Have you ever wondered what happens when a stock broker fails to follow SEBI’s rules?

Recently, Jainam Broking Limited, a registered stock broker in India, received an important order from SEBI (Securities and Exchange Board of India) that sheds light on exactly how seriously regulators take compliance.

But here’s the interesting part: while the broker was caught making mistakes during the inspection process, SEBI didn’t slap them with a penalty.

Confused? That’s exactly why you need to read this. In this blog, we’ll break down the Jainam Prop Desk Scam, what happened, why it matters, and what this order means for you as an investor.

Let’s dive in and understand this in simple terms without all the legal jargon.

Jainam Broking Case

In simple terms, SEBI conducted an inspection of Jainam Broking Limited between November 27-29, 2024.

The inspection was focused on one specific area: how the broker was onboarding (enrolling) new clients.

Think of onboarding as the initial process when you open a trading account, like your KYC verification, identity checks, and account setup.

After the inspection, SEBI found that Jainam Broking had violated certain rules. But SEBI decided not to impose any monetary penalty on the broker. Why?

Because the officer investigating the case felt the violations were mostly “technical and procedural in nature” rather than intentional misconduct.

What Were The Violations Done By Jainam Broking?

Let’s understand what went wrong in Jainam Broking scam.

First Violation: Late Reply to SEBI’s Urgent Data Demand

SEBI gave the broker an “administrative warning” in November 2024, asking them to submit detailed information about their client onboarding process.

The deadline was tight (just two days), but Jainam Broking took an extra day to respond.

Even when they did respond, there were problems. The broker submitted data that wasn’t properly organized. SEBI asked for information about the two months when they registered the maximum number of clients, but Jainam Broking gave them data for different months (January and July instead of May and July, for example).

This mismatch happened because their back office software had errors when calculating across multiple exchanges and trading segments.

When SEBI pointed this out, the broker quickly corrected it, but the damage was done, and they had already submitted incorrect information.

Second Violation: Ignored Direct Instructions to SEBI

Jainam Broking didn’t follow a basic instruction from the warning letter. SEBI asked them to present the warning to their Board of Directors and send SEBI the Board’s comments within two weeks.

Instead, the broker sent the Board’s comments to BSE (Bombay Stock Exchange), thinking that would be sufficient. They never sent it directly to SEBI. This happened in November, but the Board’s comments only reached SEBI in March, which was almost four months later.

Third Violation: Delayed Inspection Response After Chases

When SEBI asked for replies to their inspection findings in March 2025, Jainam Broking was slow to respond. SEBI sent the initial email on March 4, asking for a reply within 5 days.

But the broker took 8 extra days, sending their response only after SEBI made multiple phone calls and sent three reminder emails.

The core issue?

According to SEBI’s Code of Conduct for Stock Brokers, every broker must “act with due skill, care, and diligence in the conduct of all his business.” Jainam Broking’s tardiness, inaccurate data, and unclear communication suggested they weren’t being careful enough.

Penalty Imposed: “The Surprising No-Penalty Verdict”

