Searching for “BP Wealth” online often means you’re looking for someone trustworthy, like Dinesh Mange, to guide your stock market moves.

With SEBI registration, Dinesh Mange presents himself as a credible voice in India’s investment world.

Many retail investors, especially those chasing quick returns, turn to such registered analysts hoping for winning stock tips.

But here’s what matters most before you hand over your hard-earned money to anyone claiming market expertise: asking tough questions about their track record, their company’s regulatory history, and whether their advice has ever gotten people into financial trouble.

If you’ve heard about Dinesh Mange through social media, Telegram channels, or if you’ve already invested based on his suggestions, you need the real story.

Through this deep dive, you’ll learn what Dinesh Mange does, which company he’s connected to, what problems investors have faced, and most importantly, how to protect yourself if something goes wrong.

BP Wealth Review

BP Wealth is the brokin & wealth management company operated by Dinesh Kashiram Mange.

Dinesh Mange holds a SEBI-registered research analyst credential with the number INH000000974, which means SEBI has officially recognised him as someone qualified to provide stock market research and investment advice.

Beyond being a research analyst, Dinesh Mange also serves as Company Secretary, Compliance Officer, and a director of BP Equities, giving him significant responsibilities in the firm’s operations and regulatory adherence.

As a SEBI-registered research analyst, Dinesh Mange’s core job is to analyse stocks, market trends, and investment opportunities, then provide recommendations to investors and traders.

In SEBI hearings and regulatory proceedings, Dinesh Mange has appeared as the Authorised Representative for the company, which means he was directly involved in defending the firm’s actions before regulatory authorities.

BP Wealth Services

BP Equities offers services through its digital trading platform, Stoxbox, which the company heavily promotes as a simplified way to invest in stocks and build a portfolio.

The app promises features like demat account integration, personalised stock picks, thematic baskets (like “green energy stocks” or “pharma plays”), and trading calls delivered via email and Telegram.

On the surface, it appears modern and user-friendly, targeting retail investors who seek easy access to stock market investing without the complexity of traditional brokerage terminals.

However, the reality users have experienced tells a different story.

