. Why did this happen to me? What did I do wrong? All I did was invest my capital—what was wrong with that? Why am I the one suffering?

Many people in Assam might be victimizing themselves by giving such statements after the police arrested two individuals, Bishal Phukan & Sapnanil Das, who ran two fake investment schemes independently.

Who is responsible for such scams?

Of course, people who invested their funds with the greed to earn huge returns. Because without demand there could be no supply. People show their interest in such schemes and that is the only reason that such scams are increasing day by day.

If people bother and consider understanding the regulations associated with investment then no one, literally no one could ever dare to run such investment schemes.

But unfortunately, this happened again and many people lost their hard-earned lifetime savings in an unauthorized and fake investment scheme.

Let’s get into the details of both these scams and focus on some very important points that victims missed while investing.

Uncovering Bishal Phukan’s Investment Scam

Bishal Phukan, a 22-year-old young entrepreneur from Assam was found involved in a massive investment scam. He was accused of collecting crores of funds from around 200 people by promising a 30% return on investment.

However, most of the people who invested got little or no return and the principal amount remained unpaid too.

The police when raiding his residential area seized foreign currency (Dihram), six iPhones, and one critical bank statement. Along with this, it was found that Phukan used investors’ funds to buy luxury cars, financing abroad tips, and has also registered himself in 4 different companies.

In the list of victims, the police came across the names of many well-known artists of Assam as well.

Now the question is how he succeeded in his objective.

Simple by luring people by promising high returns and along with this he used certain tactics to gain the trust of people. Let’s get into those strategies one by one and also look at the points that escaped victims’ notice or they just ignored in their greed to earn quick gains.

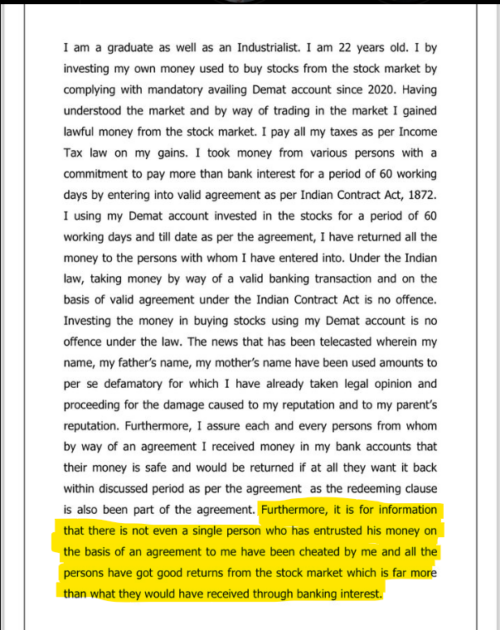

- He claimed guaranteed returns of 30% or more. Now that seemed to be tempting enough to many people. But that was a clear violation of SEBI regulations and he mentioned that openly in one of his Instagram posts as well.

Look at the audacity of these scammers; they have no fear of any regulatory body or law. That’s why they openly post things that directly violate the rules.

