There are around 1.5 crore active traders in the share market, but let’s be realistic about how many are earning money. In the last two reports of SEBI around 71% of intraday traders and 91% of FnO traders are in loss.

If we go deep into the FnO report, out of 42 lakh new traders 92.1% of traders were in a loss in the FY 2024 with a net loss of ₹46,000 per year.

Now what do you think are the biggest reasons for these losses?

Well, lack of knowledge is the top most. But the most people end up making losses because of unawareness too.

Unfamiliar with the market regulations and other parameters mostly made them fall into the scammers’ trap. These scammers mostly make their way through Telegram, WhatsApp, or other social media platforms.

Now one such novice trader Mr. Kamlesh (name changed), got trapped in one such scam. First, he joined one random telegram group and later shared his account details which led to the loss of ₹1,20,000.

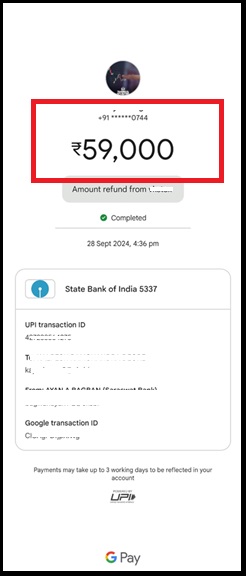

However, he took quick action and reached out to our team where with proper reporting he got a recovery of ₹59,000.

Let’s dive into the details to understand Kamlesh’s trap story.

How a Scammer Trapped Kamlesh in Account Handling Fraud?

Kamlesh, a novice trader who opened his account in Zerodha, one day got added to the Telegram Group. And there the scammer lures users by showing high PnL screenshots.

Later, the scammer reached out to Kamlesh and offered him profit profit sharing scheme on account handling.

Kamlesh unaware of account handling in stock market and the regulations and risks involved shared his details. The scammer further asked him to add a minimum ₹1,00,000 fund in the account.

On the first day, the profit was around ₹20,000 out of which Kamlesh shared ₹10,000 as per the initial deal. The scammer kept on asking to add more funds and at the same time also earned profit.

But after a few days, the scammer called Kamlesh and asked him to share one OTP giving him the excuse that he needed to display the trades and PnL screenshots in the group.

Kamlesh did that and in the next few minutes, his account was down to ₹40,000.

This means the fund value declined to ₹40,000 and the 50% profit he earned after sharing the rest of the profit was gone.

Later on, Kamlesh found no solution or refund for the same. Instead, the scammer asked him to add some funds for loss recovery.

Disheartened, Kamlesh was left with nothing but only disappointment.

He was not aware of how to report online frauds in India.

But then found a ray of hope when he came across our video and in the next minute contacted us.

What Steps Our Team Took to Recover the ₹59,000 Loss!

In the stock market, both registered entities handle client accounts in compliance with regulations, and unregistered ones, like the scammer involved in Kamlesh’s case.

In Kamlesh’s case, our team followed a systematic approach, beginning by sending an email to the scammer.

When no response was received, we escalated the matter and reported the case to higher authorities. After reviewing the evidence and documentation, actions were taken against the victim.

With no other options, the scammer was forced to contact Kamlesh and eventually agreed to refund the profit-sharing amount of ₹59,000.

What Other New Traders Can Learn from This?

Now, just imagine if Kamlesh had been aware of the regulations—he likely wouldn’t have shared his account details with an unknown, unregistered entity. Right?

His blind trust and failure to validate before sharing sensitive information like OTPs only deepened his losses.

This kind of negligence is common among newbie traders, often leading them to quit trading before they even truly get started.

Kamlesh’s case serves as a powerful reminder that every trader must make education a priority, not only in terms of market knowledge but also regarding regulatory protections. Without this understanding, traders become easy targets for fraudulent schemes.

Awareness is the key to safeguarding one’s investments and ensuring accountability in an industry where online scams are at their peak.

By staying vigilant and working exclusively with SEBI-registered entities, traders can significantly reduce the risks and potential losses they face.