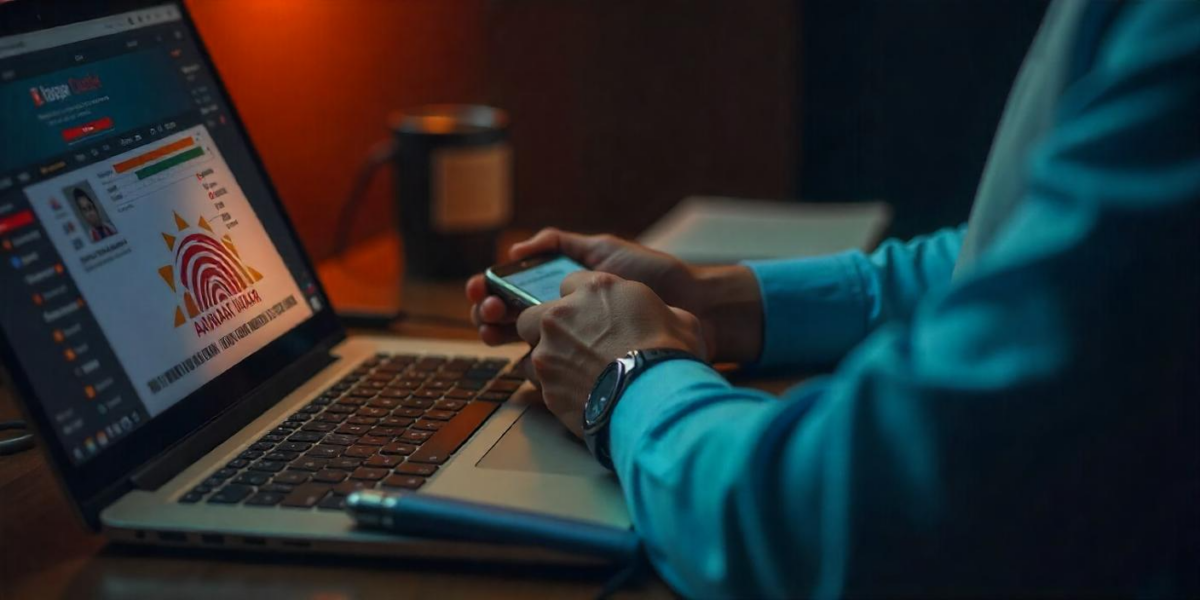

The effects of Identity theft are more dangerous than you think, it’s not just about losing money!

Scammers don’t just steal your money; they steal your identity, reputation, and peace of mind.

Your stolen details could be used for fraud, tax evasion, or even illegal activities. All these could leave you to deal with the legal mess.

The worst part? By the time you realize it, the damage is already done. This isn’t just a financial risk, it’s a complete invasion of your life. Stay alert, because ignoring the signs today could cost you everything tomorrow!

Here are the 11 major consequences of this identity theft in your life:

11 Consequences of Identity Theft

You can recover the cash you lose in theft or scam, but when it comes to identity theft, it takes weeks, months or even years to get recovery of the same.

Even if you get out of it, there are chances of again facing the consequences. It is therefore important to know ways to prevent different types of identity theft in the first place. Secondly, to be aware of the effects of identity theft.

Here is the list of 11 major consequences you might face in case of identity theft:

1. New Account or Loan in Your Name

Imagine the shock of checking your credit report one day and discovering a loan you never took.

After digging deeper, you realize you’ve become a victim of identity theft. A scammer has used your Aadhaar and PAN details to secure a personal loan in your name.

Now, the bank is demanding repayment, and despite your efforts to explain the fraud, you struggle to prove your innocence.

Legal notices start piling up, your credit score takes a massive hit, and financial opportunities slip away.

Meanwhile, the real fraudster has vanished with the money, leaving you to deal with the mess.

This is how identity theft can silently destroy your financial stability, turning your life upside down before you even realize what’s happening.

2. Takeover of Your Accounts & Emails

What if, while trying to log in to your email or social media account, you found that your password has been changed?

Considering it to be a technical glitch you try again but at the same time, a message pops up on your mobile screen with the details of the banking transaction you didn’t make.

Your account has been compromised and a scammer took over your email to reset your banking passwords.

By the time you realized the scam, the scammer has gained a full control of your financial accounts and siphoned out the money.

Now, when you report the recovery of your lost amount, you face even more challenges just to prove your non-involvement in any of the transactions made.

The recovery process is lengthy, frustrating, and in many cases, unsuccessful.

3. Credit Score Decline

You dream of buying a home and after setting all things move ahead with the final step of getting loan approval. You are confident enough based on your financial standing.

But in no time, you find that your loan request has been rejected due to poor credit score.

Confused about getting the report you check your credit score and find details of multiple credit card payments and loans you never applied for.

Now, in this case, too, the scammer succeeds in stealing your identity, using it for opening an account, and then reaping benefits by taking loans applying for credit cards, and misusing them.

With a ruined credit score, getting loans or even a credit card becomes impossible and when it comes to repairing the damage of such consequences, it takes years to completely get out of it.

4. Deed Fraud & Mortgaged

Now this is something scary, imagine the day when you visit a property you own and find strangers living there.

Confused and frustrated, you start digging into what happened and discover that, on paper, you’re no longer the owner.

