Stock brokers are there to provide trading platforms, and if the broker is full-service, they also offer Research & Advisory Services.

However, there are instances where even the top stock brokers misuse their services for their interests.

Many traders who fall victim don’t fight back due to a lack of awareness or because they feel threatened by these registered entities.

One of the victims Sanket (name changed) faced a similar situation, but his persistence and positive attitude helped him recover more than 60% of his lost amount.

Here is how our team helped Sanket in recovering ₹1,90,000.

ADB: Hello Sanket, we came across your case where you lost around ₹3 lakh due to your stock broker.

Sanket: Yes, sir.

ADB: Can you please provide details of what exactly happened?

Sanket: I used to make a few investments using my Groww Demat account, but one day I received a call from a full-service stockbroker.

He told me that, unlike Groww, he would provide me with a Relationship Manager (RM) who would assist me in trading. He also mentioned that I would be able to learn about the stock market on their platform.

Before proceeding, I decided to verify the details. I contacted the Customer Care of that broker and shared the number from which I received the call. They confirmed that it was from one of their employees.

ADB: So, did you open a demat account then?

Sanket: Yes, with the objective of learning and trading. But I was disappointed when nothing like that happened. Instead, the assigned RM provided me with call tips. Luckily, the tips worked at first, but after a few days, he asked me to trade in options.

I had heard from friends that options trading without knowledge is like gambling, so I refused. But he convinced me, assuring me that he would educate me first and that all trades would be done under his guidance.

I agreed, and he activated my FnO segment. He explained the call and put options to me and started giving tips. Initially, I made a profit, but soon after, I faced continuous losses.

When I contacted the RM, he said that I often took positions late, which reduced my profits. He convinced me to share my account details, and that was my biggest mistake.

ADB: Did he take multiple positions?

Sanket: Yes, he opened multiple positions, and in large quantities. This led to a loss of ₹1.8 lakh in a day.

ADB: Did you contact him?

Sanket: I called his senior, who said he would provide a team to recover the losses. But he asked me to add ₹50,000. The very next day, I lost that amount as well. To recover the full amount, I added more funds and eventually ended up losing ₹3.20 lakh.

ADB: Did you report it anywhere?

Sanket: I sent an email to that broker, and after a few days, I got a call where they blackmailed me, saying that if I didn’t withdraw my complaint, there would be no chance of recovering the lost amount. I got scared and sent another email, withdrawing the complaint.

ADB: That was their trick to get out of the case. But don’t worry, there are still chances to recover your money.

Sanket: So, what can I do?

ADB: Do you have all the proofs, like chat recordings, transaction details, etc.?

Sanket: Yes, I have all the proofs.

ADB: Let’s start by sending an email to the stock broker’s compliance officer.

Sanket: But sir, I already did that.

ADB: Yes, but you sent it to the broker. Every stock broker has a compliance officer who handles such matters and negotiates to settle the case. Share all the proofs with us, and we will assist you in the process.

Sanket: Okay, I’m sharing all the proofs.

Our team shared the email draft with Sanket, who then forwarded it to the compliance officer.

ADB: Sanket, have you received any reply to that email?

Sanket: Not yet, but I received a call today. They said that since I had already withdrawn my complaint, it made no sense to pursue it.

ADB: They are just trying to intimidate you. Don’t worry and stay positive.

Every other day, Sanket received a call from the stockbroker, sometimes with the RM on the line as well. They weren’t accepting their mistake and were blaming Sanket for sharing his account details.

Sanket: Sir, I received another call and this time they agreed to refund the brokerage amount of ₹30,000.

ADB: Do you want to settle for this amount?

Sanket: No, sir. That’s not even 10% of my lost amount.

ADB: Then don’t accept their offer.

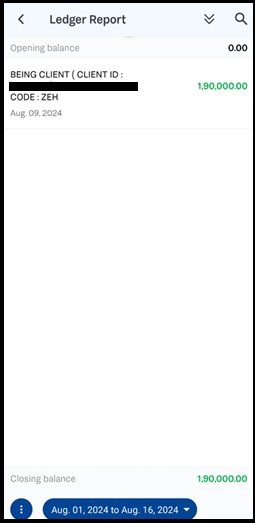

Sanket: Sir, I received a call from the compliance officer. They agreed to refund ₹1.9 lakh.

ADB: That’s great! Do you want to settle now?

Sanket: Yes, sir. Thank you so much. I had lost hope of ever getting my money back. It’s all thanks to your assistance and support.

This is just one case where the client gets a refund, but there are multiple cases where the client lost their capital and doesn’t fight for their refund.

There are chances that it takes time to get the lost amount back but quick action and regular follow-up make a recovery of the lost amount faster & easier.

And in case you need assistance in any such case then feel free to contact us for the same.