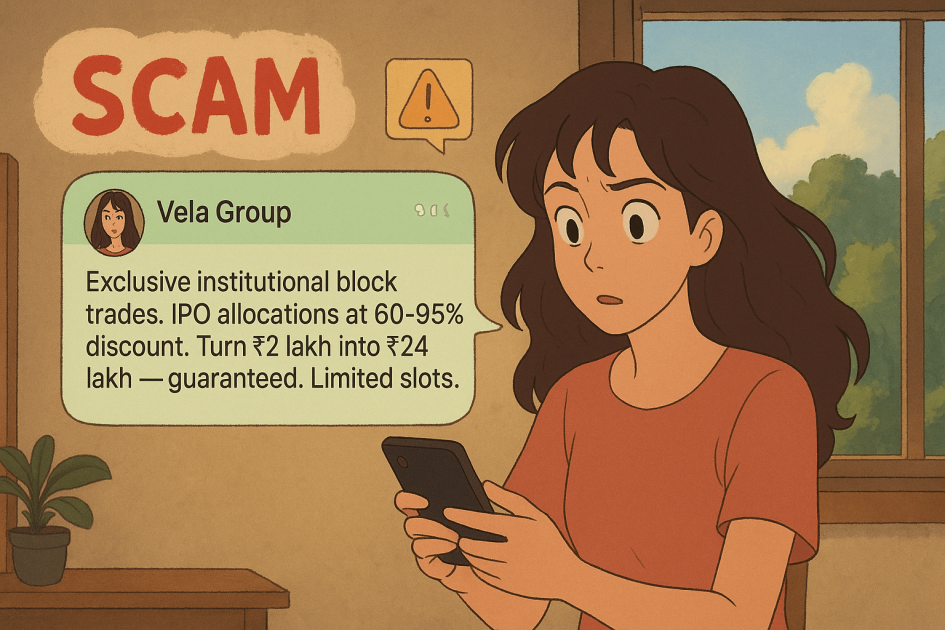

Imagine receiving a WhatsApp message:

“Private equity account slots are extremely limited. You must complete the recharge tomorrow to participate in the block trade; otherwise, one less account will be available for other members.”

This is exactly how Vela Capital and similar fraud rings are operating in 2025. They reach out directly to potential investors with slick messages, professional-sounding terminology, and fake “platforms” that appear to offer legitimate institutional trading access.

This blog explains how block trades really work, how scammers exploit them, and how you can protect yourself from ongoing schemes like Vela Capital.

Unmasking the ‘Vela Capital’ IPO Investment Scam

We all dream of that golden ticket – early access to a hot IPO, or a special institutional deal that promises quick, substantial returns. Scammers know this dream intimately, and they’ve perfected a strategy to turn your aspirations into their illicit gains.

They’re leveraging complex financial terms like “Block Deals” and “Private Equity” to create a facade of legitimacy, drawing you into a meticulously crafted scam.

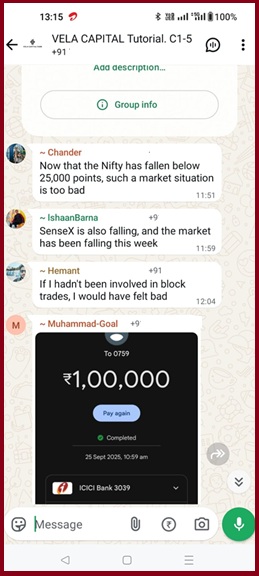

Our research team has tracked these scams, engaging directly with operations often using the name ‘Vela Capital’. We have conclusive evidence showing how they promise exclusive, guaranteed profits on IPO shares and block deals, only to use fake trading apps that display illusory gains.

The final, crucial step is a massive red flag: they demand you transfer your investment and subsequent “withdrawal fees” directly into personal, unregulated bank accounts, a move that ensures your hard-earned money disappears forever.

Let’s understand the modus operandi of the scam

Phase 1: The Initial Hook – Promise of Exclusivity & High Returns

It often starts innocently enough, an unsolicited message on WhatsApp, Telegram, or even a targeted social media ad.

They present themselves as an exclusive investment firm, let’s call them ‘Vela Group’ or ‘Vela Capital’, offering “limited-time opportunities” for massive profits.

The core of their pitch revolves around two enticing concepts:

- “Block Deals”: In the real financial world, a block deal is a large, single transaction of shares, usually between two institutional investors, executed outside the regular trading hours to avoid market disruption.

They involve massive volumes and are not for the average retail investor. Scammers twist this, claiming they have “insider access” to these deals, promising guaranteed returns in a matter of days. - “Pre-IPO Allotments” / “Private Equity Slots”: This is another big draw. They’ll claim they can get you shares in a company before its IPO, at a discounted price, ensuring huge profits when it lists.

They frame it as a “private equity account slot,” hinting at exclusivity and superior returns compared to regular retail IPO applications.

The language is always urgent, creating a fear of missing out. “Limited slots,” “offer closing soon,” “only a few spots left.”

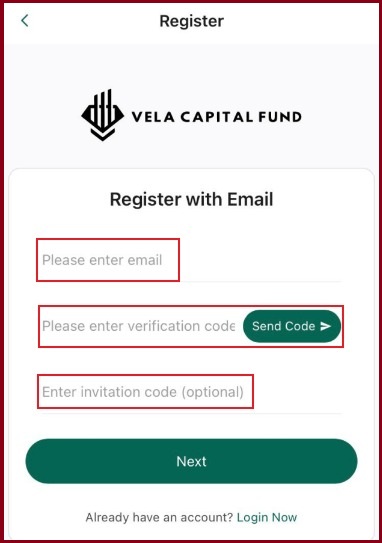

Phase 2: Building the Illusion – The Fake Platform & Initial Steps

Once you show interest, they guide you through a seemingly professional, yet entirely fraudulent, onboarding process.