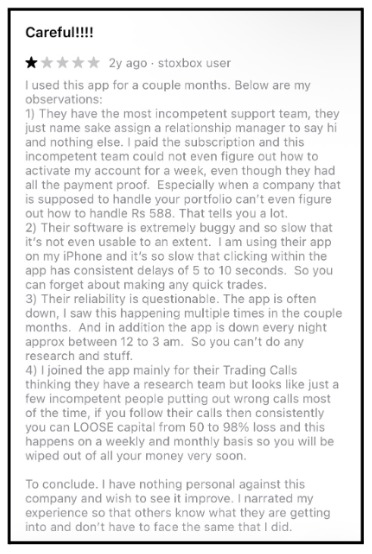

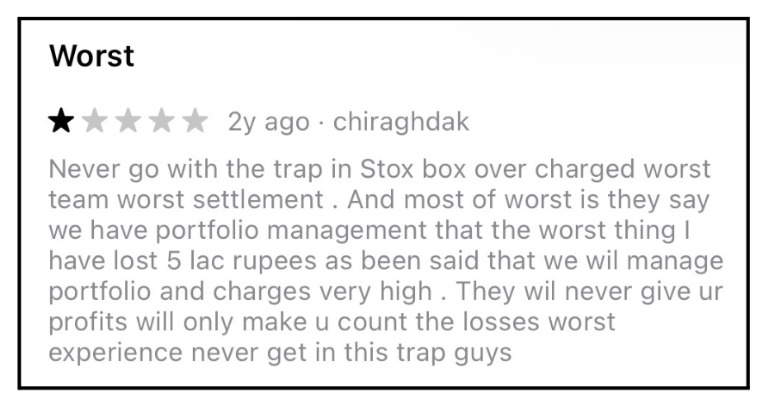

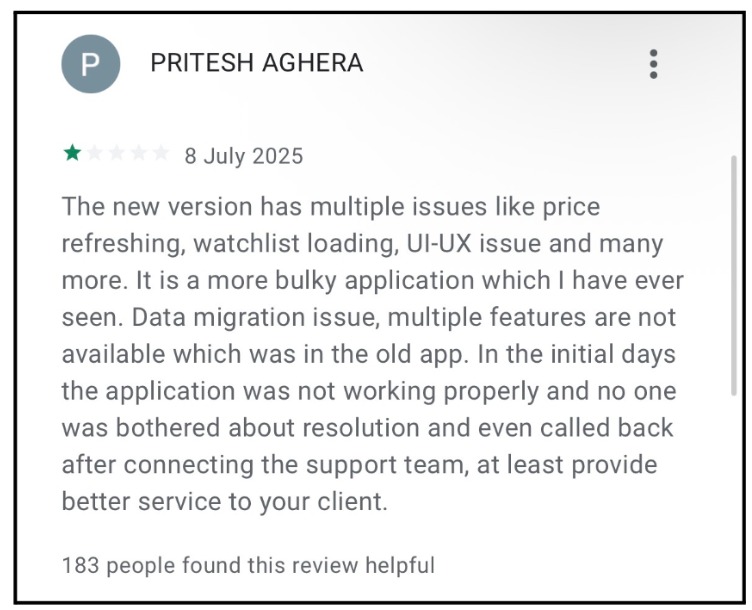

The Stoxbox app has drawn criticism for technical glitches, delayed price updates, slow customer support response times, and, most painfully, complaints about unexpected fund deductions even after users thought they’d cancelled subscriptions.

When the app fails, investors lose money on missed trading opportunities or incorrect executions, but getting refunds or explanations from the company has proven frustratingly difficult for many.

BP Wealth User Complaints

Looking at official records from the National Stock Exchange (NSE), BP Equities recorded one investor complaint in 2024-25 and three complaints in 2023-24, despite having approximately 12,000 active trading clients.

While these numbers may seem small in percentage terms, they mask real financial harm to affected investors. Most complaints have been resolved through the exchange’s grievance system, but resolution often takes months, leaving frustrated traders without their money or answers.

Stoxbox App Issues

The biggest source of complaints ties directly to Stoxbox, the trading app that BP Equities uses to deliver services. Users report several recurring problems, like:

1. Technical Glitches

The app frequently freezes, crashes during market hours, or displays outdated prices, causing traders to miss trades or execute at prices that no longer exist.

Imagine wanting to sell a stock at ₹500 because market conditions suddenly worsened, but the app shows the price as ₹510 from 20 minutes ago. By the time you realise the error, the stock has dropped further, and your intended exit price is gone.

2. Unauthorised Charges

Perhaps most frustrating, users report that cancelling their paid subscriptions doesn’t actually stop charges. The app continues deducting monthly fees long after the user thought they’d cancelled, sometimes leading to overdrafts or negative account balances.

When users contact support, responses come slowly, if at all.

3. Poor Customer Support

The advertised 24/7 support often doesn’t materialise. Users struggle to reach anyone who can actually help resolve their issues, let alone offer refunds for lost trading opportunities or wrongful charges.

These aren’t isolated complaints; they appear repeatedly across Google Play reviews, investor forums, and grievance databases, suggesting a systemic issue with service quality.

