The world of cryptocurrency moves at breakneck speed. One day, an exchange is the “gold standard,” and the next, it’s facing a regulatory storm or a security breach.

If you’ve been looking for a platform to trade futures or try “Copy Trading,” you’ve likely encountered BingX.

This post walks you through what BingX is, how its app works and downloads, whether it’s legal in India, what users are saying via reviews, and what to watch out for.

Sounds important, right?

BingX Review

BingX is a global crypto exchange and social-trading platform that lets users trade spot and futures markets, follow professional traders through copy-trading, and manage everything through a feature-packed mobile app.

Sounds exciting, right?

But before you rush to hit Download, especially if you’re in India, there are a few important things you should know.

As an Indian user, you’ll usually find the BingX app on the Android Play Store or Apple App Store.

In some cases, Android users may be redirected to an APK version, depending on availability. That’s your first checkpoint, where you’re downloading from matters just as much as what you’re downloading.

Once inside the app, BingX offers plenty to explore. You’ll find support for spot trading and futures across a wide range of cryptocurrencies, making it appealing to both beginners and experienced traders.

One of its standout features is copy-trading, where you can automatically mirror the trades of experienced traders, essentially learning by following the pros.

Add to that a clean mobile interface, trading tools, and even bots, and it’s easy to see why the platform feels powerful at first glance.

So what’s the bottom line?

Yes, the BingX app can be used by Indian users as a crypto trading platform. But “usable” doesn’t always mean “seamless.” Local support, payment options, and regulatory comfort levels can vary, so going in with awareness is key.

Explore smartly, verify everything, and never assume global automatically means local-friendly.

Is BingX Legal in India?

If you’re an Indian crypto user, you’ve probably asked yourself this at some point: “BingX is available, but is it actually legal in India?”

It’s a fair question, and the answer isn’t as straightforward as a simple yes or no.

India’s crypto regulations are still evolving, and that grey area is where many global exchanges operate. BingX is one of them.

While several international crypto exchanges allow Indian users to sign up and trade, that doesn’t automatically mean they’re fully licensed in India.

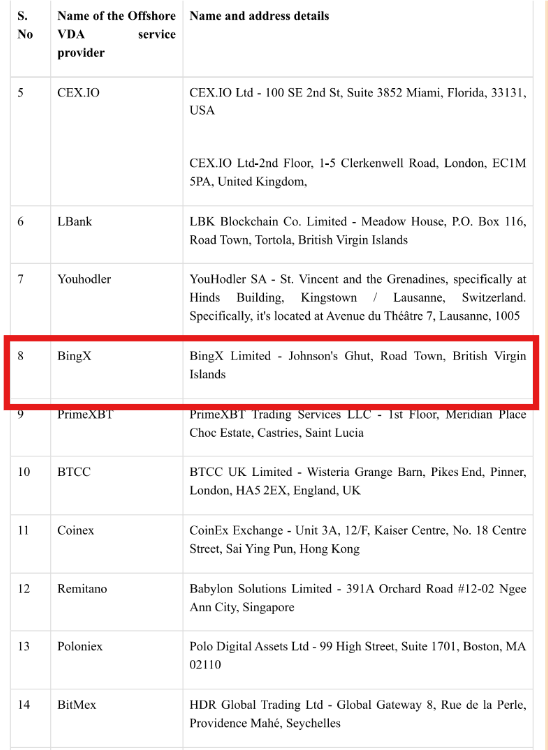

In fact, Indian authorities have recently taken action against multiple offshore crypto platforms, including BingX, for alleged compliance failures.

That move sent a clear message: regulators are watching, and enforcement is real.

BingX does not hold a clear, top-tier licence specifically issued by Indian regulators.

While the platform remains accessible and functional for Indian users, the absence of formal local approval raises legitimate concerns.

When authorities issue notices or initiate action against offshore exchanges, it creates uncertainty for users caught in the middle.

Is BingX Safe?

Before asking “Is BingX safe?”, there’s a more important question to answer first: Is it legally compliant in India? Because when it comes to crypto platforms, legality and safety are deeply connected.

In October 2025, India’s Financial Intelligence Unit (FIU-IND) issued show-cause notices to 25 offshore crypto exchanges operating without proper registration. BingX was one of the names on that list.

Now, here’s where things get interesting.

While major platforms like Binance and KuCoin chose to take the legal route—registering with FIU-IND, paying penalties, and aligning themselves with India’s Anti-Money Laundering (AML) rules, BingX did not. At least for now, it remains classified as a non-compliant offshore exchange.

So what does that mean for users sitting in India?

First, access itself has become a problem.

