Headlines across Maharashtra are buzzing about TWJ Investment, promising lucrative opportunities. But amidst the noise of high returns, a critical question looms large: Is this a golden opportunity or a red flag that could cost you everything?

This comprehensive guide cuts through the hype to explore everything you need to know about TWJ investment.

It will cover their operations, legal status, investor experiences, and most importantly, whether your hard-earned money is truly safe.

Make a wise decision by reading till the end.

TWJ Investment Review

TWJ stands for “Trade With Jazz.” It operates as TWJ Associates Private Limited, a company registered in Pune, Maharashtra.

Company Registration Details:

- Full Name: TWJ Associates Private Limited

- CIN: U74999PN2019PTC182532

- Registered Office: Pune, Maharashtra-411045

- Directors: Sameer Subhash Narvekar, Neha Sameer Narvekar

Sounds professional, right? But let’s dig deeper.

How Does TWJ Investment Operate?

Understanding TWJ’s operations is crucial before making any investment decision.

Promised Returns:

- Monthly returns of 3% to 5%

- Annual equivalent: 36% to 60%

- “Guaranteed” or “assured” profits

- Regular monthly payouts

TWJ uses multiple channels to reach potential investors.

Moreover, the company used aggressive marketing tactics across social media, promising quick profits and financial freedom through “stock market tasks” and investment plans.

Is this a Blueprint of a Potential Scam?

You need to think before investing.

Is TWJ Investment Safe?

Now, let’s examine why TWJ investment carries significant risks.

- Unrealistic Return Promises

- Promised: 3-5% monthly (36-60% annually)

- Reality Check: Warren Buffett averages 20% annually

Promising “extremely high, guaranteed, or even double returns” is characteristic of Ponzi schemes.

When someone promises 36-60% guaranteed returns, alarm bells should ring. This is mathematically unsustainable in legitimate markets.

- The “Double Return” Scheme

TWJ reportedly promotes a “Double Return” scheme. This promises to double your investment within a specific timeframe.

“The money of new investors is used to pay off the older investors, creating an illusion of profit until the whole scheme collapses.”

This is a textbook Ponzi scheme structure. It’s not investing, it’s a circular money flow.

- No Regulatory Approval

- NSE Warning Issued: Official public caution

- SEBI Registration: None found

- Investor Protection: Not available

NSE explicitly stated: “For any kind of disputes relating to such prohibited schemes, none of the resources will be available to investors.”

- Telegram-Based Operations

Legitimate investment firms don’t operate primarily through Telegram. Why does TWJ?

Why Telegram?

- Easy to delete messages

- Hard to trace transactions

- Can block complainers instantly

- Less regulatory oversight

- Payment Pattern

According to English Lokshahi reports, there’s a consistent pattern:

- Months 1-4: Regular payments

- Month 5 onwards: Delays begin

- Eventually, Payments stop completely

This isn’t a random technical issue. It’s a deliberate operational model.

When initial investors receive returns (from new investor money), trust builds. More people invest. Eventually, the scheme can’t sustain and collapses.

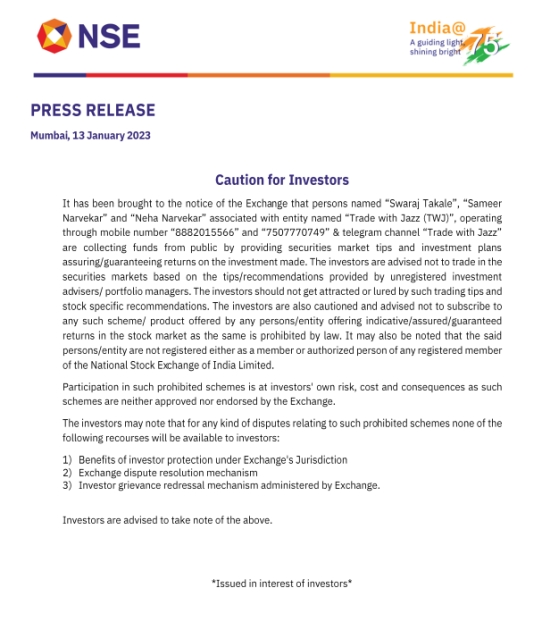

NSE Public Caution

The National Stock Exchange doesn’t issue warnings lightly.

NSE’s Advisory to Investors

“Investors are advised not to trade in the securities markets based on the tips/recommendations provided by unregistered investment advisers/portfolio managers.”

“Investors should not get attracted or lured by such trading tips and stock-specific recommendations.”

“Investors are cautioned and advised not to subscribe to any such scheme/product offered by any person/entity offering indicative/assured/guaranteed returns in the stock market, as the same is prohibited by law.”

Named Individuals

- Swaraj Takale

- Sameer Narvekar

- Neha Narvekar

These are the same directors registered with TWJ Associates Private Limited.

Is TWJ Investment Legal?

This is the most critical question. Let’s examine TWJ’s legal standing.

The National Stock Exchange of India (NSE) issued an official public caution. The warning specifically names individuals associated with “Trade with Jazz.”

Key Points from NSE Warning:

- Not Registered: These persons are NOT SEBI registered.

