Have you ever downloaded an app promising quick money, only to realise it’s harder to get your money out than to make it in? If so, you’re not alone; a surge of people in India are now raising a 91 Club complaint about this color trading platform.

The app looks tempting at first, but it has left users frustrated and stuck.

In this blog, we will break down the full pattern of 91 Club complaints, what financial risks users face, and how you can report the app if you’ve been affected.

91 Club Complaint Online

91 Club Colour Prediction app is a platform where users predict outcomes in simple colour-based games. The idea seems easy: pick a color, win money.

The app also promises quick profits and flashy bonuses, which attract many users.

But many wonder, is 91 Club Legal in India?

The platform is not officially registered in the country and holds no SEBI or RBI license, meaning there’s no legal protection if your money gets stuck.

Being unregulated also puts it in the gambling category, which is illegal in most states.

This raises the bigger question: is 91 Club App safe?

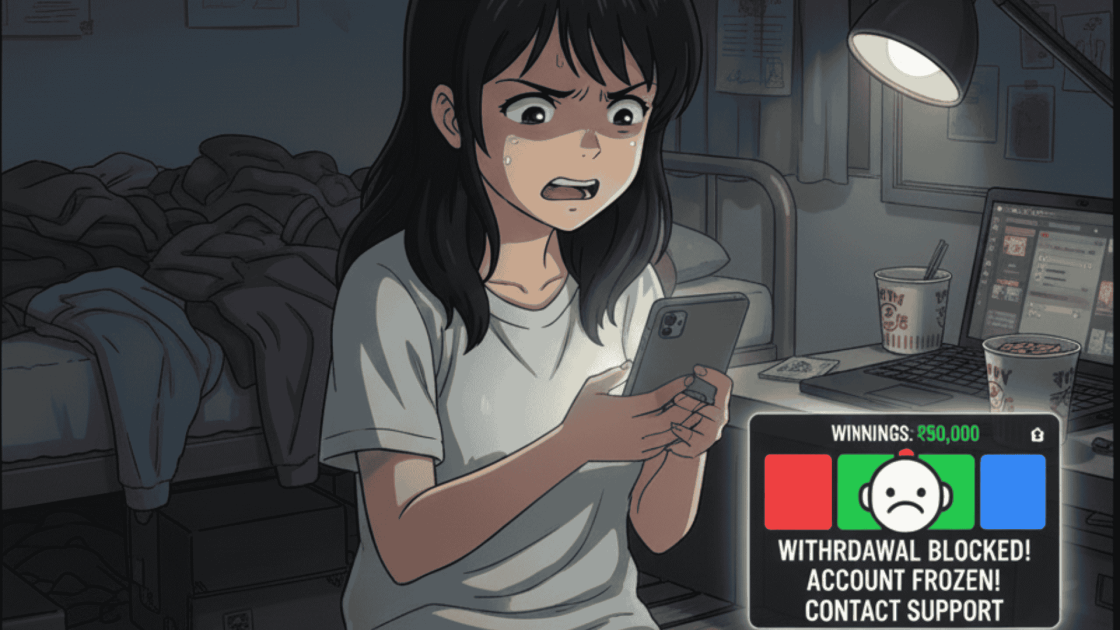

While depositing money is easy, withdrawing it is often a nightmare.

Users report delays, blocked accounts, and zero response from support. Many users also complain that the 91club deposite not been received yet. Over the past months, complaints about the platform have been piling up online.

From Reddit threads to YouTube exposés, a clear pattern emerges.

Let’s break it down:

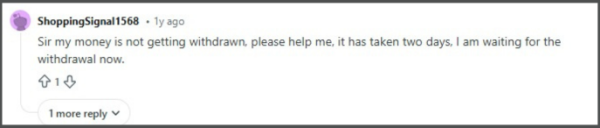

1. 91 Club Withdrawal Problem

A user named reported that their withdrawal request has not been processed.

Despite waiting for two days, they have not received their money and are seeking assistance.

This highlights a common issue on the platform where withdrawal delays leave users frustrated and uncertain about accessing their funds.

2. 91 Club Deposit Not Received

Many users also report issues when depositing money.

Payments via UPI, PayTM, or other gateways often don’t reflect in the app, leaving users frustrated and unsure if their funds were received.

Attempts to contact support usually go unanswered, adding to the confusion and risk.

3. Unresponsive Support

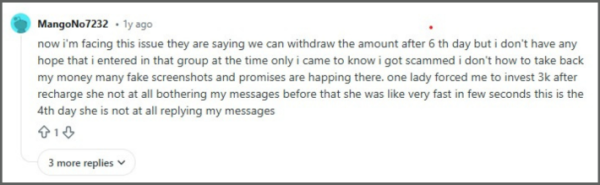

One user reported serious issues with withdrawing funds from the platform. He explained that although the platform promised withdrawals after six days, they had no confidence that it would actually happen.

