If you’ve been seeing ads or messages about an app called Basket Loan promising instant cash in minutes, you’re not alone.

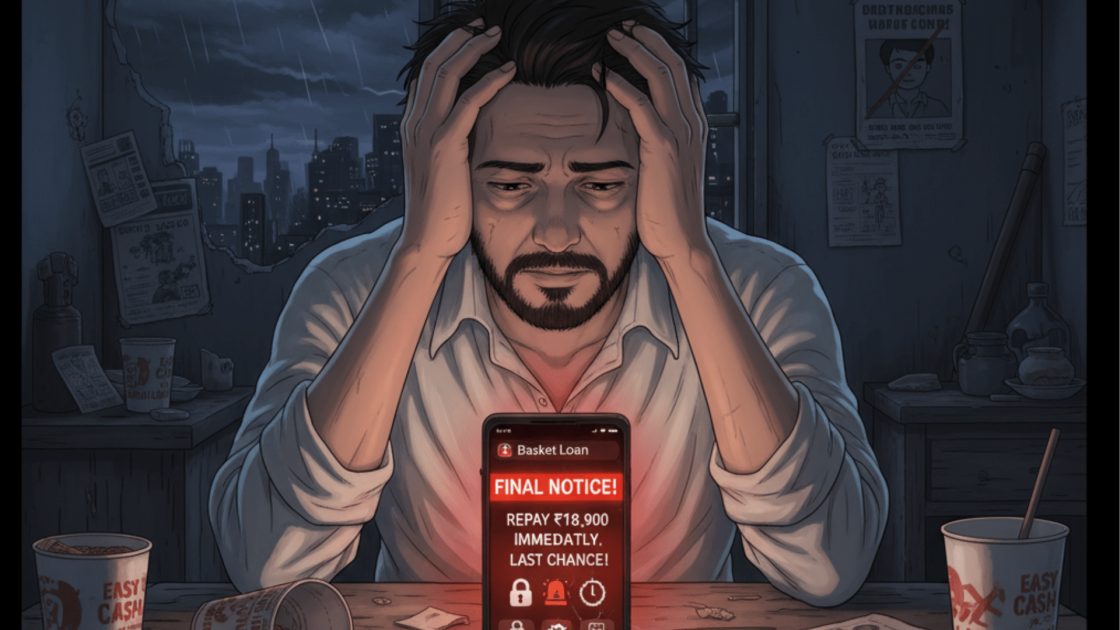

In today’s economy, quick loan apps seem like a lifesaver, until they’re not. Many users have recently started questioning whether Basket Loan is legit or just another trap in the growing wave of fake finance apps.

Reports of online personal loan frauds in India highlight how such apps misuse personal data, charge hidden fees, and manipulate users with false loan offers.

Before you tap “Install,” it’s worth taking a closer look. In this guide, we’ll break down how these apps really work, what red flags to watch for, and what to do if you’ve already downloaded or borrowed from one.

Basket Loan App Review

Over the last few years, India has seen waves of look-alike loan apps: “Rupee/Cash/Loan/Basket/…”. They promise ₹2k–₹10k in minutes, then bury you in fees and threats. Investigations and police cases describe the same playbook:

- Short hidden tenures & fee traps. Ads hint at “90+ days,” but inside the app, you’re pushed to repay in 7–14 days, with processing fees, GST, and late fees that inflate the actual APR.

- Data grab to enable extortion. During “KYC,” the app demands Contacts/SMS/Photos. Those permissions aren’t needed for underwriting, but they’re later used to threaten or shame borrowers.

- Harassment even after payment. Victims report morphed photos sent to family or colleagues and repeated demands despite paying.

- Name churn & foreign handlers. When a name gets flagged, operators relist under new brands.

“Basket Loan” appears in a 2025 fake-loan-app list that compiles many of these rotating names. While such lists aren’t official, the combination of (a) no verifiable RBI-licensed lender, (b) typical naming/positioning, and (c) alignment with the harassment pattern is a strong red flag.

How to Check Fake Loans?

Use this for Basket Loan or any instant-loan app:

1. Name the lender (not just the app)

Inside the app/site, there must be a bank or RBI-registered NBFC named as the actual lender, with a real company name and registration number. Cross-check on RBI resources. If you can’t find it, walk away.

2. Demand the Key Fact Statement (KFS)

Legit apps show the KFS up front – actual APR, all fees, tenure, cool-off/foreclosure, repayment schedule. No KFS before KYC = fail.

3. Permissions hygiene

Contacts / Photos / Call logs / SMS are not required for a small personal loan. Those permissions correlate with the harassment pattern researchers flagged. Do not grant.

4. Support & address you can reach

Look for a grievance officer, physical address, and working phone/email. Telegram-only support or PO boxes are red flags.

5. Independent footprint

Real lenders leave trails (RBI filings, audited statements, credible press). If all you see are app-store clones, APK mirrors, or aggregator lists, treat it as high risk.

How to Complaint Against Online Loan App?

Act now, and document everything:

- Save evidence: Screenshots of app pages, KFS/terms (if any), payment receipts, call/WhatsApp logs, threatening messages.

- Revoke & Uninstall: Go to phone Settings, app, and then to Contacts/SMS/Storage permissions, to uninstall. Change banking/email passwords.

- Block & report:

- Tell your bank to block suspicious UPI mandates/auto-debits.

- File a complaint in cyber crime. Include screenshots/phone numbers/UPI IDs/QRs.

Need Help?

Are you also among those caught in these schemes? Register with us to get personalized guidance on reporting the fraud and starting recovery.

Conclusion

The dangers of Loan app scams are becoming increasingly apparent. These apps look and behave like the broader illegal loan app ecosystem that India’s police, regulators, and reporters keep warning about – short tenures, hidden fees, contact shaming, and name churn.

Your best defense: verify before you install and maintain a zero-tolerance policy for hidden lenders or hidden terms.