In the trading world, trust is everything especially when dealing with brokers who claim to have your best interests at heart. Unfortunately, not every broker lives up to this expectation.

One of our clients recently fell victim to a software sales scam, where the broker pressured him into purchasing overpriced trading software, promising extraordinary profits.

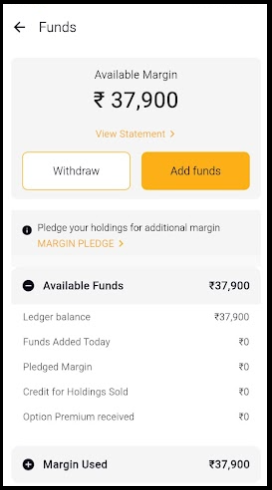

When the software didn’t deliver as advertised, it resulted in significant losses and shattered trust. That’s when our team stepped in. After thoroughly investigating the case and guiding the client through the right legal and regulatory channels, we successfully recovered ₹37,000 for them.

When Broking Services Turned Out to Be Costly

“Hello, I am interested in taking your broking services,” the client Nitesh (name changed) said to an executive of one of the renowned stockbrokers.

“Great Sir! you can avail our full-service broking services at a discounted price,” the sales executive replied.

Further, the sales executive asked, “Are you an experienced trader.”

“No, I have just thought of beginning trading,” Nitesh replied.

“In that case, sir you can buy are automated trading software at just ₹30,000/-. In this software you will get inbuilt strategies, that would help you in trading smartly right from the beginning”, said the sales executive.

Initially, Nitesh showed no interest and ended up opening a demat account only. But after every other day, he received a call from the sales executive convincing him to buy software.

Finally, the sales executive succeeded in meeting his target as Nitesh agreed to buy the software by paying ₹30,000.

After a few days, he received a call again.

“Hello sir, I am your Relationship Manager and will be guiding you with your trades.” said the Broker’s RM.

“But I don’t want any more services, I have already paid for the software,” said Nitesh.

“Yes sir, but since we are a full-service broker, these services are for FREE!” replied the RM.

“Oh, then it is fine,” Nitesh replied with relief.

“Okay Sir, so you just need to follow the trade calls I will provide. It will help you in earning profit quickly,” RM added further.

“Great!” the Nitesh replied with excitement.

The next day, Nitesh received a call, and he started trading based on tips provided by the RM. But soon his excitement turned into frustration when he started facing losses.”

Soon, this frustration reached to next level, when RM asked Nitesh to take a trade using software with a stop loss of ₹10,000 but by the end the SL hit at around ₹18,000.

Nitesh then called the RM angrily, “None of your tips is working, also your software is good for nothing for a beginner like me.”

“Calm down sir, all the trades were open after taking your confirmation, and also the market is quite volatile, but I will help you recover losses,” RM replied.

“If I had the knowledge to trade, why would I have taken your services? This is completely illogical. Due to your tips, I have already lost around ₹40,000 I don’t want any of your services,” Nitesh replied.

Later when Nitesh checked his trading balance he was shocked to see that the broker had charged a high brokerage too.

Instead of ₹20 per trade, they have charged him ₹20 a lot. RM later made him trade in high volume which led to high brokerage charges.

His anger was on cloud nine but even after multiple calls to the broker, he didn’t get and satisfactory response.

Nitesh Fight for Refund: How Our Team Helped in Recovering ₹37,900 From Broker?

Nitesh had faced a loss of ₹92,000 including ₹30,000 software cost. He knew that talking to a broker, would not help him further so he decided to take action against them.

His decision proved to be beneficial.

Not fully 100% but with the help of our team he got a recovery of ₹37,900.

However, this was not the complete recovery of his losses but at least he got the money back that the broker charged him for useless software.

Here’s how our team proceeded with the recovery of funds.

Firstly, after listening to his case, our team helped him in drafting an email. Luckily, after a few days, Nitesh again received a call where the broker admitted its mistake of a software glitch due to which the stop loss hit 8000 away from the mentioned value and agreed to pay the refund of ₹8000.

However, Nitesh faced many more losses in the name of tips, software costs, and brokerage.

We suggested he wait. After a few reminders ultimately broker reached out and agreed to refund the software fees ₹30,000 and around ₹8,000 loss that Nitesh faced in the last trade.

Although the recovery was not complete, Nitesh agreed to this proposal and finally settled the case.

Conclusion

Now what can you learn from Nitesh’s experience?

The first and foremost is to understand how important it is for you to stay aware even if you are engaging in the brokerage services of a well-known stockbroker.

Lack of understanding of the market and the broker’s services made it easier for the broker’s executive to trap him in their fake promises and later charge unrealistic brokerage which further added to his losses.

However, through persistence and the support of our team, he was able to recover a portion of his losses.

This case serves as a reminder for all traders, to thoroughly understand the services they are signing up for.

By staying informed and proactive, traders can better protect their investments and make more informed decisions in their trading journeys.