Are you short of money and need to get some cash quickly?

Most of us have been in such a situation. We cannot help but be tempted by those apps that claim to provide us with loans instantly and with very few formalities.

However, the “Anytime Rupee” app and many other similar platforms are the main reasons why digital lending is a risky trend.

In fact, these apps, which give the impression of being a convenient way out, are basically racketeering scams that aim to ensnare you in a debt and harassment spiral.

Anytime Rupee Loan App Review

What is the “Anytime Rupee” model actually, and how do they manage these devastating digital lending frauds?

- The “too good to be true” offer is the very first warning signal. After downloading the app and applying, it asks for very wide permissions to access your phone, including your contacts, photos, and gallery. This is the most important part of the scam.

- If you allow these permissions, the application will give you a small loan amount, but it will charge a high “processing fee” by deduction.

- The recovery agents of the app, who are usually not regulated, begin to harass and abuse you in a concerted manner. They use the information which they have taken from your phone to intimidate and threaten you.

- It comprises sending altered or offensive pictures to your friends and family from your contact list, making WhatsApp groups to defame you, and issuing constant abusive calls.

Anytime Rupee Loan App Safe or Not

This is the point where things get tricky.

The app is asserting transparency, but the overall environment of such “instant” loan apps in India is very risky, and user reviews for similar apps and the category as a whole indicate that there are serious issues.

Every time Rupee’s official privacy policy and responsible lending pages mention that they use bank-grade encryption and partner with RBI-registered lenders, it sounds safe in theory.

There have been user reports in which a loan amount was deposited into their account without their final confirmation, and as a result, they were forced to get into debt that they didn’t explicitly agree to.

Is the Anytime Rupee loan app safe?

The potential to be harmed is quite high, considering that such risky tactics are commonly used in the instant loan app market.

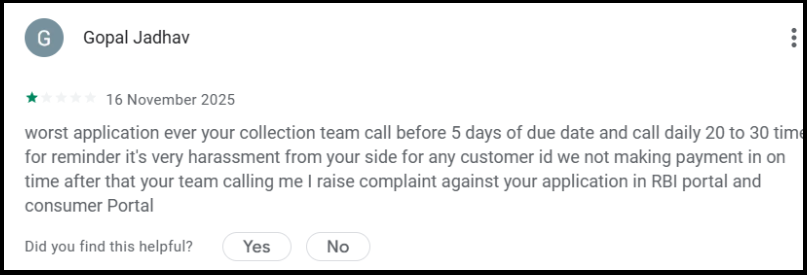

Anytime Rupee Loan App Complaints

- In Bengaluru, a man, as a last resort for money, borrowed approximately ₹73,000 from a conglomerate of these apps. Due to the predatory interest and daily penalties, the amount he had to repay skyrocketed to more than ₹6.38 lakh! The app loan horror that followed him made him lose it completely.

- Nationwide, victims of such app loans have reported that if they fail to repay under the unfeasible conditions, the recovery officers start bombarding the WhatsApp accounts of the victim’s relatives and friends with threats and doctored pictures, thus branding the victim publicly as a defaulter or even a criminal.

- One instance of such abuse in Hyderabad is cited, where the man’s family was sent morphed images branding him as a paedophile, even after he had repaid the loan.

The above evidence shows how this application is scamming the people. It is evident that the agents also harass the common people in the name of an easy loan.

How to Report Loan Frauds in India?

If it might be you or someone close to you who has been victimized by “Anytime Rupee” or similar loan app scams, take action immediately.

The steps are outlined below to file a complaint against online loan app:

- Make sure to block all the calls and messages from the numbers which trouble you or send spam.

- Calling the National Cyber Fraud Helpline Number should be your very next step.

- File a complaint in cyber crime.

- Tell your bank about the fraudulent transactions and ask them to keep an eye on or stop any unauthorized transfers.

- In case a loan has been taken in your name fraudulently, contact credit bureaus like CIBIL to register a dispute and safeguard your credit score.

- Initiate a complaint on the RBI portal, if applicable.

- Remove and recall: Uninstall the malware-infected application and report it on Google Play Store or Apple App Store by marking it as illegal.

Need Help?

You can register with us, keep your evidence handy, and get the support you need quickly.

There are many people in the same boat as you.

Conclusion

Never forget: a real lender would not ask you for money or fees in advance, force you to make a decision quickly, or get access to your personal contacts and gallery.

So, before you download any instant cash app, make sure it is a registered entity with the Reserve Bank of India (RBI).

Keep your wits about you and your safety intact, and do not let the lure of an anytime rupee turn into a regret that lasts a lifetime!