SEBI Actions Against BP Wealth

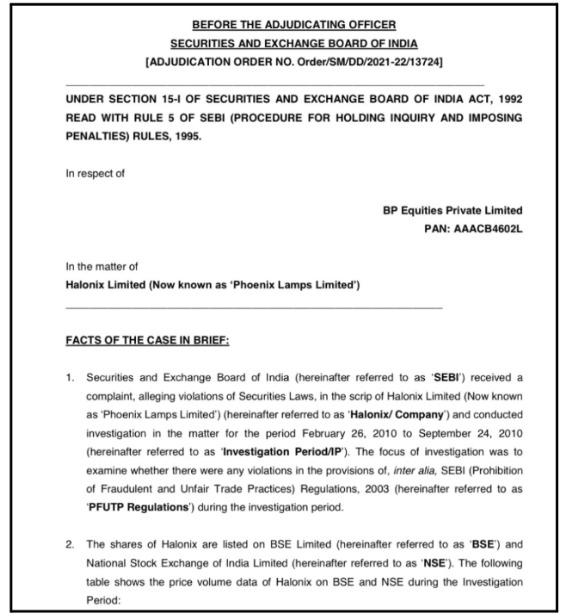

SEBI issued an adjudication order against BP Equities for facilitating self-trades in Halonix Limited shares (now Phoenix Lamps).

Imagine you’re playing a game where you’re supposed to sell your toy to someone else. But instead, you sell it from your left hand to your right hand. Nothing really changed, right? That’s basically what a “self-trade” is in the stock market.

BP Equities client, BP Fintrade, bought and sold 650 shares of a company called Halonix to itself 132 times. BP Equities helped process both sides of these trades, meaning they were the broker for both the buyer and seller, even though it was the same person.

SEBI noticed unusual activity in Halonix shares and started investigating. They were worried because self-trades can sometimes be used to create fake activity, making it look like lots of people are trading when they’re not.

This can trick other investors into thinking a stock is popular when it’s actually not.

When SEBI sees a broker helping the same client buy and sell to themselves, they question whether the broker was being careful and responsible. Brokers are supposed to watch out for suspicious behaviour.

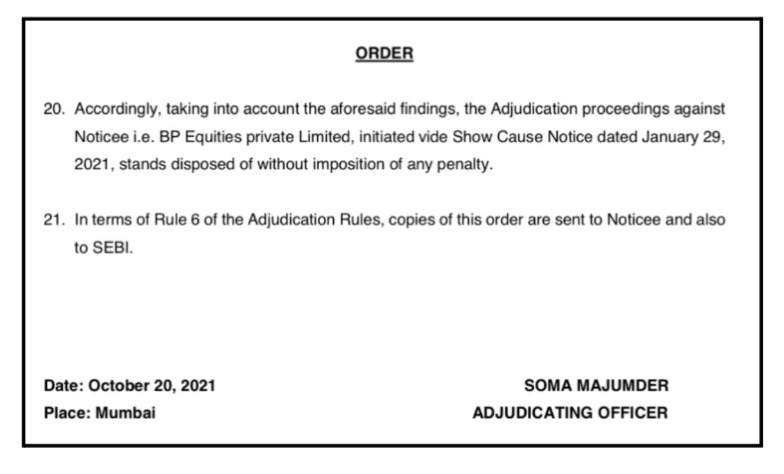

What did SEBI do?

After reviewing everything for over 10 years, SEBI found that these 650 shares were extremely tiny compared to the total trading that happened.

Out of over 10 million shares traded during that period, these self-trades were just 0.0056% of the total volume. That’s like one drop in a swimming pool.

More importantly, SEBI couldn’t find proof that these trades were done to manipulate prices or fool other investors.

There was no evidence of harmful intent. Because of this, SEBI decided to drop the case completely without imposing any fine on BP Equities.

BP Wealth Arbitration Cases

When it comes to formal arbitration cases, the public record shows minimal activity. This could mean either that disputes rarely escalate to arbitration or that they’re being settled internally at BP Equities’ grievance redressal level before reaching the arbitration stage.

According to NSE complaint data, most grievances against the firm have been resolved through the exchange’s own systems, not through formal arbitration awards. But there is one arbitration case against the company.

