In India, only 8% of the population holds demat accounts. What do you think is a major reason behind this?

Well, it is clear, that many people still perceive the stock market as risky and, in some cases, even consider it as gambling.

While it’s true that the stock market carries risks and requires expertise, discipline, and emotional resilience, there is still a strong preference for safer, more familiar options like bank savings.

People trust banks because they are seen as secure, offering a sense of stability for their hard-earned money.

However, what if one day you wake up to the news that the money you deposited in the bank has been used in fraudulent activities and now there’s a possibility you may never get it back?

This is the harsh reality facing clients of New India Cooperative Bank right now.

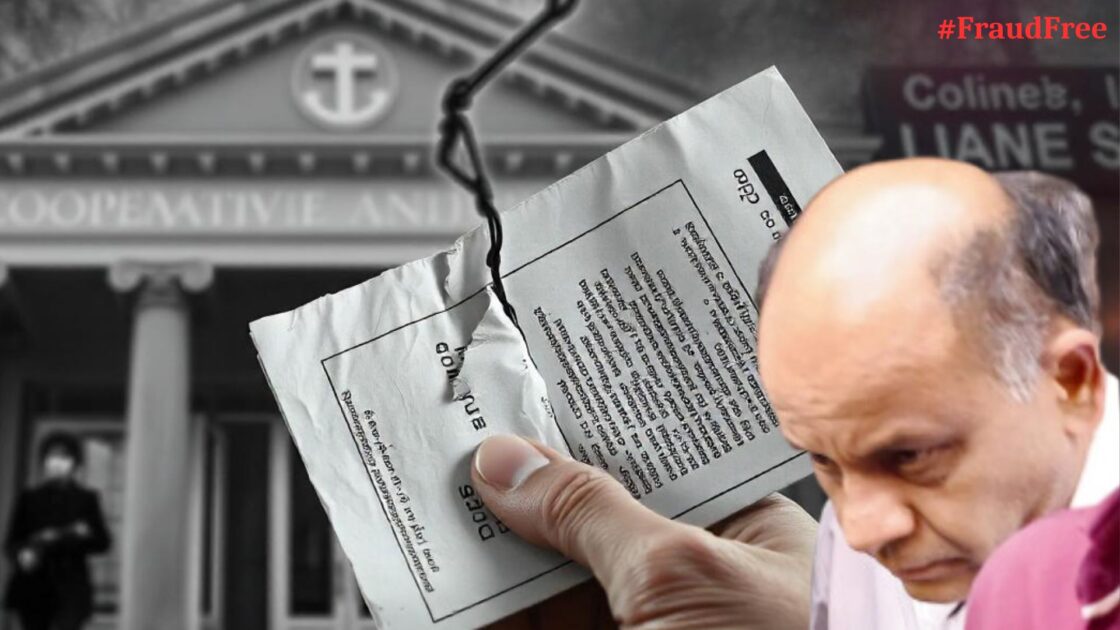

An investigation by the Economic Offences Wing (EOW) uncovered a ₹122 crore fraud at New India Cooperative Bank. The investigation further revealed the name of former General Manager Harsh Mehta.

Here’s a closer look at how the EOW uncovered the scam, and how such fraud can have a devastating impact on the financial security of ordinary people who place their trust in these institutions.

Uncovering ₹122 Crores Fraud in New India Cooperative Bank

The fraud was uncovered on February 12, 2025, when a team of RBI officials arrived at the Prabhadevi head office of New India Cooperative Bank for an audit. During their review, they discovered that ₹112 crores were missing from the safe.

Upon further investigation, the auditors found irregularities amounting to ₹10 crores at the Goregaon branch as well.

When the auditors questioned the bank staff, they did not receive satisfactory answers. It was later that Mr. Hitesh Mehta, the former General Manager, allegedly admitted to the theft during a meeting with the RBI officials.

Mehta revealed that he had provided unsecured, “friendly” loans to small businesses after the COVID-19 pandemic. A major portion of these loans included ₹70 crores lent to Mr. Dharmesh Paun and ₹40 crores to Arunachalam.

This raised several important questions: Why were these irregularities not flagged in the annual audit of the bank? And why was there no report of such suspicious activity to the RBI?

The investigation is still ongoing. The auditors now trying to determine the interest rates Mehta charged on these loans. Also, they are trying to uncover other benefits he may have gained from lending depositors’ money in an unsecured manner.

As a result of the findings, a case has been filed against Mehta and his associates.

In response, the RBI has suspended the bank’s operations for the next six months. The regulatory body also put strict restrictions on withdrawals due to supervisory concerns.

While the regulatory body has taken swift action, the true victims of this fraud are clear; the depositors who showed their trust in the bank and put their savings, believing it to be stable and secure.

Impact of Such Frauds on the Common Man

- Loss of Savings

Many individuals, especially small investors, deposit their hard-earned money in cooperative banks as a safer investment.

When such banks engage in fraudulent activities or mismanagement, the common man risks losing their savings.

In this particular case, money that was meant to serve as a deposit for individuals was misused for unsecured loans to traders, resulting in potential loss for depositors.

- Erosion of Trust in Banks

Such fraud erodes the trust of depositors in the financial bodies that are regulated. Such incidents divert them to other investment options that can benefit them with high returns.

Most of the time such scams end up in a much bigger scam than this.

- Financial Stress

When depositors face losses, it can lead to significant financial stress. Now this stress increases multi-fold for individuals who rely on their savings for their daily expenses, retirement funds, or medical needs.

The delay or inability to retrieve their money adds to this burden.

- Legal & Recovery Challenges

Victims of such frauds often face long delays in legal proceedings and compensation. The process of recovering their lost money can be time-consuming and uncertain.

In many cases, it becomes difficult for common people to navigate the complex legal system to reclaim their losses, leaving them disillusioned.

In all, the direct and indirect consequences of such scams hit the average person hard. Such cases impact their financial security, eroding trust, and making it more difficult for them to recover their losses.

It also shifts their perception of how safe and reliable their financial institutions are.

Conclusion

No wonder, safer banking options like savings accounts often keep people away from riskier investments like the stock market, incidents like the New India Cooperative Bank scam serve as a harsh reminder of how vulnerable even the most trusted financial institutions can be.

When a bank, which is considered as safe to keep hard-earned money, engages in fraudulent activities, it not only causes immediate financial losses for depositors but also damages their trust in the entire banking system.

The repercussions extend far beyond monetary loss. Such scams affect mental and emotional well-being, as people struggle with the uncertainty of recovering their funds.

This case highlights the importance of greater transparency, stricter regulatory measures, and the need for financial literacy among the public.

While banks may still be seen as safe places for savings, incidents like these show that one must stay alert even when taking services from one of the renowned and trusted financial institutions.

Last but not least, one must not completely rely on one financial institution to save their funds.