A scammer forged your identity, transferred the ownership, and even took a loan against the property before disappearing.

Now, you’re stuck in a legal mess, trying to prove that the sale was fraudulent and reclaim what was rightfully yours.

Worse yet, some people don’t even realize they’ve been scammed until a bank demands repayment for a mortgage they never took.

By the time they figure it out, the fraudster is long gone, and the fight to get their property back becomes an uphill battle.

Identity theft isn’t just about money, it can cost you your home, too.

5. Stealing of Tax Refunds

Tax season is around the corner and while you eagerly wait for your tax refund someone else has already claimed it.

A scammer hacked and stole your identity and used it to file a tax return, collecting the refund before you even had a chance to submit yours

Now, you’re stuck proving to tax authorities that it wasn’t you.

The process of correcting the ITR refund scam is lengthy and stressful, and in some cases, you may even be held accountable for errors or unpaid dues caused by the fraudster.

6. Involvement of Name in Crimes

Identity theft has terrifying consequences too where the scammer uses your identity to execute a crime like stealing identity documents, cyber frauds, etc.

And now without any clue you are linked to crime and your name appears on police records.

Now it is not just about clearing your name from the case but also to give answer to thousands of questions that arise because of the theft and crime executed later.

No wonder, it takes years and sometimes a lifetime to recover the loss of money, your professional career, personal relationship and the effect of identity theft in other areas of life.

7. Health Insurance Coverage Loss

Identity verification is used for almost every area of life even when you take health insurance.

Now health insurance are meant to prevent you from facing financial distress at the time you fall sick or face some other issues related to your health.

But just imagine a case, where when you visit the hospital and at the time of hefty bill payment find that your health insurance has reached to the maximum limit.

A scammer has stolen your insurance details and used them for expensive medical treatments under your name.

Now, when you need coverage, there’s nothing left. Worse, some victims find false medical records attached to their names, making it difficult to get future insurance claims approved.

In emergencies, this could mean being denied life-saving treatment due to fraud you didn’t even commit.

8. Spam Emails & Calls

Now this is something common that most of the victims of identity theft face.

They generally experience an increase in spam calls, phishing emails, and scam messages.

Their stolen details are sold on the dark web to fraud networks, making them an easy target for further scams.

Fake loan offers, lottery winnings, and investment schemes flood their inbox and phone, increasing the risk of falling for another trap.

9. Unauthorized Sim Cards

Now just think what it takes to apply for the new SIM card.

Just any of your ID cards.

Identity theft makes it easier for fraudsters to use it to obtain SIM cards in your name and then linking the number with your bank accounts and other accounts.

Once he is successful in the same, he use it to reset all your passwords, making transactions and even impersonate you to get more benefit.

Now by the time, the victim realizes the scam, the significant damage has already been done.

10. Fake Social Media Profiles

Social media makes it easier for you to connect with the world at the same time just think of the scenario where you start receiving messages from friends about strange posts or requests from an account with your name and picture.

A scammer has created a fake social media profile impersonating you, either to scam others, ruin your reputation, or commit cybercrime.

These fake profiles can be used for fraudulent activities, spreading misinformation, or even harassing others under your name.

Victims often struggle to get these fake accounts removed, as social media platforms can take time to verify and act on complaints.

Meanwhile, the scammer continues to manipulate others using your stolen identity.

11. Emotional Distress

Identity theft isn’t just about money, it messes with your peace of mind, too.

Imagine constantly feeling anxious, wondering if a scammer is still using your identity somewhere. The endless calls to banks, the piles of legal paperwork, and the frustration of proving who you are, it’s exhausting.

Sleep becomes a struggle and even simple things like shopping online or filling out a form start feeling risky.

The worst part? That theft left a fear in you that never really goes away. Even after fixing the mess, you find yourself double-checking everything, second-guessing every email, and hesitating before sharing any personal details.

It’s not just a financial hit, it’s an emotional rollercoaster that can make you feel helpless and paranoid long after the fraud is over.

How to Prevent Identity Theft?

Now the effect of identity theft could be much bigger and sometimes beyond our imagination. It is therefore important to protect yourself from falling into the trap.

Here are some of the effective ways by which you can prevent identity theft:

- Never hand over your data and identity to the unknown.

- Use a strong password and set two-factor authentication to log in to your accounts.

- Keep checking your financial data

- Don’t open unknown links

- Download apps only from the Play Store or App Store.

How to Report Identity Theft?

No doubt, scammers are using sophisticated methods to scam people and sometimes it becomes almost impossible to identify the fraud.

In case, you have been a victim of the same, don’t waste time once you identify it and take proper action to report it.

Register with us now and our experienced team will reach out with personalized support to help you recover, rebuild your confidence, and take back control — safely and securely.

Conclusion

Identity theft can disrupt your entire life, from your credit score to your emotional well-being. With scammers finding new ways to steal personal data, staying cautious is no longer optional, it’s a necessity.

Always double-check the websites you share your details with, monitor your financial statements regularly, and enable two-factor authentication for added security.

If you ever suspect fraud, act fast. Report it to the authorities, contact your bank, and take immediate steps to secure your identity.

Prevention is the best defense.

The more aware and proactive you are, the harder it becomes for scammers to take advantage of you.

Stay alert, stay safe, and protect what’s rightfully yours.