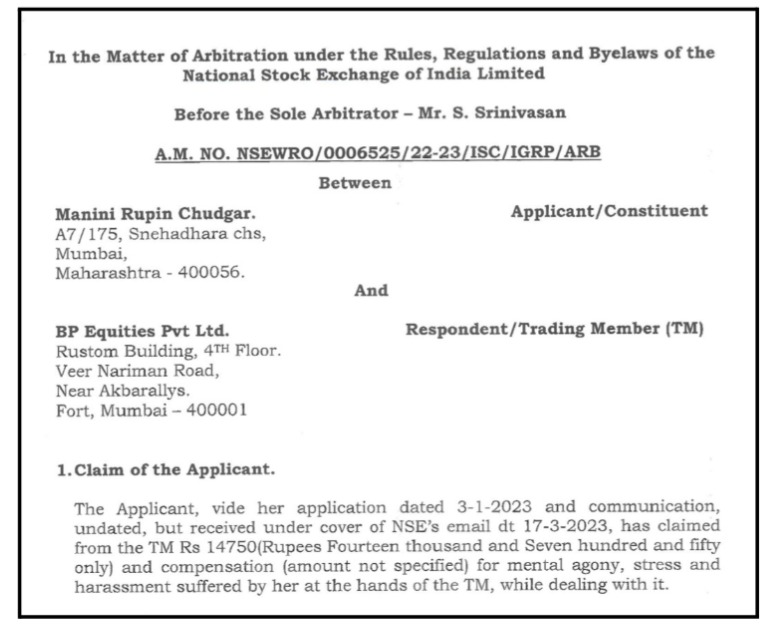

Manini Rupin Chudgar from Mumbai filed the arbitration claim against BP Equities Pvt Ltd in early 2023.

She joined them as a client in July 2021 and relied on tips from their sub-broker’s employee, Brijesh Shah, via WhatsApp and calls.

He pushed her to buy 500 shares of Birla Tyres at Rs 29.40 each, totalling Rs 14,750, despite the company facing wage default issues she learned about later.

The shares tanked, becoming worthless, and she blamed coercive advice driven by commissions. On top of that, when she complained, BP Equities froze her trading account multiple times without notice or reason, and the staff got rude during account closure.

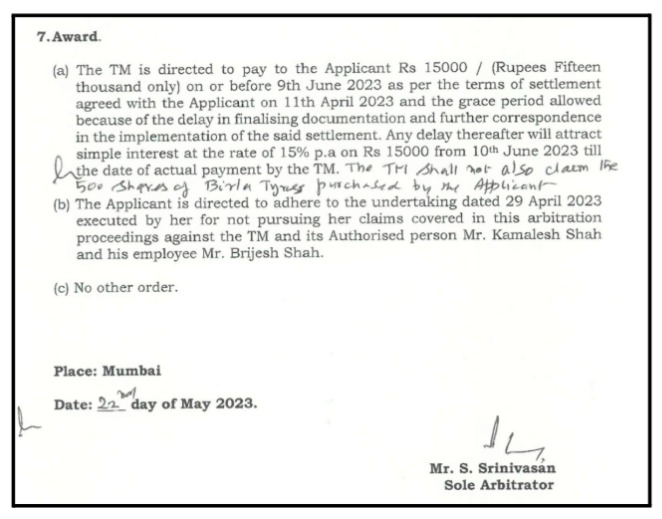

Penalty Imposed

BP Equities agreed to pay Manini Rs 15,000 as full and final, waiving the claim on her Birla Tyres shares. She signed an undertaking on April 29, 2023, to drop all proceedings against them, their authorised person Kamlesh Shah, and Brijesh Shah.

The arbitrator made it binding, ordering payment by June 9, 2023, with 15% interest if delayed. The award also criticised BP’s no-notice freezing policy as anti-investor and urged NSE action.

Lessons for Investors

One should always check a company’s basics, like defaults, before buying on tips. Record all advice chats and insist on email trails, as verbal pushes lack proof.

Read broker policies upfront, especially on account freezes, and complain to exchanges like NSE if they misuse them. Start small and ignore “hot tips” from relationship managers chasing commissions.

