Many retail investors believe that if an advisory is SEBI-registered, it must be safe and trustworthy. Unfortunately, some advisories misuse this registration to trap innocent traders with false promises of guaranteed profits.

One such case recently came to us, where Suresh (name changed) was deceived by an advisor and suffered heavy losses.

Fortunately, in this case, the victim contacted our team in time, and with our support, he was able to recover nearly 50% of his losses.

How It All Started

Suresh received a call from Trade Wealth, claiming to be a SEBI-registered advisory specializing in stock options. To gain his trust, they gave him a demo trade, where he earned about ₹1,000 profit.

Soon after, they pressured him to register for their services. On seeing his portfolio in a negative of ₹30,000, they assured him that with their guidance, he could make daily profits.

Suresh was asked to pay ₹10,000 initially, after which they conducted 1–2 trades that failed to yield any results.

The advisory then demanded the full payment of fees, promising ₹1 lakh guaranteed profit if he complied.

Misleadingly, they:

- Forced him into trades.

- Collected ₹75,000 as fees.

- Made him hold risky positions without any stop loss.

- Even gave him commodity tips despite no margin in his account.

One particular trade – a 72 call option sold at 23 – was held the entire month without proper risk management. Eventually, it became zero, leaving him with a ₹1,00,000 trading loss in addition to the high fees.

Violations of SEBI Rules

Despite being registered, the advisory clearly violated SEBI’s regulations, which prohibit:

- Promising or guaranteeing profits.

- Forcing clients to pay extra fees.

- Advising trades without proper stop loss or risk management.

- Giving services unsuitable for the client’s profile (e.g., commodity tips without margin).

- Charging high fees without transparency.

Unfortunately, like many retail investors, Suresh was unaware of these rights and rules.

How Our Team Stepped In?

By the time Suresh reached us, his total loss had crossed ₹1.75 lakh (₹75,000 fees + ₹1,00,000 trading loss).

Our team carefully documented all proofs – calls, emails, and trading records – and initiated a formal complaint on the SEBI SCORES portal.

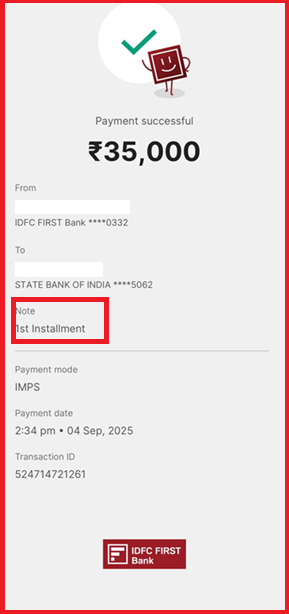

After months of follow-ups and direct communication with both SEBI and the advisory, we managed to secure a partial recovery.

- Total Fees Paid: ₹75,000

- Trading Loss: ₹1,00,000

- Total Loss: ₹1,75,000+

- Recovery Secured: ₹50,000

- 1st Instalment: ₹35,000 (received)

- 2nd Instalment: ₹15,000 (pending)

A Recovery with a Lesson

While Suresh could not recover his entire loss, getting back ₹50,000 was a meaningful success in a case where most victims usually end up empty-handed.

This case highlights key lessons for all traders and investors:

- Registration doesn’t guarantee ethics – check track record and reviews too.

- Guaranteed profits = biggest red flag.

- Always use the SEBI SCORES portal in case of disputes.

- Keep every piece of evidence – it makes recovery possible.

Thanks to persistence and the right approach, Suresh was able to recover part of his losses and regain confidence in the regulatory system.