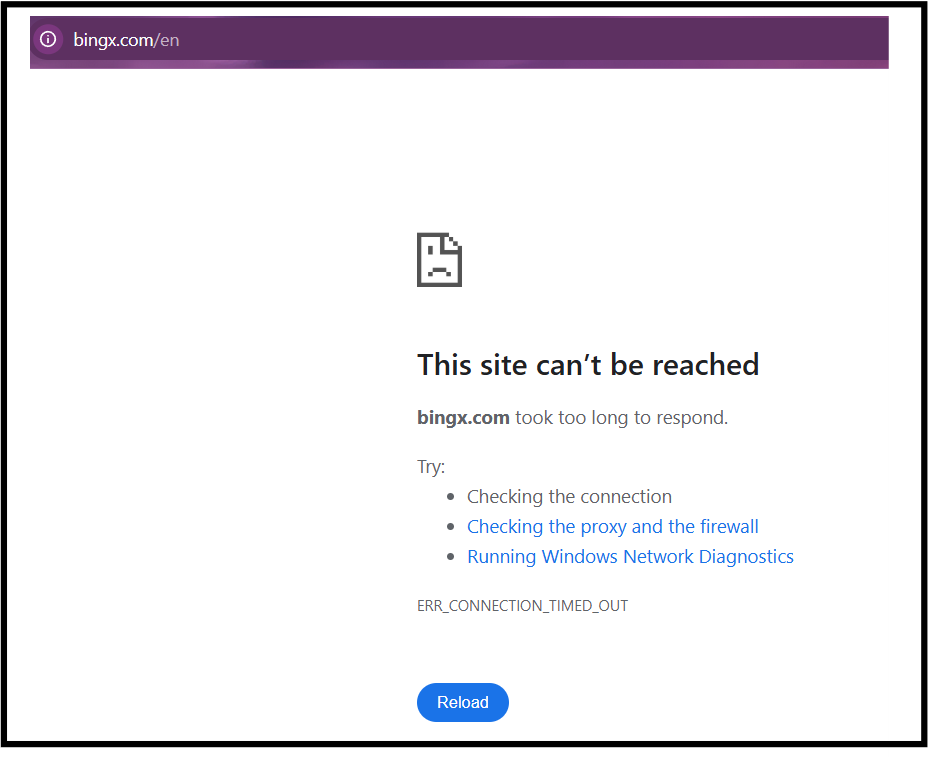

Many Indian internet providers have already started blocking the BingX website and app, which explains why some users suddenly find the platform unreachable without using workarounds.

So, is BingX “safe” in India?

From a regulatory and legal standpoint, the answer leans heavily toward no. And when real money is involved, that’s a risk worth thinking about, before clicking “deposit.”

BingX Complaints

Across review platforms, user feedback paints a concerning picture.

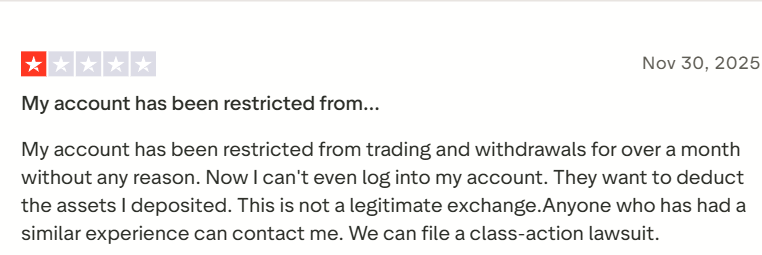

On Trustpilot, BingX holds a very low TrustScore, with many users reporting serious issues related to withdrawals and sudden account restrictions.

One trader shared that after starting to trade using the BingX API, their account was unexpectedly blocked without a clear explanation.

Stories like this appear repeatedly, often with users claiming that support responses are slow or unhelpful once funds are involved.

Indian users on Reddit have raised similar concerns. Many posts don’t even accuse the platform outright; they simply ask whether withdrawals are safe or reliable. When a large number of users are questioning whether they can access their own funds, it signals a deeper trust issue.

In the end, the real question for traders isn’t just “What can this platform do?”, it’s “What happens when something goes wrong?”

How to File Cryptocurrency Complaints in India?

If you face problems with BingX (for example, withdrawal issues, account blocks, unclear fees), here’s what you can do:

- File a complaint with your bank (if the payment/deposit is related) or the payment provider.

- File a complaint with SEBI or via other relevant Indian financial consumer grievance portals.

- Keep all evidence: screenshots, chat logs, deposit receipts, app versions, and correspondence.

- File a complaint in Cyber Crime.

Need Help?

If you’ve been a victim of such crypto scams and are now worried about your funds or account access, register with us now.

We will guide you step by step on how to file your complaint and escalate it for trading scam recovery.

Conclusion

Putting it all together: You now know what BingX is, how its app works in India, what reviews it gets, and the legal questions it raises.

If you want to use it, start small: deposit only what you can afford to lose.

Keep track of your transactions and communications. Consider alternatives with clear Indian regulatory frameworks and strong track records.