If you’ve ever explored wealth management firms in India, chances are you’ve come across Basant Maheshwari Wealth Advisers LLP.

It is known for its strong presence in the equity investment space. This firm has built quite a reputation among investors looking for expert guidance and well-researched stock ideas.

But what exactly makes it stand out? And just as importantly, what kind of track record and regulatory background does it have?

Investing can be exciting, especially when you are guided by experts who live and breathe the markets.

That’s why understanding how a firm like Basant Maheshwari Wealth Advisers LLP operates can help you make smarter financial choices.

Whether you’re a seasoned trader or a first-time investor, this quick read will give you a useful snapshot of what you need to know.

Basant Maheshwari Wealth Advisers LLP

Basant Maheshwari Wealth Advisers LLP (BMWA LLP) is led by Basant Maheshwari, a well-known investor, author, and market commentator.

The firm provides investment advisory and portfolio management services that focus on building long-term wealth through equity investments.

With a reputation for identifying high-growth stocks, BMWA LLP caters primarily to retail and high-net-worth clients who value active research-led strategies.

The company is registered with the Securities and Exchange Board of India (SEBI) under registration number INP000004946, ensuring that it operates under regulatory oversight and transparency norms.

This registration means the firm adheres to SEBI’s strict guidelines for investor protection, advisory conduct, and compliance.

For anyone considering investment advisory services, verifying this SEBI registration is an important first step. But, it is also very important to look at official orders and arbitrations filed before you think of putting your money at stake.

Basant Maheshwari SEBI Violations

Like any financial advisory firm, Basant Maheshwari Wealth Advisers LLP has also faced some investor complaints and scrutiny over time.

While the firm has a loyal client base, it’s always good to look at both positive feedback and any concerns raised by investors. Transparency matters the most, especially when your hard-earned money is involved.

1. Basant Maheshwari Arbitration Cases

Arbitration cases typically arise when clients feel that the advisory service or recommendations didn’t meet expectations or caused financial loss.

As per available public records, there are currently no reported or disclosed arbitration cases against Basant Maheshwari Wealth Advisers LLP. This suggests that, so far, no client dispute has escalated to a formal arbitration process.

This does not mean the firm is perfect or risk‑free, but it does mean there is no record of serious disputes being fought out through arbitration.

Investors should still keep checking official platforms like SEBI’s complaint and dispute portals for any new updates, because this status can change over time.

2. Basant Maheshwari SEBI Order

SEBI orders are another important indicator of a firm’s compliance record. They show whether the regulator has ever taken action or issued warnings for alleged violations.

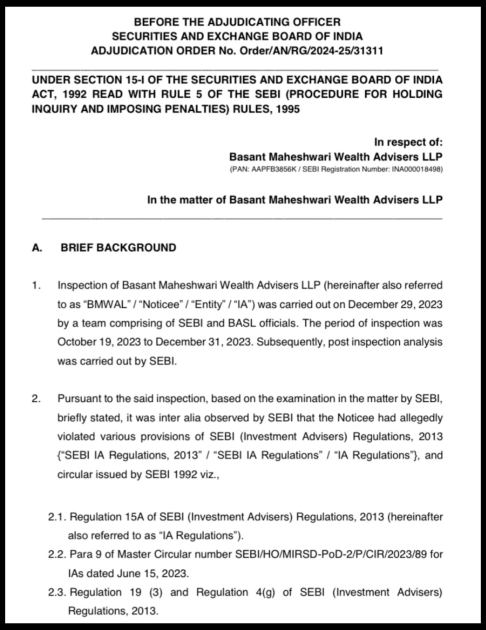

As of publicly available information, there has been one SEBI order against Basant Maheshwari Wealth Advisers LLP.

SEBI inspected Basant Maheshwari Wealth Advisers LLP (BMWAL) in December 2023 and found violations of Investment Advisers Regulations. BMWAL charged 32 clients fees in both fixed (max ₹1.25 lakh/year) and AUA (max 2.5% of assets) modes.

This is against the rules as SEBI allows only one mode per client annually. They also posted YouTube videos with exaggerated titles like “100x Portfolio in 3 Years?” without proper disclaimers, promoting their smallcase.

They even skipped required annual audits for IA compliance while using the PMS exemption.

