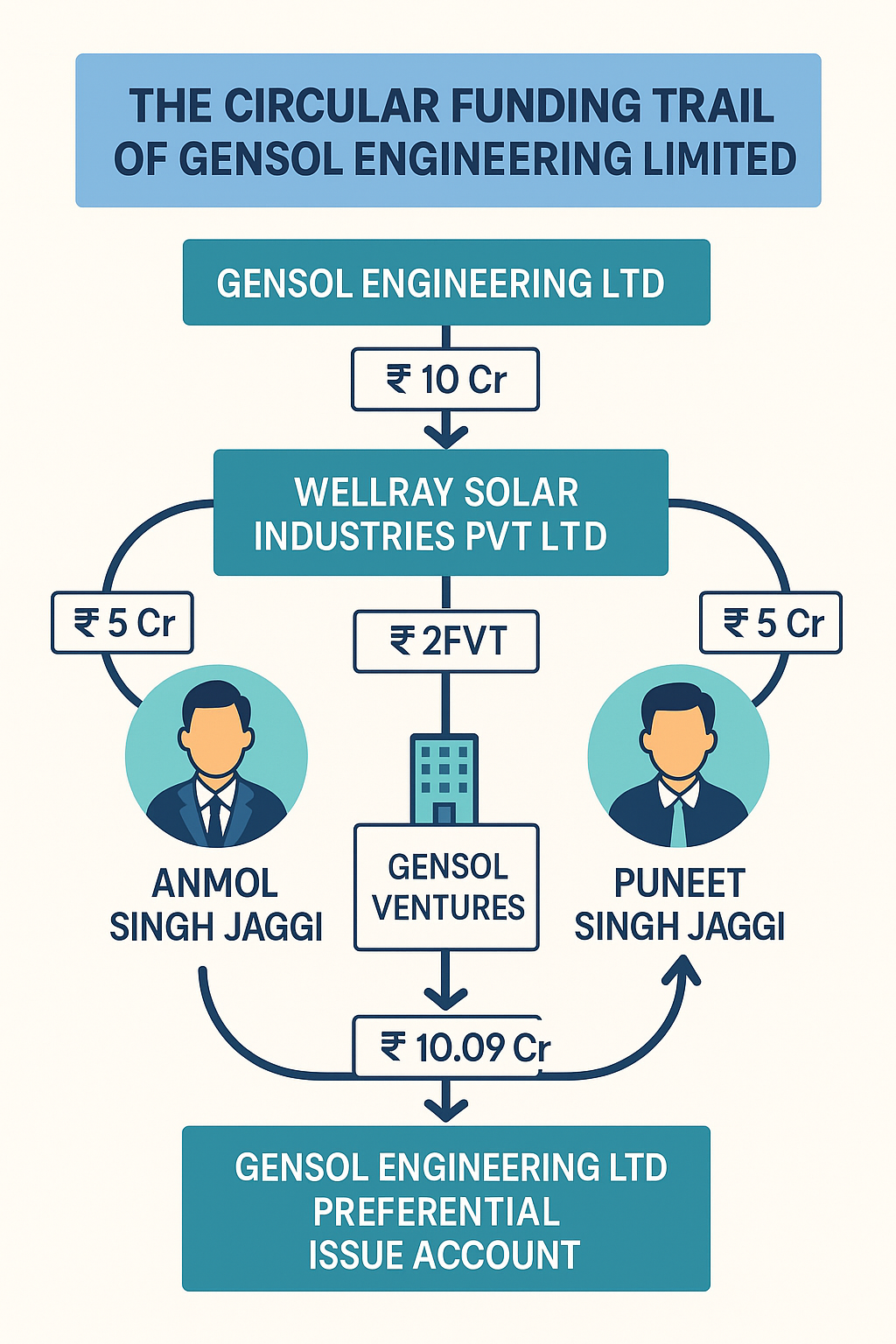

One of the more shocking findings was how one of these connected entities, Wellray Solar, used company-funded transfers to trade in Gensol’s stock.

That’s right. SEBI found that Wellray bought and sold shares of Gensol worth over ₹160 crore over two years. And it wasn’t doing it with its own money; more than ₹100 crore came from Gensol and its related entities.

This kind of trading isn’t just unethical, it’s manipulative. It creates false volumes and prices, lures in unsuspecting retail investors, and creates an illusion of strong market interest.

To make matters worse, while all of this was going on, Gensol continued filing “No Default” statements with rating agencies, even when SEBI found multiple missed payments on its loans.

It even submitted forged conduct letters claiming timely payments, which were later denied by the lenders.

Misleading the Market – The False EV Orders

In January 2025, Gensol announced it had received 30,000 EV pre-orders from 9 companies. The stock responded positively. But when SEBI investigated, it found:

- These were just MOUs, no delivery dates, no price, no clarity.

- The EV plant in Pune was mostly inactive, with just 2–3 workers.

- Even the electricity bill showed no sign of manufacturing activity.

Preferential Allotment – Was the Company Paying Itself?

In September 2022, Gensol Engineering issued shares at ₹1,036 a piece through a preferential allotment to its promoter group.

At first glance, it seemed like a healthy capital infusion from the promoters. But when SEBI dug deeper, things didn’t add up.

The promoters weren’t exactly using their own money. Instead, Gensol had routed funds to a private entity named Wellray Capbridge, which then transferred the same money back to the promoters to subscribe to the shares.

So essentially, it was Gensol’s own money coming back in a loop, giving the illusion of a promoter investment, when in reality, the company was just funding its allotment.

The Victims No One Talks About

In scams like these, it’s easy to focus on the wrongdoers. But the real damage is often felt by people whose names never appear in SEBI orders.

Retail investors who got in late, after all the buzz, saw their investments collapse as the stock crashed from over ₹1,100 to ₹133.

Young traders, new to the markets, mistook the price and volume action for a genuine breakout.

ESG-focused long-term investors, drawn to Gensol’s green narrative, now sit on dead capital.

And let’s not forget that the loans taken by Gensol were from public institutions. If those loans go bad, it’s our money, as taxpayers, that goes down the drain.

That’s the real tragedy. The company got richer. The promoters got apartments, dollar transfers, and golf sets. And the average investor? They were just exiting liquidity.

What SEBI Did and Why It Matters

To its credit, SEBI moved swiftly.

Post Gensol engineering scam exposed, Anmol and Puneet Jaggi, the promoters, have been barred from holding any directorial positions or acting as KMPs.

They’ve also been banned from trading, and Gensol has been forced to pause its stock split, which could’ve attracted more unsuspecting retail investors.

A forensic audit has been ordered. And more action is likely coming once the full picture is out.

But even before that, this case stands as a serious reminder for investors.

We live in a time where numbers are easy to dress up. Disclosures can be exaggerated.

Related-party dealings can be buried in fine print. And “growth stories” can be spun out of a few PowerPoint slides.

If we don’t pause and ask why the story makes sense, how the numbers add up, and who benefits the most, we’re not investing. We’re gambling.

Final Thoughts

Before the Gensol engineering scam was exposed, the company looked like a poster child of India’s clean-tech future. It turned out to be a case study in how a listed company can be hollowed out from within, quietly and cleverly.

This isn’t just a cautionary tale. It’s a wake-up call.

Because if we don’t call these things out—and keep asking tough questions—we’ll keep getting fooled by the next Gensol.

If you have ever been trapped in any such fraud linked with stock manipulation, register with us and get assistance to file a complaint to SEBI against company.