Ponzi scams have become synonymous with financial deceit in India, and no region is safe. West Bengal, in particular, has witnessed some of the most notorious scams in the past decade, including the infamous Saradha and Rose Valley scam. Now, a fresh scandal has emerged this time, the Asansol Chit Fund scam, worth ₹350 crore.

This scam, which is shaking the community to its core, has affected over 3,000 families. Let’s explore how this fresh scam unfolded, its impact on the local community, and the solutions to prevent such fraudulent schemes in the future.

₹350 Crore Ponzi Scam in Asansol Details

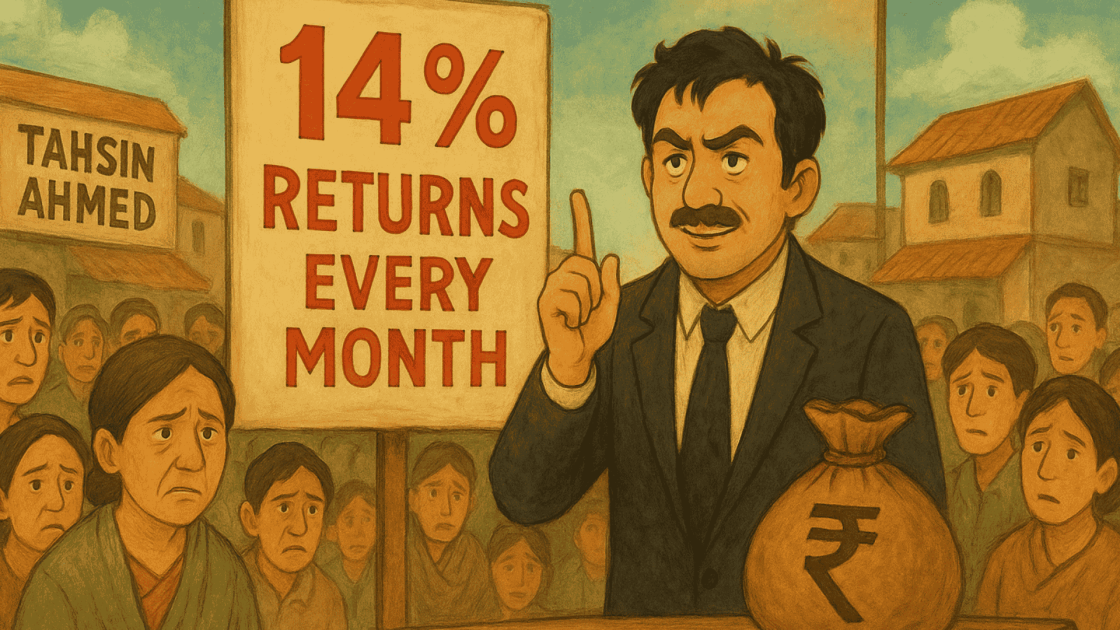

The recent scam in Asansol, Paschim Bardhaman district, involves an unlicensed chit fund company run by Tahsin Ahmed, who promised exorbitant returns to thousands of investors.

The promise was clear: 14% returns every month. It was a deal that appeared lucrative to many, especially during tough economic times when people are looking for ways to grow their money.

However, like most Ponzi schemes, this one quickly unraveled. After successfully collecting funds from unsuspecting investors for years, Tahsin Ahmed vanished on October 15, 2025, leaving a trail of financial devastation.

The total amount siphoned from investors? A jaw-dropping ₹350 crore.

Modus Operandi of the Asansol Ponzi Scam

The scam operated in a typical Ponzi fashion. Tahsin Ahmed, the son of Shakeel Ahmed, a leader of the Trinamool Congress (TMC) minority wing, set up an unlicensed financial company.

He used his connections and political leverage to build trust and attract investments, promising sky-high returns.

- For three years, thousands of families in Asansol invested large sums of money, drawn in by the promise of quick and effortless wealth.

Many people even mortgaged their homes, jewelry, and savings, believing they had found a haven for their hard-earned money.

