Everyone is in search of a safe money-earning platform, especially college students, retired personnel, and others.

But, is InCoin Pay safe to invest in and earn money?

Well, InCoin Pay is a relatively young platform that promises high daily income without requiring significant investment. It gives you many benefits. At the same time, the platform involves high risks.

Before you start using it, learn about its pros and cons here!

InCoin Pay App

InCoin Pay is an online earning platform where you invest in crypto assets to earn money in return. You have to buy and sell crypto assets available in INR. You will make a profit from the difference between the purchase price and the sale price.

But the website does not reveal that users have to buy crypto assets. It simply says you have to buy and sell orders? You might assume it is something similar to purchasing and selling Amazon products. But you are wrong.

Buying crypto assets involves a lot of risks in India. Are you ready to take those risks? Do you have the training and knowledge required for that? If not, think again.

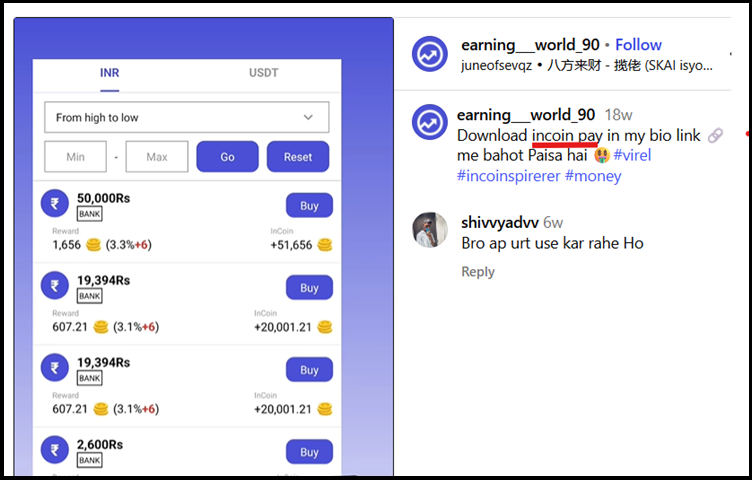

The platform where you have to buy and sell looks like below.

Here, you have to make purchases on unknown products, actually crypto assets, without understanding where your money is going. Obviously, for every purchase, you will get 3% commission.

Does it sound so simple? There is much more information you need to learn about it.

Is InCoin Pay Real or Fake in India?

There are certain red flags you should be aware of before trusting the app. The following details will help you decide why InCoin Pay is a fake app operating in India.

The Website Lacks Crucial Information

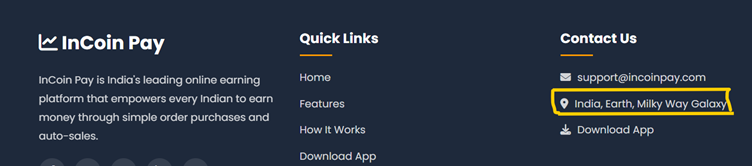

InCoin Pay is not a registered entity in India. Even on its website, it doesn’t show any office address. Look at the snapshot taken from its website.

Stating the address of Earth and the Milky Way Galaxy is no less than a joke! But here you put your money at stake. Should you rely on them? Think before using the app.

The Operations are Not Regulated

Nevertheless, if you are interested in crypto trading, you must know that cryptocurrency transactions are not regulated by SEBI. It falls under the purview of the Prevention of Money Laundering Act (PMLA).

Thus, trading in InCoin Pay is safe as long as you are not doing anything related to money laundering. This makes using the InCoin Pay app questionable to the legal authorities in India.

Trusting that information and investing your hard-earned money can result in a huge loss. Since crypto trading is not regulated in India, there is no way to recover any guaranteed amount.

Is InCoin Pay Safe to Use?

As of 2025, InCoin Pay raises serious red flags and cannot be considered a safe platform. If you’re thinking about using it, pause for a moment, because the risks go far beyond the surface.

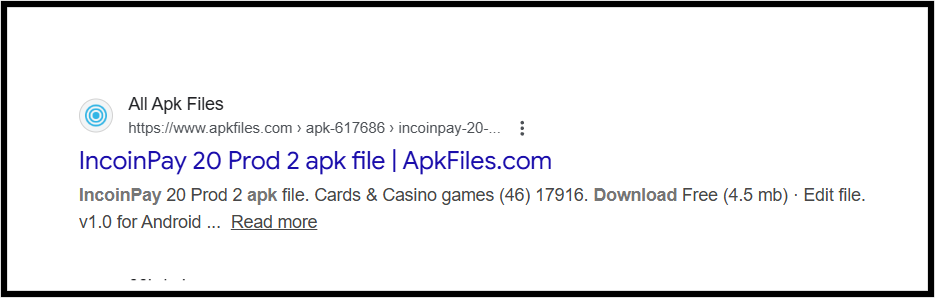

One of the first warning signs appears before you even use the app. Legitimate financial platforms are usually available on the Google Play Store or Apple App Store, where users can read verified reviews and report issues.

InCoin Pay avoids this entirely. Instead, it asks users to download an APK file directly from its website, much like installing an unknown .exe file on a computer.

This method conveniently bypasses public scrutiny, real-time reviews, and platform-level security checks—making it harder for users to assess whether the app is trustworthy.

And that leads to the most important question: if InCoin Pay suddenly shuts down tomorrow, what exactly do you have to trace back to the company? A registered office? A licensed entity? A regulator to approach? If the answer is unclear, then the risk is already too high.

When it comes to financial platforms, transparency and regulation are not optional; they are essential. In the case of InCoin Pay, both are noticeably absent.

How to Report InCoin Pay?

Is InCoin Pay safe? While this doubt arises, you must also consider the situation if the app suddenly stops working. How will you claim your money? How will you recover lost data? Because InCoin Pay is not a SEBI-registered broker.

Here are the steps you should follow to stay safe.

- Immediately seizing your bank account is mandatory to avoid any automated deduction.

- You must take a screenshot of the communications, payment details, relevant images, and messages.

- Lodge an FIR at the nearest cybercrime police station.

- Complaint in SEBI or RBI through email or a direct call can be helpful.

Need Help?

In case of any unsafe transaction or operations with IncoinPay, we will guide you to the best way to move forward.

Register with us for:

- Recover the invested amount following the legal norms.

- Access legal help to get justice, adhering to applicable norms and rules.

- Take necessary steps to avoid repetition of the same instances again.

Therefore, choose only the best for you when you lose a lump sum without getting any return.

Conclusion

Online payment apps easily lure millions of people by offering high returns and easy money.

But when they fail to deliver what they offer, people incur high financial loss. Since your loss is unconscionable, we fight for you.

If the mishaps have already happened, consult with us to fight the battle.