The user mentioned being scammed after joining a group that pressured them into investing more money, specifically, they were encouraged to add ₹3,000.

Despite multiple attempts to contact the person who persuaded them, their messages went unanswered for several days.

The user also noted that many others shared screenshots and promises, but the situation remained unresolved, leaving them frustrated and worried about recovering their funds.

4. Sudden Account Shutdowns

Another recurring problem is sudden account shutdowns.

People report attempting 91 Club login one day and finding their account restricted or deleted, often with their balance inaccessible.

5. Reported Scam Losses

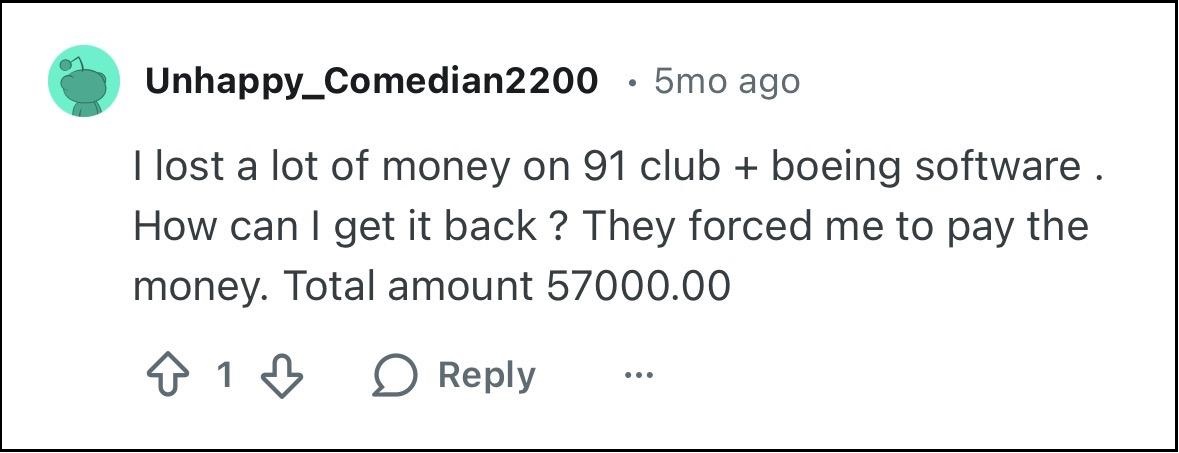

One User Reported: He lost a significant amount of money due to the 91 Club and “Boeing software”.

According to him, he was pressured or forced into making payments, resulting in a total loss of ₹57,000.

The user is seeking guidance on how to recover his money, indicating possible fraud, coercion, or scam-related activity.

6. Social Media Scams and Warnings

Another user shared how the scam began on Instagram/Facebook and moved to WhatsApp and Telegram.

He warned that many fraudsters misuse big brand names like Amazon, Flipkart, and Meesho, urging everyone to stay vigilant.

How to File a Complaint Against 91 Club?

Lost money or facing withdrawal problems on the 91 Club app?

You’re not alone.

Many users encounter similar issues, but acting quickly and documenting everything can make a difference.

Register with us today.

We assist with:

-

Evidence Documentation: We help you organize screenshots, transaction records, chat messages, and any other proof of deposits or wins/losses.

-

Complaint Filing: Our team guides you in preparing and submitting your complaint in the correct format to ensure it’s officially recognized.

-

Collective Action: By joining other affected users, your complaint gains stronger visibility and legal weight.

-

Data Protection: We provide steps to secure your personal and financial information to prevent further misuse.

- Personalized Support: Our experts provide one-on-one assistance, answering questions and helping you navigate challenges during your complaint.

According to consumer protection trends, complaints from multiple victims carry significantly more weight. Individual submissions often face delays, but group action forces faster attention from authorities.

Time is critical.

The sooner you document and report your case with our assistance, the higher the chances of taking meaningful action against the platform.

Conclusion

The growing number of 91 Club complaints shows a clear pattern: the app initially lures users with small wins and flashy bonuses, but withdrawals are often blocked, accounts frozen, and additional deposits demanded.

With no official registration or legal protection in India, users have very limited recourse if their money gets stuck.

If you’ve been affected, it’s important to report your complaint.

And before investing in any similar colour trading apps, always check their credibility, research complaints online, and be cautious of unofficial APKs or unverified payment methods.