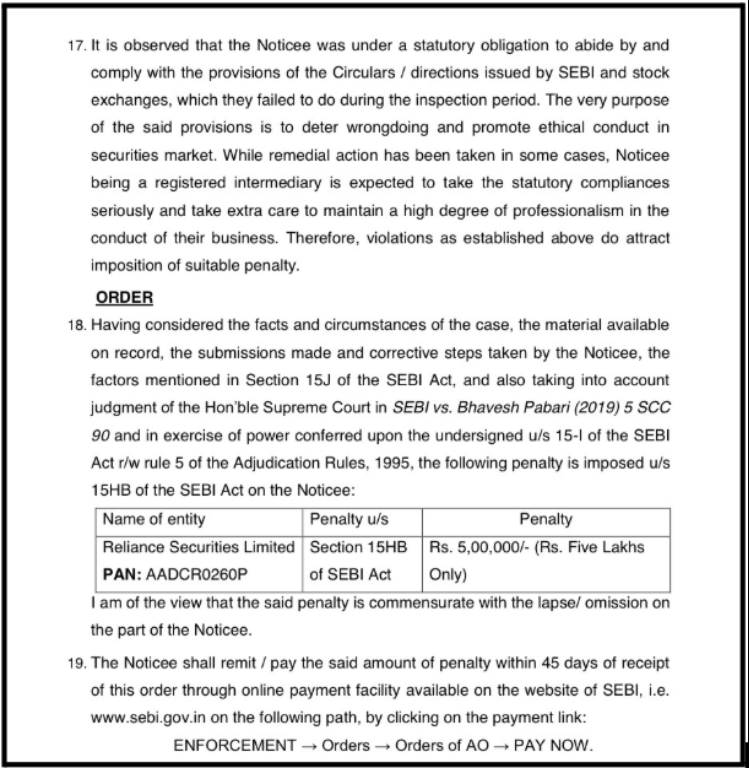

Despite finding clear violations around late submissions, wrong data, and ignored instructions, SEBI’s Adjudicating Officer Amit Kapoor dropped a bombshell on November 26, 2025: zero monetary penalty.

Why the leniency?

The officer called these “technical and procedural lapses” rather than intentional wrongdoing.

Jainam quickly fixed errors when pointed out, provided extra data (even if not perfectly formatted), and showed no manipulation attempts.

They even sent Board comments to BSE (just not directly to SEBI as required).

SEBI recognized the broker’s prompt corrections and procedural intent, deciding these honest mistakes didn’t warrant financial punishment under Section 15HB.

This “clean slate” outcome shows regulators can separate sloppy paperwork from serious fraud, but it stays on Jainam’s permanent record for future scrutiny.

What Does This Order Mean for You?

Now, you might be thinking, “This all sounds technical. How does it affect me as an investor?”

Great question. Let’s connect the dots.

First, this order is about protecting you during the account opening process.

Client onboarding rules exist to ensure that when you open a trading account, the broker:

- Properly verifies your identity

- Checks your financial background

- Ensures you understand the risks involved

If a broker isn’t careful during this process, fraudulent accounts could sneak through. Your information could be misused, or your money could be at risk.

Second, it shows SEBI is actively monitoring brokers.

This inspection wasn’t triggered by complaints; it was a “thematic inspection.” SEBI proactively decided to check how all brokers handle client onboarding.

This gives you confidence that regulatory bodies are working to catch problems before they hurt you.

Third, the fact that no penalty was imposed despite violations is actually important for understanding how SEBI operates. It shows that SEBI distinguishes between serious wrongdoing and honest mistakes.

Jainam Broking wasn’t trying to hide information or deceive anyone.

They were sloppy and slow, yes, but they quickly fixed errors when pointed out. This distinction matters because it keeps the system fair and prevents over-regulation while still holding brokers accountable.

Fourth, this order sends a clear message to all brokers: “We’re watching, and we’re keeping detailed records.”

Even though Jainam Broking didn’t get penalized this time, the order becomes part of their regulatory history. If similar issues happen again, SEBI can point to this order and impose stricter penalties.

Need help?

We understand how frustrating it can be when your money is at stake. But don’t worry!

If you have ever faced something similar and want to know where to complain against a stockbroker, feel free to reach out to us.

We are a team that specialises in providing help to victims. We make sure your case is heard and handled with care so that the recovery process becomes easier for you.

Conclusion

Jainam Broking’s SEBI order is a reminder that behind every trading account you open, there’s a regulatory framework designed to protect you.

While the broker’s procedural lapses were highlighted, the absence of a penalty reveals that SEBI judges violations on their merit, separating genuine negligence from intentional fraud.

As an investor, this order should give you two things:

- Reassurance that regulators are actively supervising the broking industry

- Confidence that compliance failures are being documented and addressed

The next time you open a trading account, remember that those KYC forms and verification steps aren’t just bureaucracy, but they’re part of a system designed to keep your money safe.

Stay informed, stay cautious, and always know that SEBI has your back.