Many investors start by relying on an investment advisory firm to help them make financial choices. Clear guidance, regular updates, and honest information help build this trust.

When advisors explain risks, strategies, and fees openly, investors feel more confident about their decisions. This partnership becomes especially important when it comes to managing money, setting goals, and planning for the future.

At the same time, investors need to understand how these advisory firms work and the rules they must follow.

Learning about the advisor’s role, their duties, and the regulations they must obey helps investors make better choices.

Having this knowledge helps create a better balance in the relationship and lets investors ask the right questions before making any decisions.

21G Investment Review

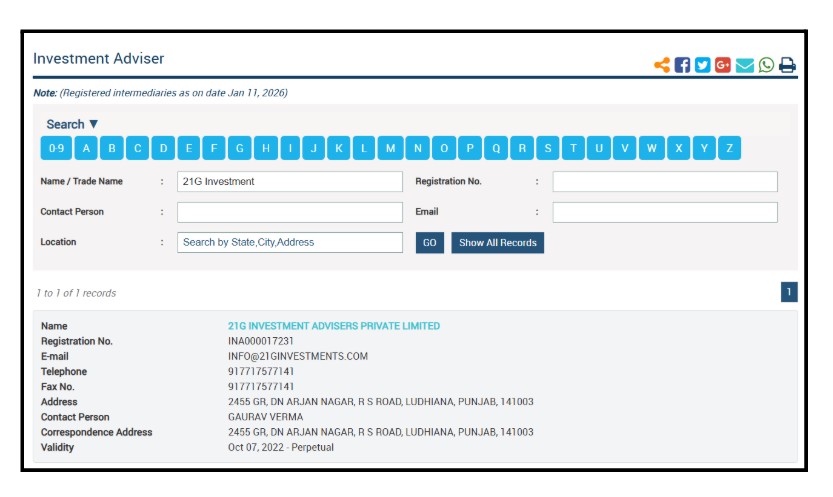

21G Investment Advisors Pvt Ltd is a registered wealth management company in India, owned by Gaurav Verma with the SEBI registration number INA000017231. The company helps people build wealth over the long term by offering advice based on rules and systems.

The company gives advice on different types of investments, including stocks and systematic trading methods.

It offers tailored solutions like smallcase-based stock portfolios and its own rule based systems.

These services are meant to help people invest consistently and wisely during different phases of the market. They charge a fixed fee instead of a commission, and they focus on being open, reliable, and following the law.

The firm is led by Gaurav Verma, who is actively involved in the way they give advice.

They work with clients through structured steps like assessing their risk and choosing the right investments. Clients use their own trading and demat accounts through supported platforms to make investments.

The firm is also active on social media, especially Instagram, YouTube, and LinkedIn. They focus more on LinkedIn to share educational finance content and market updates.

Besides helping clients, the firm also teaches people about investing through digital channels.

They often share insights on finance, the market, and educational material to increase awareness.

LinkedIn is their main platform for professional and educational interaction. This helps them clearly explain their advice and also helps investors understand more about systematic and rule based investing.

The 21G Investments Telegram channel mainly sends out special information, market news, and investment chances to its followers.

The content is about their approach to investing using numbers and analysis, and getting access is usually connected to their paid advice services.

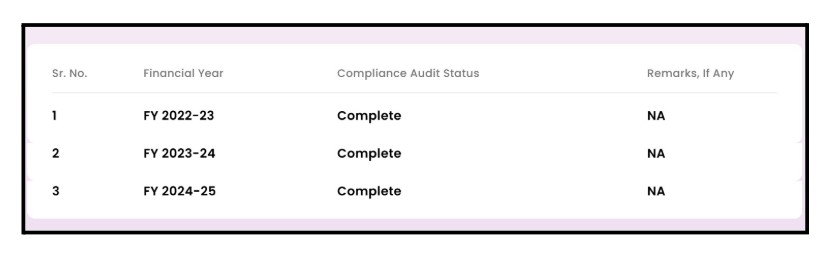

The table shows how the entity did with its compliance audits in the last few financial years.

This means that the necessary compliance audits were carried out during these periods according to the rules set by SEBI, and there were no issues or observations recorded in the audit reports up to those years.

When to Complaint Against an Investment Advisor?

Every investor needs to be aware and stay alert about the services provided by investment advisors. These advisors work under strict rules and have specific duties they must follow.

When investors understand these rules, they can recognize when something needs to be addressed properly.

Taking action quickly helps investors report issues through the correct channels.

An investor can file a complaint if:

- The advisor advises without checking their risk level or getting written permission.

- The fees charged are different from what was agreed upon or shared.

- Important information, like disclosures or updates, is not clearly provided.

- The advisor offers services that are not allowed under their registered category.

- Required documents or reports are not given on time.

- The communication is confusing or does not follow the rules set by regulators.

Conclusion

21G Investment Advisers Pvt Ltd is a SEBI registered company that gives investment advice in a structured and rule based way.

They use a clear system with set processes and follow all the rules set by the regulator. Their advice is transparent, and they communicate clearly with clients.

They also make sure that clients are in control of how things are carried out. Knowing how these advisory firms work helps investors have clear expectations from the beginning.

At the same time, it’s important for investors to be aware and do their own research when making financial decisions.

Being informed about the role of the advisor, how much they charge, and how they report their work helps investors make smart choices.

Being aware also means knowing the right way to bring up any concerns if needed.

Taking a careful and informed approach helps keep things safe and builds confidence in long-term financial planning.