When it comes to trading, every rupee counts. But sometimes, retail traders face situations beyond their control—technical glitches, unfair brokerage practices, or lack of transparency. Recently, we worked with a client, Roop Singh Meena (name changed), who faced exactly this issue with Angel One. Here’s how we helped him recover 60% of his amount and what you must be aware of as a trader.

How an Angel One Technical Glitch Led to a Loss of ₹1,79,000?

Roop Singh Meena, a new trader, reported a loss of ₹1,29,000 due to a technical glitch in the Angel One platform.

- He had added ₹2,00,000 to his trading account.

- After a trade, he faced a loss of ₹21,000, which should have left him with around ₹1,79,000.

- Shockingly, his account balance showed only ₹4,000 instead.

This was not a normal trading loss—it was a platform error.

Misguidance by Angel One

Being new to trading, Roop relied heavily on the guidance of Angel One’s team. Unfortunately, instead of offering clarity, one of their members misled him.

He was asked to send an email to upgrade his brokerage plan, without being fully informed about what this change meant.

As a beginner, he had no clear understanding of how brokerage plans impact charges, trading costs, or recovery processes. This lack of transparency further worsened his situation.

How Our Team Took Action?

Initially, Angel One did not acknowledge the discrepancy clearly. The client was frustrated and unsure how to proceed. That’s when he reached out to us.

Our team immediately stepped in and followed a structured approach:

- Detailed Audit of Records

We carefully analyzed the client’s statements, contract notes, and account history to identify exactly where the mismatch occurred. - Direct Communication with Broker

Once we had the evidence, we reached out to Angel One on behalf of the client. Multiple follow-ups were made to push for accountability, since brokers often delay or downplay such issues. - Escalation to SEBI via SCORES

When the broker’s response was insufficient, we guided the client in filing a complaint on SEBI’s SCORES portal (Sebi Complaints Redress System). This ensured the issue was formally recorded and taken seriously. - Resolution and Refund

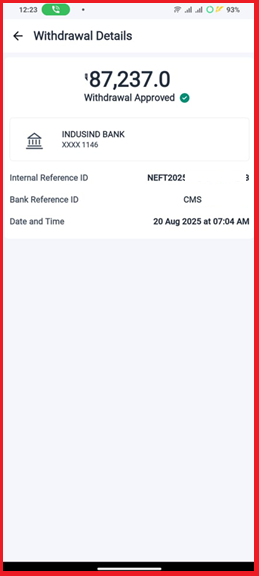

With combined pressure from our intervention and the SEBI complaint, Angel One processed a refund.

- Claim Amount Filed: ₹1,50,000

- Refund Processed: ₹87,237

And in this way, we were able to recover 60% of his lost money, something that would not have been possible without proper guidance, persistence, and escalation to the regulator.

How Brokers Manipulate Traders in Such Case?

From our experience across multiple such incidents, here’s what typically happens:

- Platform Glitches Go Unnoticed

Brokers often attribute losses to “market volatility” even when the issue lies in their trading system. - Misguiding New Traders

Beginners are often pushed into unfavorable brokerage plans or unnecessary upgrades without clear explanations. - High Charges and Hidden Costs

Traders don’t realize how much brokerage, taxes, and hidden fees eat into their capital. - Delayed or Partial Refunds

Even when refunds are due, brokers rarely return the full amount unless clients fight back with evidence.

What You Can Learn from This Case?

If you’re trading in India, especially as a beginner, here’s what you must keep in mind:

- Always Download Contract Notes: After every trade, verify charges and executed prices.

- Check Ledger Statements Regularly: Don’t rely only on the app balance—cross-verify with detailed statements.

- Don’t Blindly Follow Broker’s Advice: Brokers may push you into plans or trades that benefit them, not you.

- Understand Your Brokerage Plan: A wrong plan can cost you thousands in hidden charges.

- Keep Records of Communication: Always email the broker when you face issues, so there is proof.

- Escalate When Needed: If the broker doesn’t resolve, escalate to SEBI SCORES for formal complaints.

Final Word

Roop Singh Meena’s case is a reminder that new traders are especially vulnerable. Brokers may not always act in their best interest, but with proper documentation, persistence, and expert guidance, fund recovery is possible.

Our team is proud to have helped recover ₹87,237 (around 60% of the claim) for the client. While not the full amount, it is still a significant win against unfair broker practices.

If you’re a trader facing similar issues, remember: don’t suffer silently—fight for what is rightfully yours.