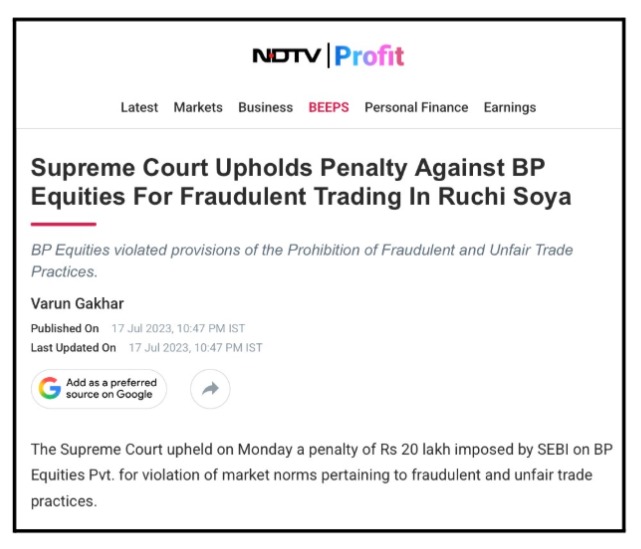

BP Equities in the News

BP Equities was trading in the shares of Ruchi Soya after the company had gone through insolvency, and very few shares were actually available for trading in the market.

The broker placed very large buy orders, often without enough margin money, and then cancelled most of those orders within seconds, which created a false impression of heavy demand and high trading volume for the share.

SEBI said this was not genuine trading but a misleading activity that could fool ordinary investors who see such fake volume on the screen.

Penalty imposed

SEBI treated this as a fraudulent and unfair trade practice and imposed a penalty of Rs 20 lakh on BP Equities in 2021. BP Equities challenged this, but the Supreme Court refused to interfere and upheld SEBI’s Rs 20 lakh penalty, so the fine stayed as it is.

However, the regulatory violations and user complaints paint a picture of a firm that bends rules or tolerates poor service quality as both red flags for cautious investors.

How to File a Complaint in Such Cases?

If you have been a victim of Dinesh Mange or any other research analyst, you can take the following steps to get your money back;

- Document Everything

Keep detailed records of all research tips, the dates they were published, the entry and exit prices you followed, and the eventual profit or loss. Save screenshots of app behaviour, error messages, and support requests.

Record the dates you requested refunds or complained about charges.

- Verify Independently

Never blindly follow any analyst’s recommendation, including Dinesh Mange’s. Cross-check stock picks against independent financial analysis, company fundamentals, and your own risk tolerance.

Read financial statements, check SEBI disclosures, and understand why a stock is recommended before investing.

- Report Issues Quickly

If the Stoxbox app fails to execute a trade, charges you unexpectedly, or causes financial loss, document it and contact BP Equities’ support within 24 hours.

Request a written response. Keep copies of every email exchange.

- File Formal Complaints

If the company doesn’t resolve your issue within 30 days, file a formal complaint with the NSE or BSE (depending on where the issue occurred) through their official grievance portals.

These complaints create an official record.

If the exchange doesn’t help, complain to SEBI’s SCORES platform. This brings in the regulator and signals the issue to the authorities monitoring the broker.

- Seek Legal Help

For losses exceeding ₹1 lakh, consider consulting a lawyer specialising in securities law.

They can guide you on arbitration, civil suits, or claims under investor protection schemes.

Need help?

If you feel burdened by the heavy process of complaining about the stockbroker, you can register with us. Our team will help you get your money back.

We have been successful in fighting 500+ arbitration cases till now.

Conclusion

Dinesh Mange is a SEBI-registered research analyst working for BP Equities Private Limited, bringing apparent legitimacy and credentials to his role.

However, his firm’s history of regulatory penalties for market manipulation, persistent user complaints about the Stoxbox app, and technical service failures paint a cautionary picture.

While SEBI registration is a real credential, it isn’t a guarantee of honesty or successful predictions. The penalties show that BP Equities’ clients have tested ethical boundaries, and as Compliance Officer, Dinesh Mange’s effectiveness in preventing such behaviour is questionable.

The real takeaway is this: if you follow Dinesh Mange’s research, do so with extreme caution. Verify everything independently.

Question unusual recommendations that seem aimed at inflating volumes rather than identifying genuine value.