When you register on any platform, a unique code or ID is assigned to you. But what happens when you find out that someone else has been using your ID for personal gain?

Scary, right?

Now, imagine how much worse it gets when the ID in question is the SEBI registration number that belongs to a registered RA, whose details—name, registration number, and other credentials—are publicly available on the SEBI website.

This is exactly what Mr. Manoj (name changed) a SEBI registered RA faced.

Our team came across this issue through a case involving Mr. Ajay (name changed). Mr. Ajay had been scammed by an Instagram Influencer impersonating himself legitimate RA.

Mr. Ajay believed that the RA was associated with this scam when he joined a Telegram tips group the same influencer offering paid calls.

When our team reached out to Mr. Manoj on behalf of Ajay, it was revealed that he had no connection to such services.

However, it was hard to believe but what happened in the end, helped Ajay in getting a recovery of ₹1,00,000.

Let’s dive deeper into the details of this case and uncover how an Instagram influencer used fraud to exploit his followers.

How Ajay Ends Up Using Telegram Tips?

“Trading Guru” (name changed), a popular Instagram influencer with a substantial follower base, misuses the trust of his followers by providing them with fake advisory services.

The person named Manu (name changed) running this handle used to lure his clients by displaying fake PnL statements in his reels. Ajay, who was new to the stock market, came across this influencer’s page.

On checking the bio, Ajay found that Manu had mentioned “Under SEBI Registration” in his bio.

This made Ajay believe him and eventually, he paid ₹7,000 for his stock market course, which he used to market on Instagram.

However, the course was nothing more than a series of recorded video lessons with no real value.

Soon after, Ajay received a call from Manu’s team, encouraging him to join their premium Telegram channel for ₹9,000, where options trading tips were shared.

Ajay, an investor, was already tempted by Manu’s trades, and agreed to make quick money, he paid fees to join the Telegram Group. However, in the group, he found that random call & put tips were provided. It looked more like gambling rather than options trading.

Yet, since Ajay believed Manu was SEBI-registered, he followed these tips, leading to significant financial losses of around ₹4,00,000/-

How was the Scam Unveiled?

After losing around ₹4 lakhs, Ajay contacted Manu on the number provided to him. However, the person on the other side introduced himself as an employee working under Manu.

Further, he said that it was not Manu who was providing tips, infact, they had a registered RA who used to provide call tips to their clients. However, all this was hard to believe for Ajay as the voice on the call sounded exactly like Manu’s.

Eventually, Manu’s team claimed the RA responsible for providing tips was on leave and another RA had been providing tips for the last week. This raised even more red flags.

Frustrated, Ajay warned the team that he had gathered evidence and threatened to file a complaint. In response, the scammers removed him from the premium group.

How Ajay Got a Refund for His Losses?

Ajay, like many victims of such scams, felt helpless. Fortunately, a friend introduced him to the A Digital Blogger FraudFree program, where he shared his experience with our team.

After reviewing the case, we reached out to the RA whose registration number was provided by Manu’s team. When we didn’t receive any response, we filed a formal complaint on the SEBI SCORES portal.

Shortly after, Ajay received a call from Manu, who offered to settle for ₹1,00,000—an amount far less than Ajay’s losses. Manu even asked Ajay to take his complaint back as his account had been frozen.

Although, as per the process SEBI had never taken such action against any complaints. Thus, it seemed that he was making fake stories to protect himself.

Finally, the real RA contacted us, stating that he had no connection to Manu or his Instagram handle. He shared proof that his name and SEBI registration number were being misused by the scammer.

On seeing our mail RA filed his own case and shared a copy of the report with us.

Now due to these actions, only Manu’s account was frozen. However, he thought the complainant to be Ajay and he agreed to refund ₹2,00,000.

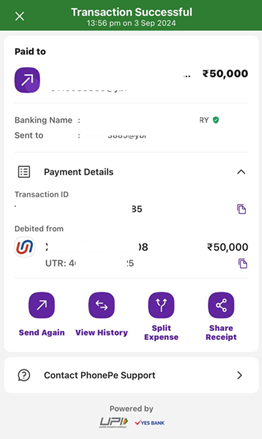

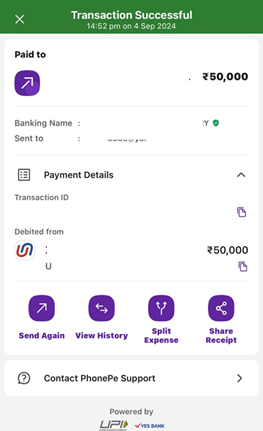

After a month of persistent follow-ups, Ajay successfully recovered ₹1,00,000 in 2 installments of ₹50,000 each and is awaiting the remaining amount.

Reading this will make you believe that it was the action of a real RA that helped Ajay in getting his money back. In the first instance, it seems to be true but there is something that makes us think twice.

According to standard procedure, in general, authorities freeze accounts where direct transactions occur between the victim and the scammer.

If we assume the RA was unaware of the scammer’s actions, why did his complaint lead to the freezing of the scammer’s account?

This implies that some transactions occurred between them. But why?

Were they connected all along, with the RA trying to cover his tracks?

If so, the scam might be much larger than it seems, making it crucial for traders to be cautious and thoroughly verify all details before enrolling in any services.

Conclusion

This case highlights the importance of verifying the credentials of those offering financial advice, especially when dealing with online influencers.

Always cross-check details on the SEBI portal and report suspicious activity promptly to avoid falling victim to similar scams.