First, the KYC and “Contract” Phase: They’ll ask you to complete a KYC (Know Your Customer) verification and sign an “Investment Contract.” This contract is designed to look legitimate, but it’s just another prop in their elaborate play.

Here’s a look at what our team encountered:

Notice how they guide you through filling out an “Initial Investment” amount and checking a box to agree to the terms. This makes you feel like you’re entering into a formal agreement.

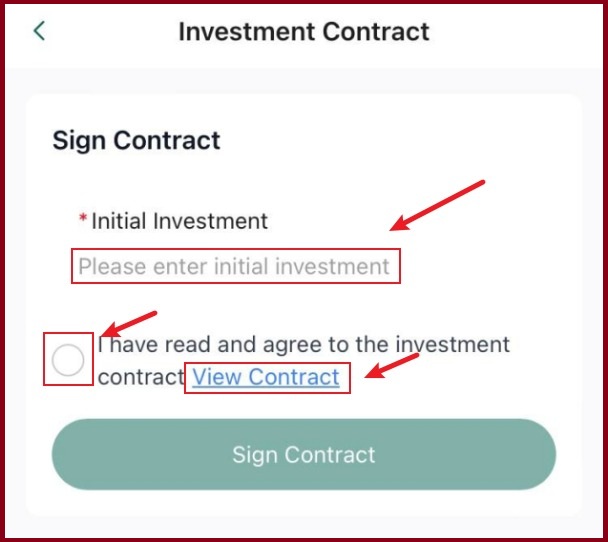

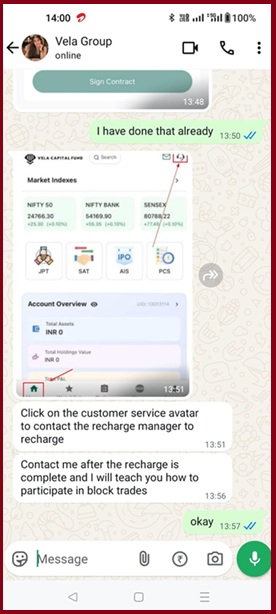

Phase 3: The Critical Step – “Adding Funds” & The ‘Recharge Manager’

Once the “contract” is signed (which is entirely meaningless in the eyes of the law), the real scam begins: getting your money.

They’ll instruct you to “add funds” or “recharge” your account. But here’s the crucial red flag: instead of guiding you to a regulated payment gateway or your own bank’s net banking, they tell you to contact a “recharge manager” via a customer service avatar on their app.

Why a “recharge manager”?

Because this is where they give you details for transferring money to a personal bank account or an unregulated entity, completely bypassing official, secure payment channels. Our team was explicitly told:

They will even provide a seemingly comforting explanation about “third-party supervision by SEBI” and “withdrawals credited to your bank account within 48 hours” – all to ease your fears about transferring money outside traditional investment routes.

Phase 4: The Illusion of Profit & The Withdrawal Trap

Once you transfer the money, their custom-built app will magically show your investment performing incredibly well.

You’ll see soaring “profits” from your “Block Deal” or “Pre-IPO allotment.” This is all fake. The app is merely a sophisticated graphic interface designed to manipulate you.

This stage is crucial because it builds false confidence and greed, encouraging you to invest more. When you finally try to withdraw your (fake) profits, the trap snaps shut:

- “Taxes,” “Fees,” or “Commissions”: Suddenly, you’ll be informed that you need to pay a “tax,” “regulatory fee,” or a “withdrawal commission” – often a substantial percentage of your supposed profits – before your funds can be released. They might even cite “SEBI regulations” to make it sound official.

- “Account Upgrade” / “Higher Margin”: In some cases, they’ll demand an additional deposit, claiming you need to “upgrade your account” or meet a “higher margin requirement” to process such a large withdrawal.

Our team’s interaction confirms this pattern:

Notice the demand for a “Withdrawal Processing Fee” – a hefty 25% of the “profit” is required to “release your profits from a regulatory tax.”

If you pay this, you’ll either be hit with another fee, or all communication will simply cease, and the app will become unresponsive. Your money, initial investment plus the “fees,” is gone.

How to Protect Yourself from ‘Vela Capital’ and Similar Scams

The allure of quick money is powerful, but knowledge is your best defense. Here’s what you absolutely need to remember:

- If it sounds too good to be true, it is. No legitimate investment guarantees high, fixed returns, especially not in a short timeframe.

- Verify, Verify, Verify. Before investing even a single rupee, check if the firm (e.g., ‘Vela Capital’) is registered with the appropriate financial regulator (like SEBI in India). A quick search on their official website can save you a fortune.

- Official Channels Only. Legitimate investment platforms use secure, regulated payment gateways. Never transfer money to personal bank accounts or to entities you don’t recognize.

- Beware of Unsolicited Offers & Pressure Tactics. Real financial advisors don’t harass you on WhatsApp or pressure you into immediate decisions.

- Understand “Block Deals” and “Private Equity.” These are sophisticated financial instruments for institutional investors. If a random person on WhatsApp is offering you access, it’s a scam.

If you have lost your money in a fake Vela Capital Fund or any such block trading scams, take immediate action and report it online.

In case you need help, register with us, and we will guide you through the process to file and escalate it to higher authorities.

Conclusion

Our research team’s interaction with ‘Vela Capital’ is a stark reminder of how sophisticated these scams have become.

They exploit your desire for financial growth with a convincing narrative, a professional-looking app, and well-rehearsed explanations.

Stay vigilant, trust your instincts, and always prioritize official, regulated channels for your investments. Don’t let your dream of an IPO profit turn into a nightmare of financial loss.