“Wait… they didn’t even disclose a ₹72 crore arbitration loss to the exchange?”

Amit, a retail trader from Thane, blinked twice while scrolling through the SEBI order on Seya Industries.

He wasn’t new to the market. He’d seen penny stocks turn to dust and heard of promoters vanishing overnight. But this? This was a listed company on the NSE, with a Board of Directors, auditors, and investors like him.

“If a listed company can do this, who can we trust?”

The Problem Beneath the Surface

Seya Industries isn’t a household name like TCS or HUL. But that’s what made the story all the more important. This wasn’t some shady fly-by-night operator on Telegram pumping fake stocks.

This was a company that raised funds through private placements of NCDs and CCPS.

A company that had audits, filings, annual reports—and yet, it allegedly managed to falsify sales, siphon funds through related party transactions, and conveniently forget to inform exchanges about a ₹72 crore arbitration order.

Yes, ₹72 crore. Not chillar.

And the worst part? When the NSE asked them for details, they just… didn’t respond. Even after SEBI told them to comply.

Now imagine being a retail investor holding the stock at the time, waiting for a rebound. The price moves without context, news trickles in slowly, and one fine day, you learn the company has been non-compliant for over a year, and is under forensic audit by Ernst & Young.

You don’t even get a chance to exit.

The Web of Violations

SEBI’s 122-page order lays it all bare:

- Fake sales: Round-tripping transactions with entities linked to the CFO and CMD’s son.

- Siphoning of funds: Transactions routed to private firms owned by the promoter’s family.

- Non-disclosure of critical events: Like the ₹72 crore arbitration award.

- Failure to respond to exchanges and regulators.

Now ask yourself: If this happens in a listed company, how secure are our disclosures?

Retail investors are told to trust balance sheets, go through annual reports, and rely on corporate governance standards.

But if companies are inflating revenue and profit on paper while bleeding cash into related party accounts, where does that leave you and me?

A Conversation the System Doesn’t Want to Have

Riya, another trader, read the order over tea. “So you’re telling me the auditors didn’t catch this? And even when NSE flagged issues, nothing happened until investors filed complaints?”

“Exactly,” her friend replied. “This wasn’t just a loophole. This was a canyon in the compliance system.”

It’s not that SEBI didn’t act. It did. Strongly, eventually. But the cracks this case exposes aren’t just about one company.

They’re about how many others may be hiding similar skeletons behind complex financial smoke screens.

SEBI’s Final Verdict – And the Price They Had to Pay

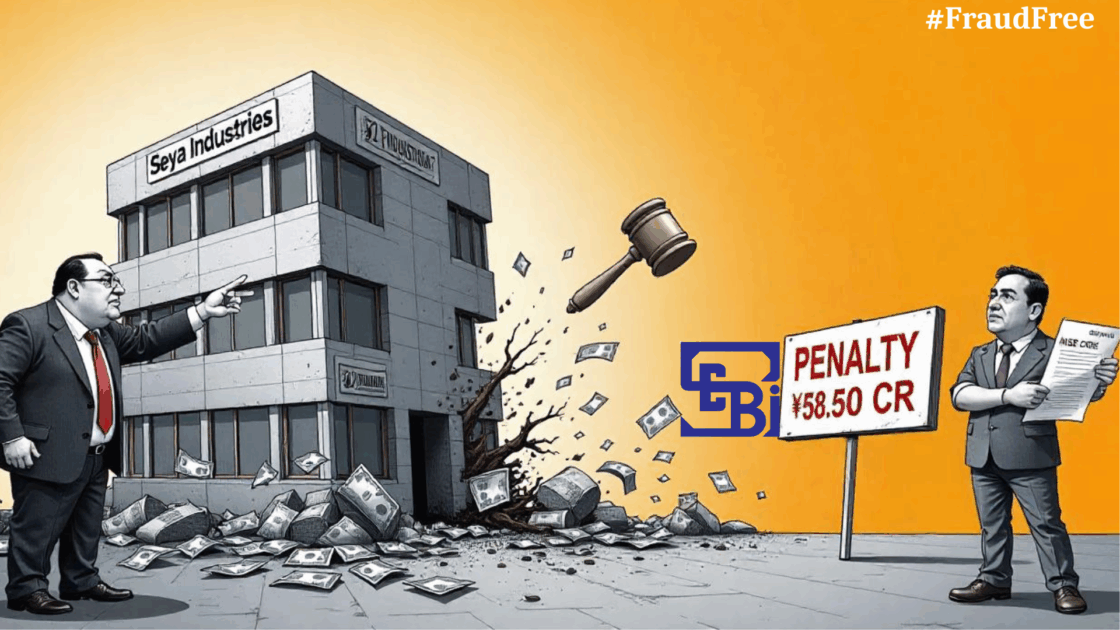

After months of back and forth, replies, legal delays, and a full-blown forensic audit, SEBI brought the hammer down.

And rightly so.

The regulator imposed a combined penalty of ₹58.50 crore on the company and its key management:

- ₹28 crore on Ashok Ghanshyamdas Rajani (Chairman and MD)

- ₹2 crore on Asit Kumar Bhowmik (Director)

- ₹50 Lakh on Sivaprasad Rao Buddi (Director)

- ₹28 crore on Amrit Rajani (CFO) for making false statements during the investigation.

But let’s be honest for a moment.

To a retail investor who lost 70-80% of their capital, or worse, exited in panic when the stock crashed without explanation, a ₹2.65 crore penalty might not feel like justice. It may feel more like a late apology from a teacher after the class is over.

What This Means for You, the Retail Investor

Let’s talk bluntly.

If you’re a small investor, here’s what this teaches you:

- Don’t blindly trust the financials. Look beyond revenue. What’s their cash flow? What’s the debt situation? Are they disclosing legal cases in time?

- Follow the company’s response to exchange queries. If a firm isn’t replying to NSE/BSE notices, that’s a red flag the size of a highway billboard.

- Dig into related party transactions. This is where the fraud often hides. Who are they doing business with? Are these shell firms owned by promoters?

- Stay alert for delays. No quarterly results on time? Investor grievance replies pending? Be suspicious. Laziness often hides something dirtier.

- Complaint to SEBI Against Company: In case you suspect anything suspicious, do not delay and report the concern in SCORES.

The Bigger Question: Can We Trust What We Read?

The Seya case is one of many. Not an anomaly. And that’s the problem.

For every Seya Industries caught, how many fly under the radar?

This is where SEBI’s evolving crackdown is a good sign—but the need for stronger real-time surveillance, greater auditor accountability, and transparency in financial filings has never been greater.

Investors don’t just lose money in such frauds. They lose faith.

And that, unlike capital, is not easy to rebuild.

Conclusion

Maybe it’s time we stop glorifying glossy balance sheets and start asking harder questions. After all, if a listed company can sell fake sales, siphon funds, dodge SEBI, and still stay listed for years…

Then maybe the real risk isn’t the stock market.

Maybe it’s what’s hiding behind the annual report.