At first, the returns were paid, which built trust among investors. But like clockwork, the payments eventually stopped. Tahsin Ahmed disappeared, leaving investors in a financial limbo.

- One of the victims, Moutusi Dutta, shared her harrowing experience. She had invested ₹20 lakh, mortgaging her gold jewelry in hopes of securing her family’s future.

At first, she received the promised returns, but suddenly, the payments stopped. When she went to collect her money, she was met with nothing but excuses and indifference.

How to Identify Ponzi Scam?

The Asansol Ponzi scam follows a well-established pattern of deception. Here are some key warning signs that you should watch out for to protect yourself from falling victim to such schemes:

- Unrealistic Returns: If an investment promises high returns, be extremely cautious. Genuine investment vehicles offer more moderate returns in line with market growth, and anything too good to be true likely is.

- Lack of Licensing: Legitimate financial institutions are licensed by regulatory bodies like the Securities and Exchange Board of India (SEBI). If the company offering the investment is not registered or is operating without any official recognition, it’s a huge red flag.

- Pressure to Invest Quickly: Ponzi schemes often pressure potential investors to make fast decisions, pushing them to invest before they have a chance to think it through or ask too many questions.

- Opaque Operations: A lack of transparency into how the business operates, where money is being invested, and who manages the funds is a major red flag. If the details are vague or evasive, stay away.

- Early Withdrawals are Difficult: Ponzi schemes often make it difficult for investors to withdraw funds or demand penalties for early withdrawals.

- Political or Personal Connections: Ponzi schemes often rely on personal or political influence to gain credibility, as was the case with Tahsin Ahmed’s connections to the Trinamool Congress. If the investment appears tied to someone with undue influence or a questionable reputation, exercise extreme caution.

Impact of the Asansol Ponzi Scam on Victims

Tahsin Ahmed’s actions have directly affected over 3,000 families, many of whom are now in deep financial distress.

The scam, with its shocking scale and devastating consequences, has drawn public outrage. Locals have staged protests, demanding that the authorities take swift action to recover the stolen funds and arrest those responsible.

Suvendu Adhikari, the Leader of Opposition, has called for a thorough investigation by SEBI and the ED (Enforcement Directorate) to trace the money trail and determine where the ₹350 crore went. Some suspect the funds may have been funneled into benami properties, terror funding, or anti-national activities. In contrast, others believe it may have been used to finance TMC’s alleged political slush funds.

How to Report a Ponzi Scheme?

For victims of Ponzi schemes, the road to recovery is long and often filled with obstacles. Here are some potential steps to recover stolen funds and safeguard against future scams:

- Report the Scam to Authorities: As soon as you realize you’ve been scammed, report the incident to local police and to relevant financial authorities, such as SEBI. In the case of Tahsin Ahmed, FIRs have already been filed at Asansol North Police Station.

- File a complaint in Cyber Crime: Ponzi scams are run using unregulated platforms. Hence, reporting to SEBI might help, but for recovery, it is important to report it to cyber crime.

- Track the Money: Investigative agencies such as the Enforcement Directorate (ED) and SEBI are often tasked with tracing the money trail and identifying any assets purchased with stolen funds. In this case, they are looking into the potential connections to benami properties or other illicit activities.

- Raise Public Awareness: Victims can help prevent future scams by raising awareness about the tactics used by fraudsters. The more the community knows about how Ponzi schemes work, the less likely they are to fall for them.

- Demand Legal Action: Victims can also push for strict legal action against the perpetrators. Public pressure often leads to faster investigations and justice.

Need Help?

If you have been scammed in such scams, then register with us now. We will guide you through the process of raising the concern and help you with the recovery process.

Conclusion

This latest case is a wake-up call for all of us. We must remain vigilant and informed, recognizing the red flags of Ponzi schemes before it’s too late. If you’ve been affected by this or any other Ponzi scam, don’t hesitate to report it to the authorities. Your vigilance and actions could help others avoid falling victim to the same scam.