What SEBI Did?

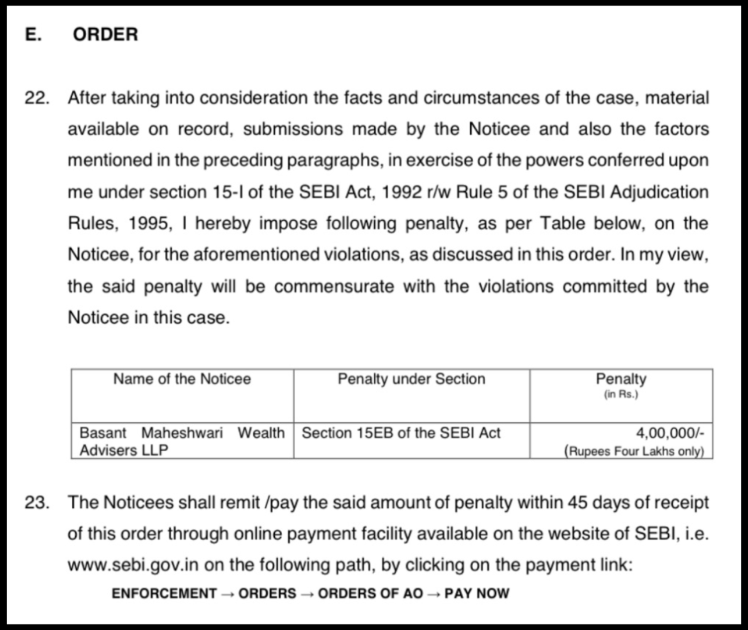

SEBI issued a show-cause notice, held hearings, and rejected BMWAL’s defenses like “separate services allow mixed fees” and “videos are educational.”

SEBI imposed a ₹4 lakh penalty under Section 15EB, payable within 45 days via their website, with recovery possible if unpaid.

What Others Can Learn?

- Investment advisers must stick to one fee mode per client with no mixing across services.

- YouTube/social media counts as ads if influencing investments; avoid hype like massive returns promises and always show clear disclaimers.

- Do yearly IA compliance audits by CA/CS, even under PMS exemption.

- Follow rules strictly to avoid penalties; SEBI enforces literally, no excuses for “client interest.”

Basant Maheshwari Wealth Advisers LLP Complaints

Many investors share positive feedback about Basant Maheshwari and his advisory services, especially appreciating his educational content and stock‑market explanations.

Some viewers feel his videos help them understand earnings, growth, and business quality.

