Have you ever wondered what goes on inside the regulator’s head before a new rule suddenly drops into the market? Well, someone actually tried to find out.

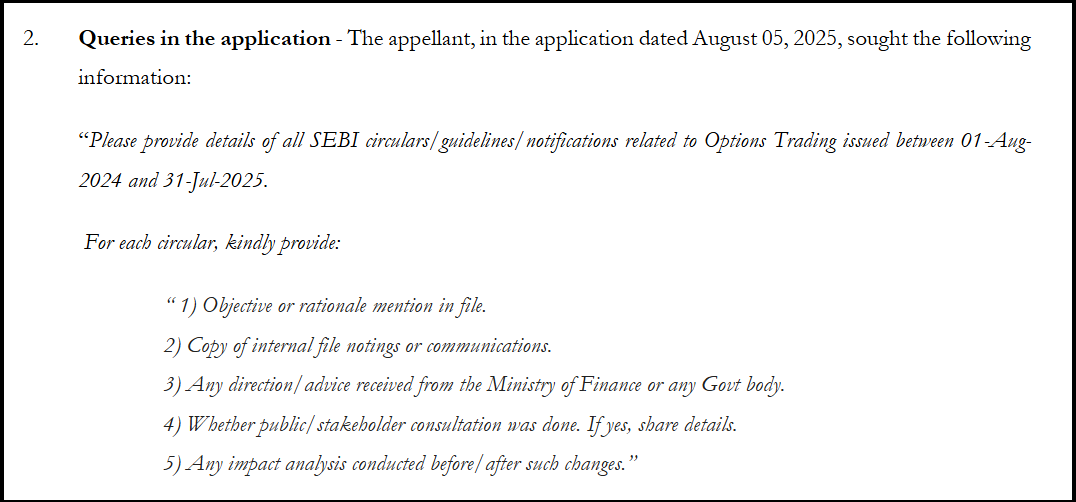

In August 2025, an RTI (Right to Information) application landed at SEBI’s doorstep with some tough questions. The applicant wanted to know:

- What was the reason or objective behind SEBI’s circulars on options trading issued between Aug 2024 and Jul 2025?

- Could SEBI share the internal file notes and emails that shaped these circulars?

- Did the Finance Ministry or any other government body play a role?

- Was there any public or stakeholder consultation?

- And finally, was any impact analysis done before or after making these changes?

In other words, the applicant wasn’t satisfied with just what. They wanted to peek into the WHY and the HOW.

