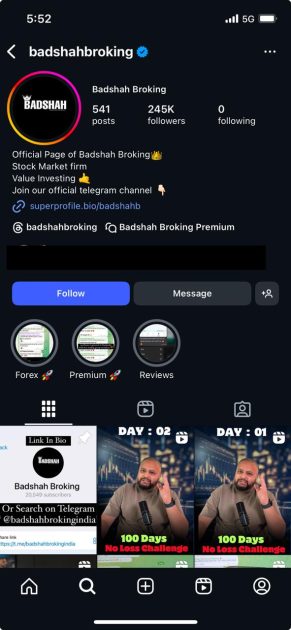

If you were to look at Instagram or Telegram, you would probably come across lots of talk about Badshah Broking. Would they not be giving you the impression of making quick profits and easy money?

However, before you simply offer a portion of your money to them, let’s have a reality check of what is going on.

The truth is that when something is too good to be true in the stock market, it almost always is the case!

Is Badshah Broking Real or Fake?

Badshah Broking appears to be a fake and unregistered entity posing as a legitimate brokerage firm. It has no registration with SEBI as a broker, Research Analyst, or Investment Advisor — a legal requirement for anyone providing stock tips, investment guidance, or trading services in India.

Despite lacking authorization, the entity’s Instagram page and online presence frequently post trading tips and stock recommendations, which is a serious regulatory violation.

Additionally, both the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) have issued public warnings cautioning investors against fraudulent schemes associated with Badshah Broking.

In short, the evidence strongly indicates that Badshah Broking is not a genuine brokerage firm, and investors should avoid any engagement with it to prevent potential financial loss or fraud.

Is Badshah Broking SEBI Registered?

Absolutely not, and this is the most critical red flag.

Badshah Broking is not registered with the Securities and Exchange Board of India (SEBI) as a broker, Research Analyst (RA), or Investment Advisor (IA).

This means it is not authorized to provide any form of stock trading, investment advisory, or financial recommendation services in India.

Under Indian securities law, SEBI registration is mandatory for any individual or organization that:

- Offers stock market tips, buy/sell recommendations, or investment advice,

- Provides portfolio management, research analysis, or financial planning services, or

- Facilitates stock or derivative trading on behalf of clients.

Entities without SEBI registration operate illegally and outside the regulatory framework.

This implies that any money you invest through them is completely unprotected by Indian law. If such an unregistered entity engages in fraudulent practices, investors have no legal recourse or protection under SEBI’s grievance redressal mechanisms.

In short, Badshah Broking is not SEBI-registered, and dealing with such an entity exposes investors to serious financial and legal risks.

Badshah Broking Scam

Confounded with real stories and warnings from regulatory bodies, here are some of the red flags that point out the falsified activities of Badshah Broking.

- Fake Profits and Dashboards: Several users claimed that they saw falsified profit screenshots and their dashboards showing balances that were not the actual market activities.

- Blocked Withdrawals: As a result, the users were frequently unable to withdraw their money even though they had already made a deposit.

- Pressure Tactics: One of the methods that the most committed agents used was to prod customers to add money to their accounts, promising them to double their returns.

- Dabba Trading: It seems that the platform is involved in illegal “dabba trading,” which is a practice whereby the trades are not done on a real stock exchange; rather, they are settled internally, thus allowing for account manipulation.

How to Report Badshah Broking?

Have you lost money or been targeted? Take steps immediately!

- Report to SEBI: Lodge a complaint on the SEBI SCORES portal in the “Unregistered Entity” category. Provide the complete evidence: conversation screenshots, payment receipts, and emails.

- Inform NSE/BSE: As both the exchanges have issued alerts, you can submit the details through their respective Investor Grievance portals to facilitate their planned operations.

- File a complaint Cyber Crime: Register a complaint at the National Cyber Crime Reporting Portal. This step is very important in the process of locating the perpetrator of the financial fraud.

- Informing Your Bank/Payment App: If you have made a money transfer, then do it without delay; a fraud dispute should be raised with your bank or UPI app. They can freeze the account from which the fraud is being carried out.

Need Help?

Do not remain silent if you have lost money or spotted suspicious activity. Find out how to file a complaint, get legal advice, and recover your money from us by registering with us.

Conclusion

Don’t be fooled by social media posts that promise quick returns or flashy social media posts. You should always verify the SEBI registration of a broker before investing anything. There is too much at stake for your financial safety to be put at risk on an unregulated platform!