One man’s complaint led to refunds for countless others!

You never know how one action can help others, and this case is a perfect example. A retail trader filed a complaint against an unregistered advisory service and ended up not only getting a refund of his fees but also helping others who fell victim to the same fraud.

And this time, it became possible because of SEBI’s quick investigation & actions against the complaint received.

Let’s break it down and know:

- What was the case all about?

- Who raised the issue with SEBI?

- What actions did SEBI take?

- How long did it take SEBI to sort it out?

So, What Was the Case?

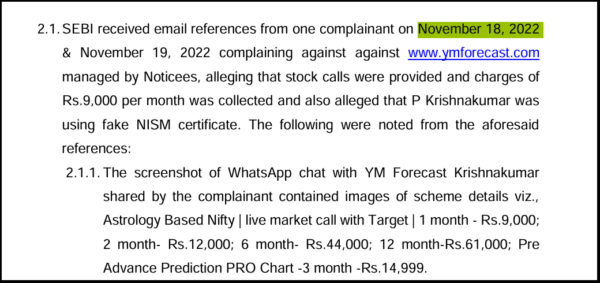

It was November 18, 2022, SEBI got an email from a retail trader about YMForecast, a company offering some illegal advisory services.

The very next day, on November 19, 2022, the trader followed up with another complaint, this time including WhatsApp screenshots showing how the company was charging people for different plans and services.

He even shared a screenshot from another victim.

SEBI started digging into it and found out that two guys from Coimbatore, P Krishan Kumar and Jagdishan S., were running illegal advisory services through their website www.ymforecast.com.

These guys set up the website in March 2021 and were offering two services: Astrotalk Advisory and Stock Advisory. They had different plans with names like Nifty Future Pre Advance and Nifty Options Pre Advance, ranging from ₹5,000 to ₹48,000, and valid for anywhere from 1 month to 1 year.

Now, even though P Krishan Kumar was NISM certified, their website didn’t have a SEBI registration number.

And here’s the thing—having an NISM certification doesn’t mean you’re allowed to offer Research Analyst (RA) or Investment Advisory (IA) services. SEBI had already issued multiple warnings to raise awareness, but people were still paying for their services without checking things out properly.

What did SEBI Do About it?

After looking into it, SEBI sent them a letter in December 2022, asking them to respond to the complaint. Krishan Kumar replied that he was NISM certified but didn’t know SEBI registration was mandatory for advisory services.

Then, in January, SEBI sent them another order, asking for details of all their clients and their contact information.

By February 13, 2023—so, within a month—Krishan Kumar and Jagdishan S. provided all the info. SEBI also checked their bank accounts and found that Krishan Kumar had ₹49,33,108, and Jagdishan S. had ₹35,15,463.

So, the total in both accounts was ₹84,48,571/-.

SEBI then asked how much of that money belonged to clients. They submitted another statement showing that about ₹25,97,884 had been charged to clients for advisory services over the past 2 years.

SEBI found another account with around ₹4 lakhs in both accounts. So, the total amount that came from clients was roughly ₹30,00,000/-.

SEBI quickly issued an order telling them to refund the clients’ money within 3 months.

They also had to publish a notice in two national newspapers, one in English and one in Hindi, saying they provided illegal advisory services and anyone who used their services could claim a refund.

The rest of the money that wasn’t claimed would go into SEBI’s Escrow Account for 1 year, and after that, it would be transferred to the Investor Protection Fund (IPF).

So, thanks to one trader speaking up, hundreds of others got their money back. Hopefully, everyone who was affected claimed their refunds.

What Can You Take Away from This?

But here’s the real lesson: Always be careful and make sure you know what’s legit and what’s not.

Paying fees to someone just because they have a fancy website isn’t enough. Always check for SEBI registration before using any advisory services.

And remember, if someone is promising guaranteed returns or anything that sounds too good to be true, it’s probably a red flag. Those promises might be tempting, but chasing quick profits can lead to long-term, big losses.