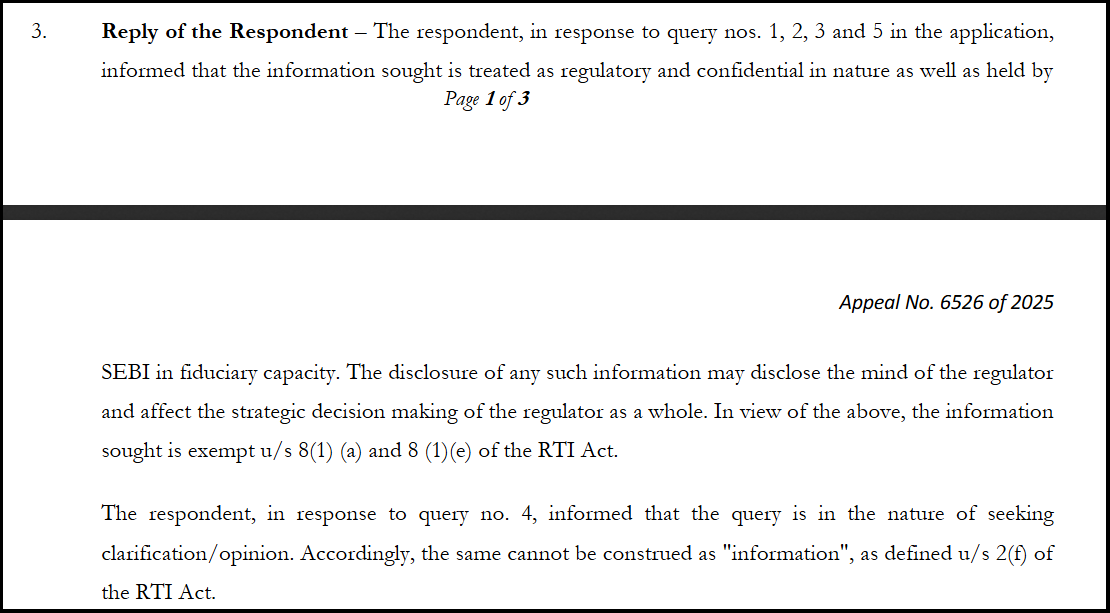

SEBI’s Response: A Firm “No”

SEBI replied, and the answer was pretty firm. Most of the information was denied. Why? Because sharing it would “reveal the mind of the regulator.”

Here’s what that meant in practice:

- The internal discussions, drafts, and risk analyses are confidential.

- Disclosing them could expose SEBI’s strategies, weaken its decision-making power, and even harm the stability of markets.

- Plus, under the RTI Act, regulators aren’t obliged to give opinions or clarifications, only facts that already exist in official records.

The appeal authority agreed with SEBI’s stand. So the door to those internal files stayed shut.

So, What is the “Mind of the Regulator”?

Think of it as SEBI’s playbook. Behind every circular, there are debates and “what if” scenarios, like:

- What if traders exploit this loophole?

- What if we tweak the margin requirement? Will volatility go up or down?

- What could be the unintended consequences?

- How do we plug gaps without discouraging genuine investors?

If these raw thoughts were made public, bad actors might use them to game the system. And stakeholders might stop giving SEBI honest feedback if they knew it could all be exposed later.

So, the regulator keeps this “mindspace” protected.

SEBI’s Point of View: Confidentiality is Key

From SEBI’s side, the logic is pretty straightforward:

- Regulators need freedom to think out loud without worrying about every draft being scrutinized later.

- Internal strategies often highlight vulnerabilities — sharing them could invite misuse.

- Confidentiality keeps stakeholder trust intact, so industry experts and government bodies can give inputs honestly.

- And, at a broader level, it protects market confidence and even national economic interests.

In short, secrecy here is not about hiding things from investors — it’s about protecting the system from being weakened.

Retail Trader’s Point of View: “But What About Us?”

Now flip the coin. If you’re a retail trader, this whole thing feels a bit different.

- Circulars sometimes appear out of nowhere, leaving you scrambling to adjust.

- Without knowing the rationale, it’s hard to gauge how a change will hit your trading strategy.

- And when you can’t see the bigger picture, it’s easy to feel like rules are made to favor “big players” over small ones.

Retail investors don’t necessarily want to read hundreds of pages of SEBI’s internal notes. What they want is clarity of intent. A simple:

- Why this rule?

- What risk is it solving?

- What should market participants expect?

That level of transparency builds confidence, even if the regulator’s deeper strategies stay under wraps.

Our Viewpoint on This: Balance is the Way Forward

Here’s how we see it.

- SEBI is absolutely right that regulators need a safe space to brainstorm and protect their strategies.

- Retail traders are absolutely right to want more explanation and context.

The solution? Structured transparency.

- SEBI could publish short explanatory notes with each circular, not the whole debate, just the broad purpose.

- A summary of impact analysis (in plain English) could go a long way in showing retail investors that changes aren’t arbitrary.

- And public consultations, when relevant, should be highlighted more clearly so retail voices don’t get left out.

That way, SEBI keeps its “mind of the regulator” safe, while also giving the market enough to understand the why.

Wrapping Up

The RTI applicant asked bold questions, and while SEBI said no, the exchange opened up a bigger conversation.

The mind of the regulator isn’t something the public can (or should) fully access. But what the public does deserve is a clear sense of intent. Regulators and investors aren’t enemies; both want the same thing: a fair, stable, efficient market.

The real challenge is balance, protecting the strategy while building trust. Because at the end of the day, knowing the entire mind of the regulator isn’t necessary. But knowing the heart behind the regulation? That’s essential.