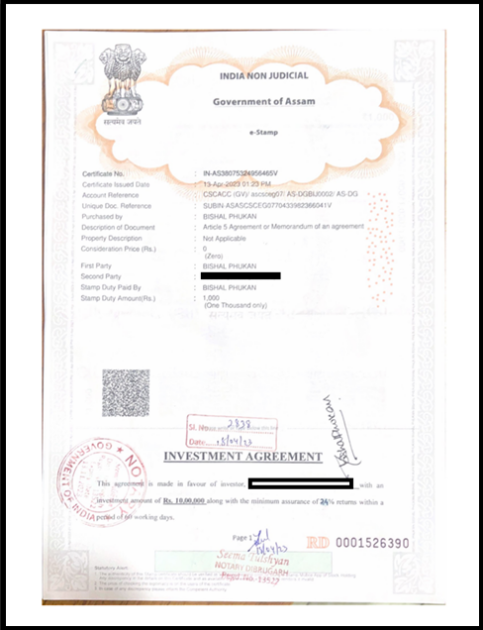

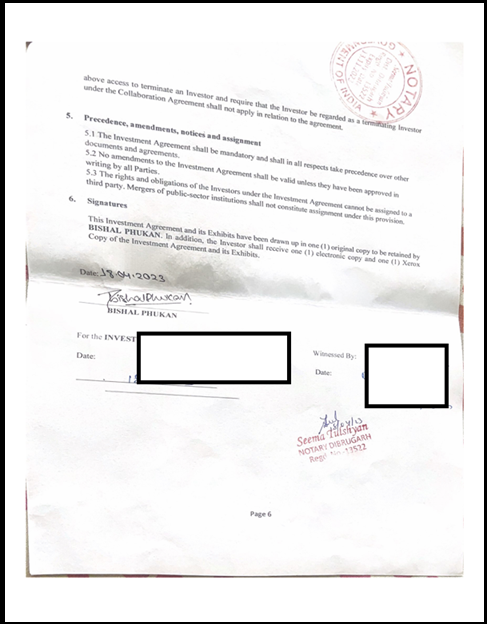

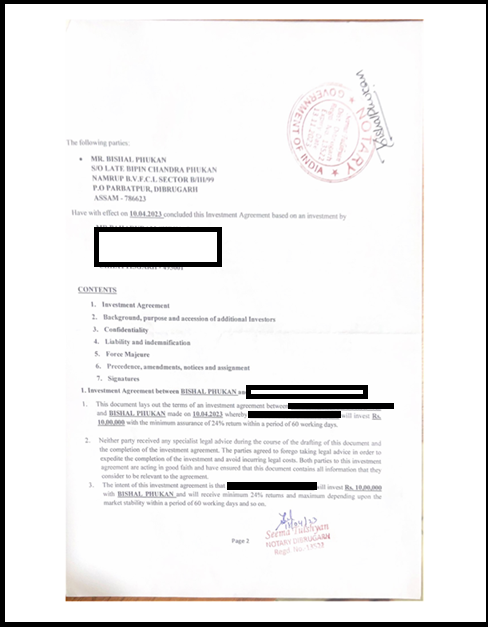

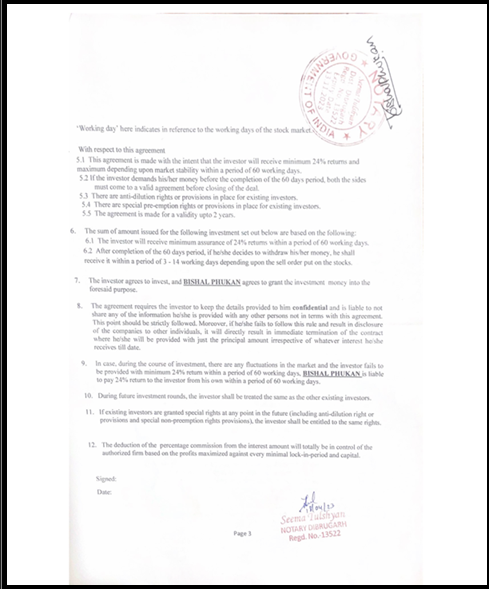

- He used to share notarized documents with investors promising fixed returns in 60 days. Here are a few screenshots of the same.

- Also, his so-called sister Sumi Borah, an artist & influencer, used her fame to convince several artists and other people to invest in the stock market scheme through him.

Now, the notarized document and the glory of his sister didn’t leave any doubt, and people invested without any doubt or worry about losing their capital.

But if people had invested time in reading this agreement before investing their money, they could have protected their capital.

How?

If we carefully look into this agreement shared by Bisal Phukan with his clients, then a few points gave a strong red signal for this investment scheme.

Let’s highlight those points.

Point number 1 in the agreement mentioned the point of guaranteed returns of 24% within 60 days. As mentioned above, that indicated a violation of SEBI guidelines. If the victim had considered stock market regulations seriously, he would have saved himself from this big scam.

Point number 2, mentioned that for the investment no legal advice had been taken and all the investment would be done based on trust and faith between the two parties.

Now, here is one question for a victim: Did he know Bishal Phukan personally? If not, would you trust someone you barely know with your hard-earned money? How can you place faith in someone you’ve never met personally?

Now in the above screenshot Point number 8 mentioned the confidentiality of the agreement. The scammer mentioned that the disclosure of this agreement with a third party would lead to its termination. In that case, the investor would be liable to get only the principal amount and no return would be provided to him.

If this agreement is to safeguard investors’ interest, then why this non-disclosure of terms was mentioned in the agreement? Why didn’t investors raise concern on this point while signing this?

Another the most highlighted red flag, Point number 9, according that if there would be any loss due to fluctuation in the market, then in that case Bishal’s Phukan took the responsibility to give a return to investors.

Seriously?

And victims believed that.

How? and Why?

Just a simple question form them that if anyone is running a business and for some reason it won’t work out, would that person pay clients money from their pocket, keeping himself in losses? If yes, then this point might not seemed to be a wake-up call, my bad!

In short, every scam gives hints and warnings. All that is required is a little awareness to recognize the same.

Let’s put some light on the other similar scam ran independently by another resident of Assam.

Exposing Sapnanil Das Scam

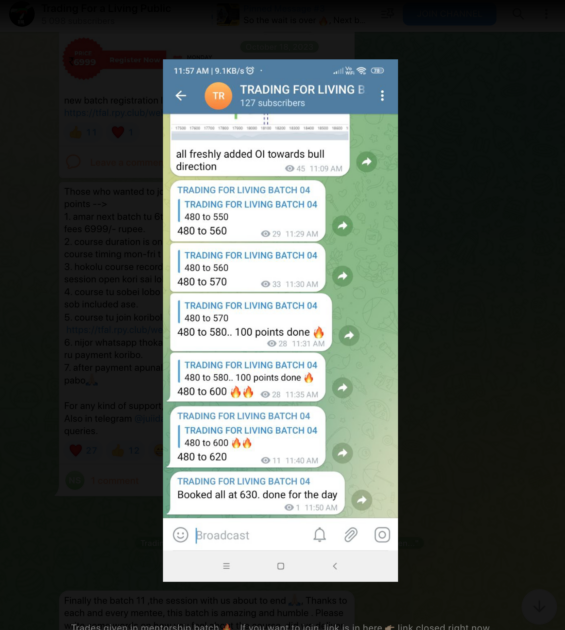

Along with the above case, another investment scam was unveiled in Assam where a person named Sapnanil was running a fake trading app, Black Stone Trading App, marketed as a high-return investment platform.