- Not Authorised: They’re NOT authorised persons of any registered member.

- Illegal Operations: Collecting funds without proper authorisation.

- Prohibited Promises: Guaranteed returns are prohibited by law.

The NSE statement clearly mentions that TWJ representatives are “collecting funds from the public by providing securities market tips and investment plans, assuring/guaranteeing returns.”

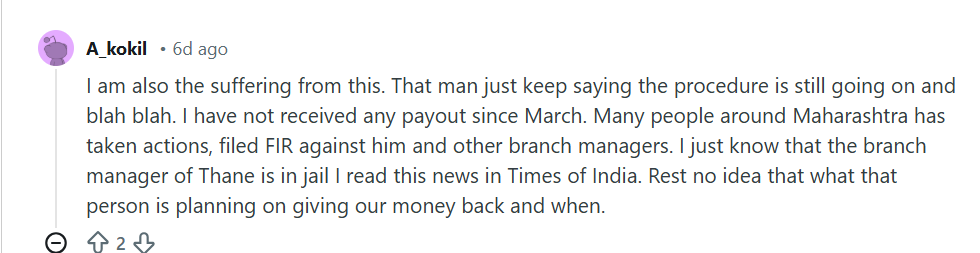

However, there are police actions across Maharashtra regarding this platform. According to English Lokshahi, multiple FIRs have been filed:

Yavatmal Case:

- FIR dated: September 21, 2025

- Against: Sameer Narvekar (CMD), Sagar Mayalwar (Branch Manager), Suraj Madgulwar (Accountant)

- Complainant: Gajendra Shravanji Ganveer

- Amount involved: ₹29 lakhs (single family)

- Total fraud: Approximately ₹3 crores in Yavatmal

Chiplun Case:

- Against: Sameer Narvekar, Neha Narvekar, Sankesh Ghag (Branch Manager)

- Complainant: Pankaj Mate

- Similar pattern of stopped payments

The legal noose is tightening. But what about existing investors?

TWJ Scam News

Let’s hear directly from those who invested.

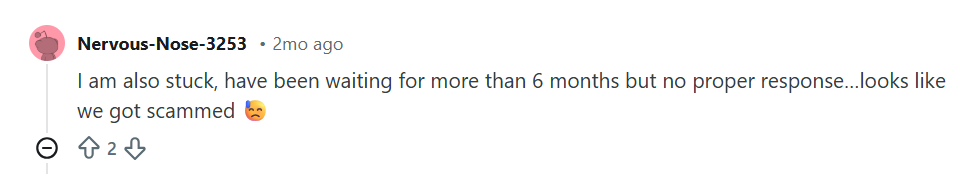

Category 1: Payments Stopped Without Warning

Initial trust followed by a sudden payment stoppage.

Real Experience (English Lokshahi): According to the report, complainant Gajendra Shravanji Ganveer stated: “After paying 3 to 4 percent interest for some time, the company suddenly stopped making payments.”

Details:

- Family investment: ₹29 lakhs

- Initial returns: Received for 3-4 months

- Then: Abrupt stoppage

- Result: Principal and interest both stuck

Category 2: Company Making Excuses

When money is demanded back, endless excuses begin.

Real Experience: The report states, “When investors demanded their principal and interest, the company started making excuses.”

But the money never comes.

Category 3: No Customer Support

Once problems start, the company becomes unreachable.

Pattern Observed (Multiple Sources):

Before Investment:

- Quick responses on Telegram

- Prompt phone callbacks

- Detailed explanations provided

After Payment Issues:

- Messages left unread

- Phone numbers unreachable

- Telegram accounts blocked

- Branch offices give excuses

Category 4: Massive Scale of Fraud

Individual losses multiplied across thousands of victims.

Statistics:

- Total Investors: 11,000+ across Maharashtra

- Yavatmal Alone: ₹3 crores fraud

- State-wide: Crores of rupees

- Individual Losses: ₹10-29 lakhs per person

When you multiply ₹15 lakhs average by 11,000 investors, you get ₹1,650 crores potential exposure.

The scale is staggering.

How to Report Investment Scams?

Filing complaints can be overwhelming. Especially when you’re already stressed about lost money.

Navigating police procedures, understanding legal requirements, drafting proper FIRs, it’s complicated.

You don’t have to do this alone.

Register with us and our team will guide you through.

How do We Help TWJ Victims?

If you’re a victim of TWJ scam, we offer specialised assistance:

Our Services Include:

- Expert Guidance: Step-by-step complaint filing assistance

- Documentation Help: Proper FIR drafting with all legal angles

- Legal Consultation: Connect you with experienced fraud lawyers

- Recovery Support: Maximise chances of fund recovery

Conclusion

After comprehensive research, evidence review, and regulatory analysis, here’s the conclusion.

TWJ Investment is not a legitimate, legally compliant investment option. The evidence overwhelmingly points to fraudulent operations.

Companies promising instant wealth are selling dreams, not investments. They’re preying on your desire for financial security. Investment fraud is rising in India. But so is awareness.

Your money matters. You worked hard for it. Don’t hand it over to unregistered entities operating on Telegram.

Stay Safe, Stay Informed.