Honestly, there are times when you just have to have some quick cash, and those “instant loan” apps are popping up everywhere, promising money in a few minutes with no paperwork.

Among the names that have been discussed in the context of shady lending is the so-called “Angel Loan App” that has been referred to.

However, understanding the scary side of these plays is what you need before you decide to download the file.

It’s a trap of the utmost kind aimed not only at robbing your money but at harassing you endlessly.

Angel Loan App Review

The term “Angel” in the financial app space can refer to two very different things, and this is where the main confusion lies.

There is a Legitimate Angel One Platform. This is the real, well-established player in the Indian market. Angel One facilitates personal loans through partnering with established, RBI-registered NBFCs.

The other one is fake, “Angel Loan App”. This is a fraudulent app that illegally uses the name “Angel Loan” to trick users.

Hero FinCorp has explicitly listed “Angel Loan” as a fake app.

Modus Operandi of Fake Angel Loan App

Basically, how does a rogue instant lending app like a fake angel loan usually work? It’s wickedly uncomplicated.

- They tempt you with a small loan without any kind of stress (for example, between ₹2,000 and ₹10,000) that is given to you almost immediately, thus creating a false impression of security.

- The app, during the registration process, requests a lot of permissions, access to your contacts, photo gallery, and even your SMS.

- When the money is credited to your account, a substantial “processing fee” (sometimes more than 30%) is already deducted.

- The loan period is very short, usually only 7 days.

- This is the part where the scam becomes really ugly. Even if you intend to repay, they make it hard for you.

- In case you miss the impossible 7-day deadline, the recovery agents initiate their terror campaign.

- They utilize the information they gathered from your phone to send threats, abusive messages, and in a large number of reported cases of digital lending fraud, they alter your photos to explicit ones and distribute them to your whole contact list.

Angel Loan App Complaints

Countless victims report being caught in a loop where they have to take out another loan from a different scam app just to pay off the first one, multiplying their debt and trauma.

Here are some of the reported complaints against online personal loan frauds in India:

Complaint 1: Mental Harassment and Public Shaming

The complainant stated that he, along with his family members and colleagues, was subjected to severe mental harassment by unknown individuals claiming to be recovery agents of Angel Loan.

He alleged that these individuals posed inappropriate images and circulated them along with his name and phone number to his contacts.

He further stated that abusive language was used and that the level of harassment and psychological torture was beyond acceptable limits.

Complaint 2: Loan Paid but App Not Updated and Continued Harassment

The complainant stated that he took a loan of ₹7,000 from the Angel Loan app and repaid the full amount on February 23, 2022.

However, the app did not update the repayment status and continued to show the amount as due.

He alleged that despite repayment, multiple customer care representatives repeatedly called and harassed him, sending threatening messages and warnings.

The complainant requested intervention to resolve the issue and stop the harassment.

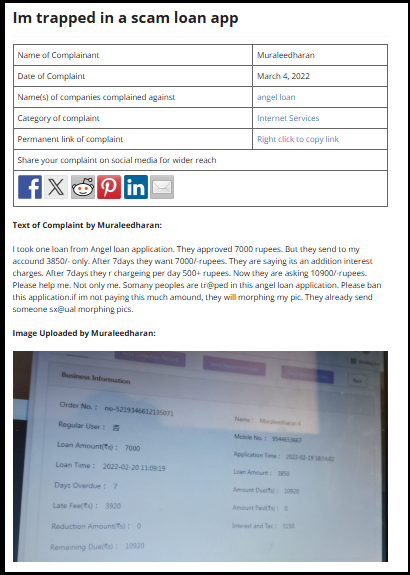

Complaint 3: Excessive Charges, Threats, and Image Morphing

The complainant stated that he applied for a loan through the Angel Loan app and was approved for ₹7,000, but only ₹3,500 was credited to his account.

He alleged that the app imposed extremely high interest and late fees, charging ₹500 per day, and demanded repayment of ₹10,900.

The complainant further stated that when he was unable to pay the excessive amount, the recovery agents threatened him and sent morphed images to his contacts.

He requested immediate assistance, stating that the app was causing severe distress and trapping users in fraudulent practices.

How to Report Loan Frauds in India?

It is very important to keep in mind that if such a situation happens to you or someone that you are acquainted with, contact the police immediately, as this is NOT your fault.

This is how you can proceed to file a complaint against online loan app:

- Police Complaint (FIR): Head over to your nearest police precinct and report what has happened. Alternatively, you can also report it to the Cyber Crime Cell, which specializes in these cases.

- File a cyber crime complaint: Complaints can be filed via an online platform of the Indian government, where the official portal is. Also, there is a national helpline number that you can dial for help.

- Bank Communication: Let your bank know about the transaction made by the fraudster and the harassment that you have undergone. And make sure you have kept all the transaction records.

- Report to RBI: The Reserve Bank of India (RBI) has issued a warning against the use of unauthorized digital lending platforms. So, share the name and report the details of the app to the RBI Sachet portal.

Need Help?

If you want to get more assistance regarding the loan app scams, register with us. We will assist you in starting the recovery process.

Conclusion

The appeal of an instant online loan is quite tempting; however, the threat of fake and unregistered apps is a scary truth.

It is very important to verify if the lender is regulated by a credible authority (for example, the RBI in India) before getting an app.

Guard your personal information and your mental well-being. Most probably, it is a trap if it looks overly simple.