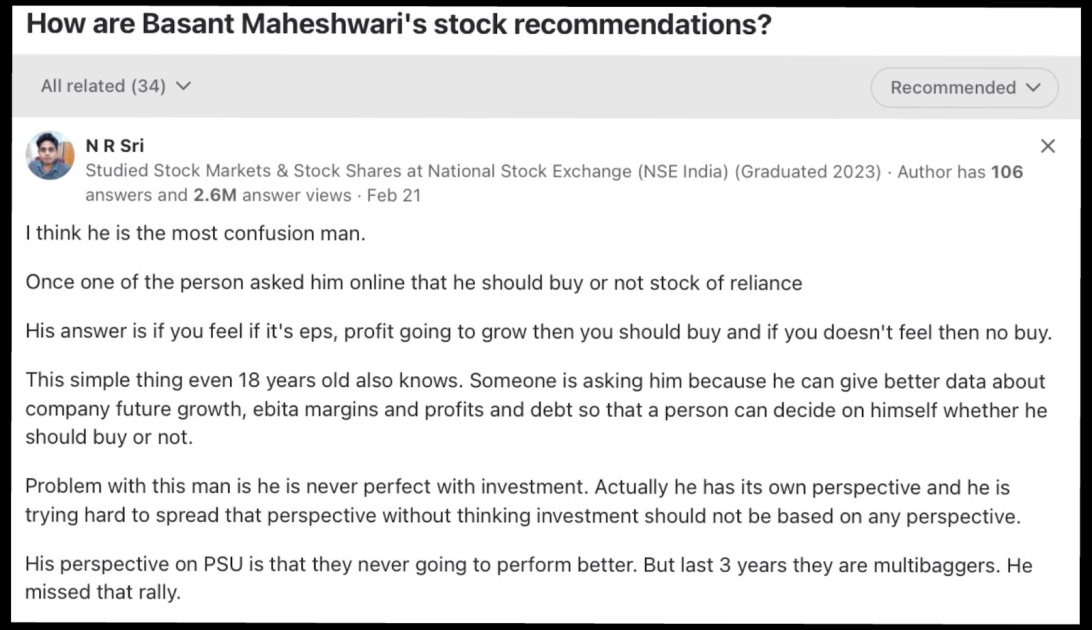

At the same time, a few online reviews express concerns that his answers can sometimes feel generic when people expect more specific company analysis before deciding to buy or sell.

One reviewer feels his strong personal views (for example, on certain PSU stocks) may have led to missing some recent rallies.

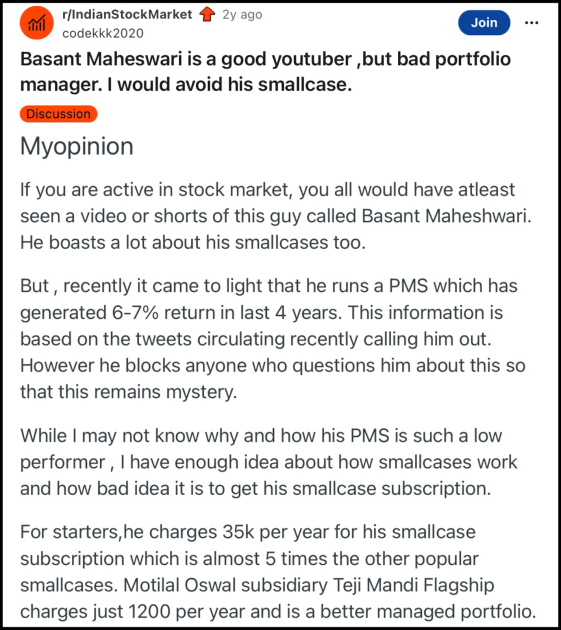

Another commenter on a discussion forum describes him as a good YouTuber but not an attractive choice for portfolio or smallcase management in their view.

They allege that his PMS returns have been modest in recent years and that his smallcase fees are on the higher side compared with some alternatives, though these are individual opinions and may not reflect the experience of all clients.

How to Report Basant Maheshwari Wealth Advisers LLP?

If you’re facing issues with Basant Maheshwari Wealth Advisers and don’t know where to begin, you can register with us, and we’ll guide you through every step of the process.

We make the complaint journey simpler so you don’t feel stuck or alone.

1. Documentation assistance

We help you gather, organize, and structure all the necessary documents related to Basant Maheshwari Wealth Advisers, such as trade statements, ledger reports, contract notes, emails, screenshots, call logs, and any agreements.

It is essential because it helps your case to be supported with clear evidence.

2. Drafting your complaint

Our team prepares clear, well‑formatted complaint drafts tailored to the requirements of NSE, BSE, SEBI SCORES, SMART ODR, or any other relevant forum.

This reduces the chances of your complaint being rejected or delayed because of language, clarity, or formatting issues.

3. Filing and escalation support

We guide you step‑by‑step while filing on platforms like SCORES or SMART ODR and ensure every mandatory field is completed correctly.

If your matter needs to be escalated beyond the adviser, we show you the right escalation path, including approaching the exchange or the next dispute‑resolution stage.

4. Case tracking and arbitration help

From registration till closure, we help you track timelines, respond to queries from the regulator or exchange, and keep your documentation updated.

If your matter goes into counseling or arbitration, we assist you in preparing your statements, evidence set, and responses so you feel confident and well‑prepared.

By registering with us, you avoid procedural confusion, drafting stress, and paperwork errors. You can focus on financial recovery while we handle the technical and regulatory side of the process.

Conclusion

Choosing where to invest your money is no small decision, and knowing about a firm’s background is half the battle.

Basant Maheshwari Wealth Advisers LLP has gained recognition for its strong market insights and disciplined approach. At the same time, smart investors don’t just rely on reputation; they verify details, understand complaint histories, and check regulatory records.

Staying informed helps you invest with confidence and peace of mind.