“I had invested because my neighbor told me she got double the money in just two years. It felt like a godsend,” said Shambhu Das, a retired schoolteacher from West Bengal.

“Now it feels like I was just a pawn in someone else’s game.”

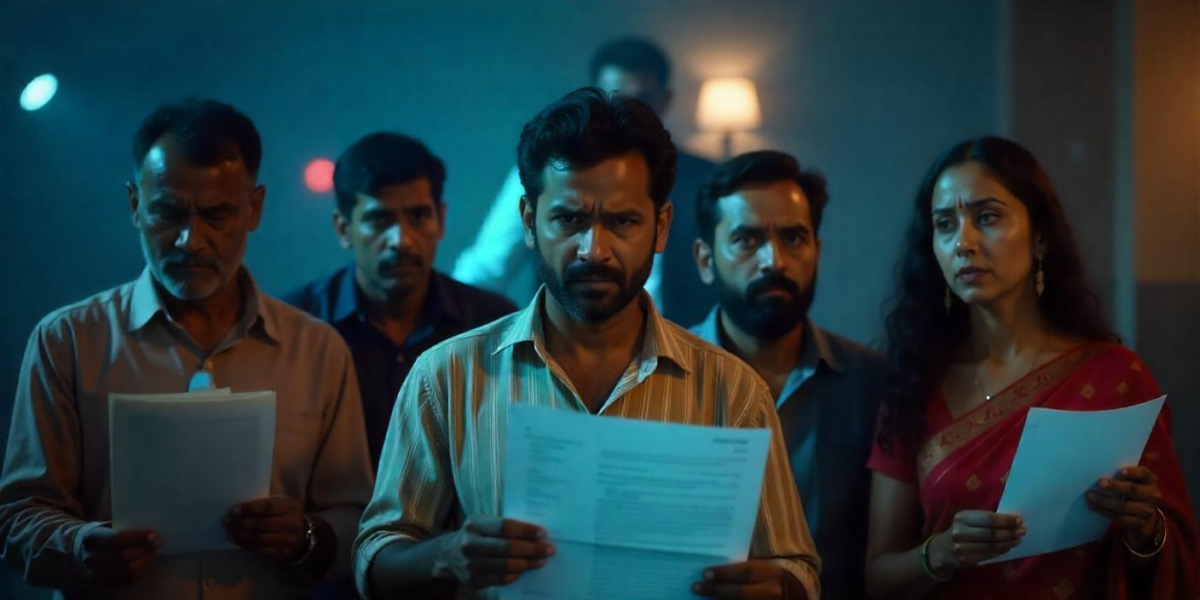

His voice cracked when he said that. And he’s not alone; there are lakhs of others like him across eastern India who fell into the glittering trap called Rose Valley.

Back in the early 2000s, if you lived in Bengal, Odisha, or Assam, you couldn’t have missed the presence of Rose Valley.

They were everywhere. TV channels, newspapers, and even hoardings on highways flaunted luxury resorts, investment schemes, and a seemingly endless list of ambitious ventures.

At first glance, the company looked legit.

They had hotels. A newspaper. A Bengali entertainment channel. Cricket team sponsorships.

Even Bengali film stars endorsed their brand. But behind all that dazzle lay one of the biggest Ponzi schemes this country has seen.

And the man at the center of it all? Gautam Kundu.

A sharply dressed man who carried himself with the swagger of a business tycoon. But instead of real profit, he was simply shuffling money from one pocket to another, robbing Peter to pay Paul.

How Did It All Begin?

Rose Valley started like a typical chit fund company. But then, it began rolling out investment schemes with unusually high returns.

Something about the promises felt off to some, but to the vast majority, especially the middle and lower-middle classes dreaming of financial security, it felt like an opportunity too good to ignore.

“Give ₹10,000 today, get ₹20,000 in 3 years,” they said. No questions asked. No stock market jargon. Just a simple promise.

The company claimed it was investing in real estate, hospitality, and infrastructure.

But investigators later found most of that was a mirage. The money wasn’t being invested; it was being rerouted, repackaged, and handed out to earlier investors to maintain the illusion of a booming business.

And like every Ponzi scheme, it worked brilliantly… until it didn’t.

The Fall of Scheme

In 2015, the Enforcement Directorate swooped in. Gautam Kundu was arrested, and it was like someone had pulled the curtain down on a very elaborate stage play.

What was left behind was heartbreaking: ₹17,500 crore collected. Over ₹6,700 crore still unpaid. Lives shattered. Families ruined.

They seized his luxury cars, attached land across West Bengal and Odisha, and froze his companies. But you can’t recover trust as easily as you seize assets.

A senior official who was part of the initial ED probe reportedly said, “This wasn’t just fraud. It was a psychological trap. People believed in him like a godman. That blind faith is hard to explain on paper.”

Justice—But in Installments

Fast forward to 2025, and now there’s a sliver of hope. According to recent news from the Times of India and other reliable sources, around ₹515 crore has been returned to about 7.5 lakh investors so far.

This includes the ₹450 crore released recently, thanks to the Asset Disposal Committee.

But here’s the catch—over 31 lakh claims have been filed. And we’re still ₹6,700 crore short.

It’s like pouring water into a bucket riddled with holes. Sure, some water’s going in, but it’s far from full.

What Happens Now?

“I haven’t got my money yet. But at least some people have. That gives me hope,” said Rekha Rani, a homemaker from Bhubaneswar, who invested ₹1.2 lakh from her family savings in 2011.

Her optimism is admirable. But it also reflects the desperation of victims who’ve been waiting a decade for some semblance of justice.

While the ED and ADC continue working through the legal maze of asset liquidation, there’s still a long road ahead.

The courts have ordered disbursal. The government agencies are involved. But bureaucracy moves at its own pace, and for many of these investors, many of them now senior citizens, time isn’t exactly on their side.

What Can We Learn from This?

The Rose Valley scam isn’t just about one company or one man’s greed. It’s about a system that didn’t ask the right questions soon enough.

It’s about regulatory blind spots and how emotionally vulnerable people are to promises of easy wealth.

And most importantly, it’s about the resilience of the common man. Because even when the system fails, and the crooks run free for years, people still hold out hope.

“Maybe next year they’ll return the rest of it,” Shambhu said with a tired smile.

Maybe they will.