Also, he ran an online trading academy defrauding multiple individuals.

But none of the Investors got a return and filed a complaint. On investigation, the police found two luxury cars which were believed to have been purchased from the funds of investors only.

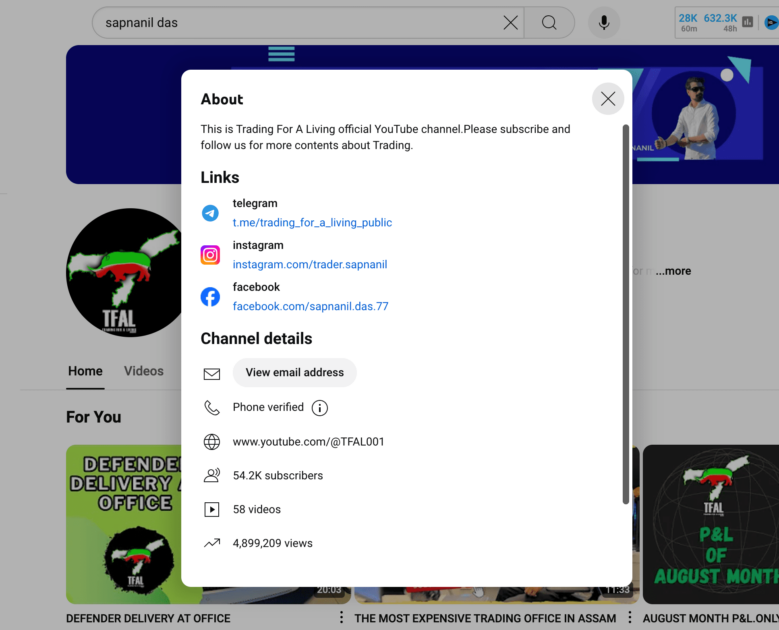

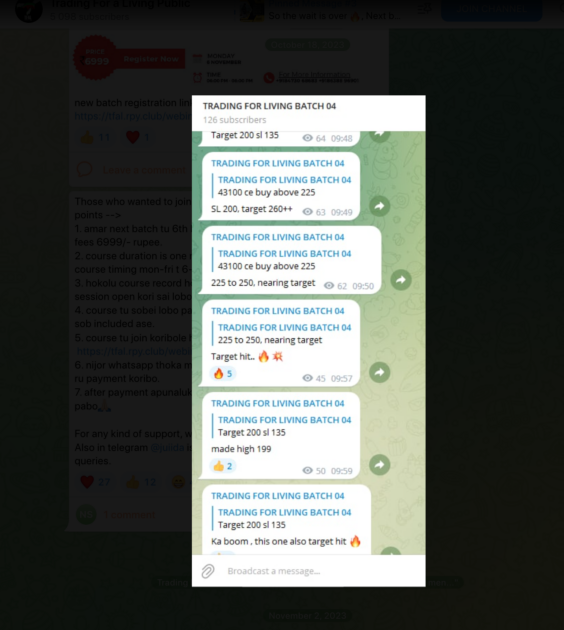

And if you look at his YouTube channel, you will find a Telegram channel link, something like this:

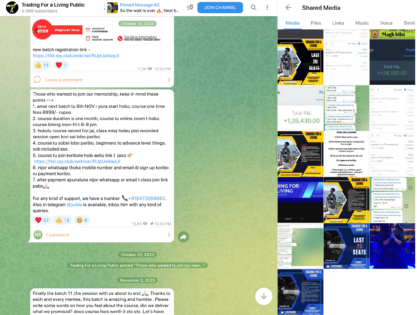

On clicking that link, you will be redirected to Telegram Channel where you will find a lot of Tips/Advisory based screenshots that seem to be taken from a separate (most likely) paid group.

As you would know that such tips can only be provided post taking SEBI RA License however there seems to be no information about such a license.

As can be seen clearly, the person has been illegally offering tips in lieu of a fee. The fresh allegation is much bigger where the person has been allegedly involved in running an app and asking individuals to invest money through it.

The allegations have been levied by the investors.

He too is in police custody and further interrogation of him would help police in finding victims and the potential scam amount.

Now, he also ran an online trading academy and most likely not to educate but to create inducement & promote his high return investment platform among his students who could fall into his trap and become his next target.

Conclusion

In both the above cases, victims might get some penalty or punishment by law. They will eventually face the consequences of their sins. But what about investors who lost their capital, and lifetime savings in these scams?

Would they ever be able to get justice?

May be! but cases like these take longer than what one can wait for. Hence the only thing victims are left with is disappointment.

So, once again investors are only going to suffer. The worst part of this is that even after so many updates, regulations, and awareness programs, people are not trying to learn until they fall victim to one or other such scams.

It is therefore high time to open your eyes and protect yourselves before you become the next victim.