Let’s start with the drama. If you’ve ever scrolled Instagram or YouTube for “stock market motivation,” you’ve probably stumbled upon Avadhut Sathe’s Bollywood-style shows. Picture this: flashing lights, pumping music, giant screens of moving charts, and Sathe dancing on stage while promising that you too can master the market.

Well, SEBI action against Finfluencers just crashed the party.

Between August 20–21, 2025, regulators spent nearly 36 hours raiding his Karjat academy — seizing laptops, trading records, and documents. The headlines call it one of the most high-profile crackdowns on India’s new wave of “finfluencers.”

But this isn’t just about one raid. This is about how influence, hype, and money are mixed in ways that could leave retail investors holding the bag.

The Story Behind the Raid

So how did we get here? Let’s rewind.

For months now, whispers about penny-stock manipulation have been floating through Dalal Street WhatsApp groups.

A few small-cap counters were moving in suspicious patterns, sudden spikes in volumes, retail piling in after flashy YouTube pitches, then equally sudden collapses.

In some of those conversations, the name Avadhut Sathe kept coming up. Not directly as a trader, but as someone whose “educational content” and “examples” allegedly overlapped with certain penny stocks that were being pumped.

Complaints started landing on SEBI’s desk. Some from students who felt misled by his academy, others possibly from rival operators who saw the growing clout of his network.

Combine that with SEBI’s heightened focus on finfluencers after its 2024–25 rule changes, and the stage was set.

By early August 2025, enforcement teams had gathered enough leads. So, on the morning of August 20th, SEBI officials landed in Karjat.

According to media reports, they went in with laptops, sealed bags, and court permissions for a full search. Students at the residential academy were told to stay calm while officials went through hard drives, phones, and paper files.

The raid reportedly stretched late into the night and even rolled over into the next day. By the evening of the 21st, truckloads of material were moved out for forensic checks.

This wasn’t just a symbolic raid. It was SEBI making a statement: the era of flashy, unregistered financial gurus operating in grey zones is ending.

The Money Side of the Story

Here’s where things get interesting. Avadhut Sathe didn’t make headlines for spectacular personal trading returns; he made money by teaching trading.

The company wrapper is Avadhut Sathe Trading Academy Pvt Ltd (incorporated Jan 2020). And while official MCA filings are still due for the most recent year, market trackers show a massive revenue ramp-up:

| Financial Year | Estimated Revenue ( in ₹) |

|---|---|

| 2020–21 | 1,74,10,822 |

| 2021–22 | 36,68,61,366 |

| 2022–23 | 86,19,00,252 |

| 2023–24 | 115,51,37,507 |

| 2024–25 | Not yet filed |

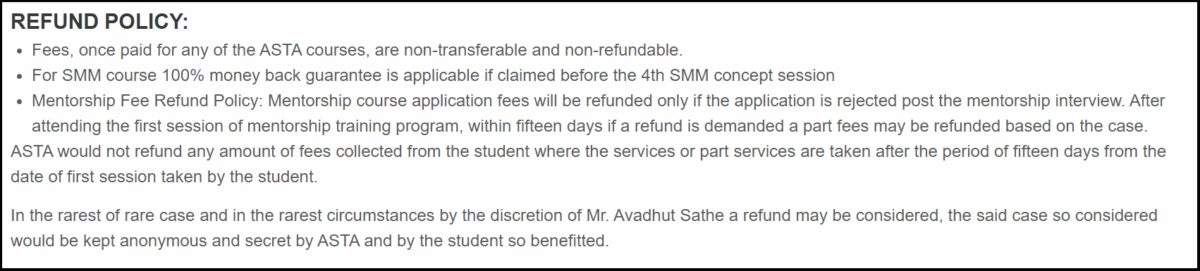

That’s a steep climb for a training business! Add to this non-refundable fees (ASTA’s website makes it clear that refunds are nearly impossible after sessions start), and you can see why so many retail learners felt locked in.

Bottom line? Fame → followers → courses → crores. The perfect monetisation engine.

How the Playbook Worked?

- Hook them with charisma: YouTube, Insta, flashy reels, and high-energy speeches. Nearly a million subscribers followed his channel.

- Dazzle with live-market theatre: Real-time charts, dancing on stage, showing trades as they happen. (SEBI has since banned this tactic — no more live-market “education.”)

- Upsell with urgency: Start with low-ticket “eye opener” sessions, then nudge students into pricey mentorships.

- Blur the line between education & advice: “We don’t give tips,” but examples looked like trade calls. Exactly the grey area SEBI now targets.

- Lock them in: Refunds are almost never allowed, and alumni groups and “family” branding to keep you inside the system.

It’s not hard to see how this setup could mislead an eager newcomer into thinking they’re learning from a guru… when in reality, they’re being milked by the system.

The Bigger Picture: SEBI vs Finfluencers

This raid isn’t random. It’s part of a much bigger story:

- 2023–24: SEBI studies the “finfluencer economy,” worried that hype is replacing regulation.

- Aug 2024: New rules kick in — registered brokers and funds cannot tie up with unregistered finfluencers.

- Jan 2025: SEBI bans use of live market data in educational programs. No more “look, I’m buying this stock right now!”

- 2025: Multiple raids, bans, and fines on tipsters and academies. Avadhut Sathe’s is just the loudest name so far.

The message is clear: influence doesn’t give you immunity.

Red Flags Every Investor Should Notice

Here’s a quick checklist you can use to protect yourself:

- No SEBI registration: If they’re not an RIA (Registered Investment Adviser), they can’t tell you what to buy/sell.

- Live trading shows: A big red flag post-2025.

- Non-refundable fees: Always ask for refund terms in writing.

- Cherry-picked screenshots: If you only see wins, never losses — run.

- Penny-stock hype: Anyone hyping microcaps as the next “10x rocket”? Probably setting you up.

What Happens Next?

- We wait for SEBI’s official order. That’s where the hard evidence will be.

- If interim restrictions are imposed, Sathe could face bans on trading or running education businesses.

- Platforms (YouTube, Meta) may be forced to verify or throttle finfluencer ads.

Conclusion

At the end of the day, the market doesn’t care about motivational slogans or dance moves. It cares about risk, rules, and records.

If the person teaching you can’t show a SEBI registration and an audited track record, maybe the smartest trade you’ll ever make… is walking away.