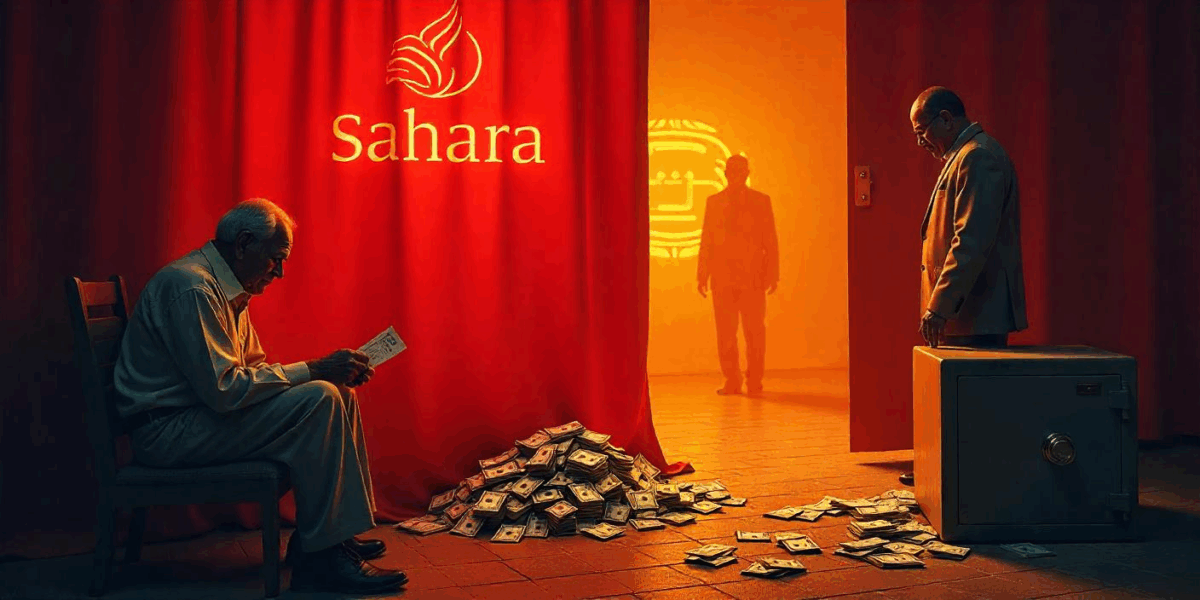

It’s been years since Sahara made headlines. For a while, it felt like the whole story was over—just another chapter in India’s long list of financial scams. But in April 2025, the Enforcement Directorate (ED) pulled the curtains back again.

“We’ve attached assets worth ₹1,500 crore in the Sahara case,” an ED officer said casually during a media update.

Most people probably skipped over the news. But for those who’ve followed the Sahara story—or worse, invested in it—this announcement hit differently.

Once Upon a Time, Sahara Was a Big Deal

Ask anyone from the early 2000s, and they’ll remember Sahara as a giant. It wasn’t just a company; it was everywhere: TV, cricket jerseys, newspapers. Subrata Roy, the founder, was treated like a celebrity. People trusted him blindly.

Sahara promised big returns through something called Optionally Fully Convertible Debentures (OFCDs).

It sounded complex, but for lakhs of common investors, the idea was simple—“Give your money, and it will grow.”

But here’s where it got messy.

Most of this money came in cash. Not a little, about 95% of it. Now imagine lakhs of people giving cash to agents, with very little paperwork. It was a ticking time bomb.

Why So Much Cash?

That’s the question one junior ED officer reportedly asked during an internal meeting.

“Sir, almost 95% of transactions were in cash. Who keeps track of so much money without any record?”

The senior officer looked up and said quietly:

“That’s exactly the point. Cash hides everything. No trail, no questions.”

And just like that, the fog around Sahara’s empire started clearing—slowly.

SEBI Steps In (But It’s Already Too Late)

In 2012, SEBI finally stepped in and asked Sahara to return ₹24,000 crore to investors. The Supreme Court backed this order too.

What did Sahara do?

They sent truckloads of files to SEBI offices, claiming these had investor details. But when the papers were checked, many were incomplete, fake, or just didn’t make sense. It became clear that this was more than just poor record-keeping—it was an organised cover-up.

Subrata Roy was jailed in 2014. But the money? Still missing for the most part.

The ED’s Recent Move

Fast forward to 2025, and ED has now attached assets worth ₹1,500 crore. These include lands, buildings, and properties held in the name of different Sahara group companies.

The money trail has led investigators to over 4,500 bank accounts connected with Sahara. Imagine the amount of data and digging that takes. Investigators believe this is just one small part of the total assets hidden over the years.

One officer was quoted as saying:

“This is not about one man or one company. It’s about how a system was built to take money from common people and then hide it in plain sight.”

Real People, Real Losses

In a small town in Bihar, 68-year-old Shyamlal still keeps his Sahara receipts in a plastic file.

“I gave ₹50,000. They told me it would double in a few years,” he says with a sad smile.

“Now no one picks up the phone. I don’t know if I’ll ever see that money again.”

There are thousands of stories like Shyamlal’s. People who gave away their hard-earned savings—some even mortgaging land or selling gold—trusting Sahara would take care of them.

Why This Matters Today

You might wonder—why dig up an old case now?

Because the scam never really ended. The investors never got their full money back. The people responsible are still not fully held accountable. And most importantly, the lessons we should’ve learned as a country haven’t really sunk in.

The way Sahara operated—taking cash, avoiding proper audits, delaying refunds—can still happen today if we aren’t careful.

What Happens Next?

The ED is still investigating. The attached assets are just a part of what they believe is a much bigger pool of hidden wealth. More properties, benami accounts, and money parked under other names may still come out in the coming months.

Whether investors like Shyamlal will ever get their money back is a tough question.

But one thing is sure—the Sahara scam is not just a story from the past. It’s a warning for the future.

Final Thoughts

The ₹1,500 crore attachment is not the end of the road—it’s just a reminder. A reminder that even big names, glossy ads, and emotional branding can hide some very ugly truths.

If you’ve ever been tempted by schemes promising “double returns,” or if someone tells you “it’s safe, just trust us,” pause and ask questions.