Looking for the best paisa loan app that’s actually safe to use? You’re not alone. With rising expenses and the promise of instant cash, these apps have become a go-to for many.

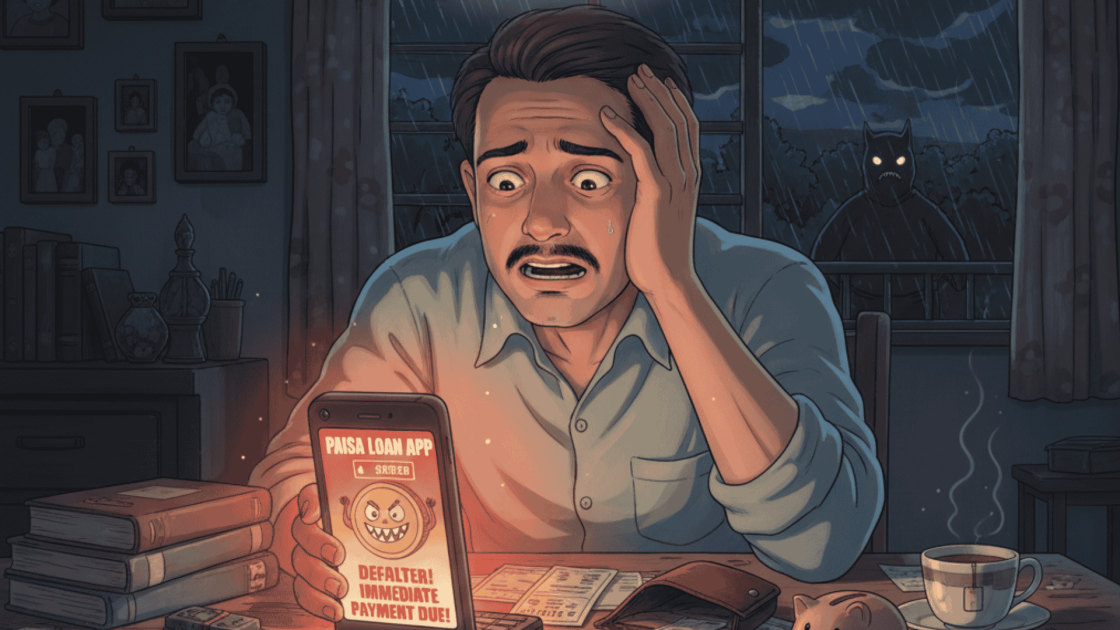

But here’s the catch: while some are genuine and RBI-registered, plenty of others hide behind flashy ads and quick approvals to trap users in unfair interest rates or misuse personal data.

Cases of online personal loan frauds in India have surged in recent years, where unsuspecting users fall prey to unverified apps that exploit their personal and financial details.

Before you download any loan app, it’s important to know which ones you can trust and how to spot the red flags.

In this blog, we’ll help you separate the safe options from the risky ones and share practical tips to protect yourself from fake loan apps. oversight, posing risks such as high interest rates, data misuse, and harassment.

Best Paisa Loan App Review

The best paisa loan app is a mobile application that provides small, short-term personal loans, typically ranging from ₹1,000 to ₹50,000. These loans are marketed as quick solutions for urgent financial needs, promising instant approval and disbursal.

Here’s how these apps typically operate in India:

- Instant Loan Offers: Users apply for loans through the app, often with minimal documentation. Approval is claimed to be instant, and funds are disbursed quickly.

- High-Interest Rates: Many of these apps charge exorbitant interest rates, sometimes exceeding 30% per annum, leading to significant repayment burdens.

- Data Collection: To process loans, these apps often request access to personal data, including contacts, SMS, and storage. This data can be misused for aggressive recovery tactics.

- Harassment and Blackmail: In cases of delayed repayment, users have reported receiving threatening calls and messages. There have been instances where morphed images were sent to the borrower’s contacts to coerce repayment.

In a recent case, a 20-year-old woman in Mumbai applied for a ₹15,000 loan through a mobile app she found via a YouTube advertisement. After submitting her bank account and PAN card information, she was informed that her loan application had been rejected.

Days later, she received WhatsApp messages from unidentified individuals demanding a ₹1,500 fee. When she refused to pay, the fraudsters circulated morphed nude images of her to her father, uncle, and a friend. An FIR was subsequently registered under the Bhartiya Nyaya Sanhita and the Information Technology Act.

Is Best Paisa Loan App Safe?

Well, to ensure the safety of any loan app, it is important to follow the checklist below:

- Regulatory Approval: Verify if the app is registered with the Reserve Bank of India (RBI) or operates through a licensed Non-Banking Financial Company (NBFC).

- Transparent Terms: The app should provide clear information about interest rates, repayment terms, and any associated fees before you apply.

- Data Privacy: Be cautious if the app requests unnecessary permissions, such as access to your contacts or messages.

- Customer Support: A legitimate app will have accessible customer service and a grievance redressal mechanism.

Unfortunately, best paisa is not regulated by the RBI, which makes it riskier.

How to Complaint Against Online Loan App?

If you suspect a loan app is fake or have been scammed, report it immediately using the following steps:

- File an online Cyber crime complaint:

Visit the cybercrime portal and file a complaint under Financial Fraud. - Cyber Police Station:

Visit your nearest cyber police station with proof such as screenshots, transaction details, and chat records. - App Store / Play Store:

Open the app’s page, select “Report” or “Flag as inappropriate”, and explain that it’s a fake or fraudulent loan app. - RBI Complaint:

Verify if the app or lender is registered on the RBI website.

Need Help?

Register with us and get assistance in reporting such fake apps, and also in reporting to higher authorities to get recovery of losses.

Final Thoughts

While the allure of quick cash is tempting, it’s essential to approach paisa loan apps with caution.

In recent times, loan app scams have become a growing concern, with many users unknowingly sharing personal data with unverified lenders.

Always prioritize safety by choosing regulated platforms, reading the fine print, and being aware of your rights. If you encounter any issues, report them to the National Cyber Crime Reporting Portal or fill in the form below to get our assistance.