While you are scrolling through your phone, a message appears: “Instant cash loan! Get money in minutes!”

Doesn’t it sound great?

Such a thing is promised by Cash Advance Loan Apps, which are basically mobile apps that offer you a quick, short-term loan usually against your next pay.

To a large number of people, these seem to be a saving tool in the situation of an unexpected expense.

Cash Advance Loan App Review

However, here is the truth that does not want to go away: these apps are not only different in terms of quality, but there is a possibility that some of them are nothing but internet loan scam programs.

You want money quickly, right?

So, you must be aware of how to distinguish a trustworthy company from a harmful one.

Is Cash Advance Loan App Real Or Fake?

Fake loan apps harm users by employing aggressive, non-transparent, and, in most cases, illegal methods.

They are very good at tricking you:

- Extremely High Repayments and Secret Charges: The scammers promise you a small, simple loan to attract you. After you agree, they impose very high and secret interest rates, and also some hidden charges.

- The Data Theft Trap: A lot of fake apps are very demanding with the permissions they require, and also, they are unnecessary, as they need access to your contacts, photos, and messages. This is the part where they trick you!

- Blackmail and Harassment: This is the method that is most terrible of all. The moment a payment is missed, the perpetrators will take the personal information they have obtained, such as your contacts, and will continually harass you and try to publicly humiliate you.

Is a Cash Advance Loan App Safe?

Let’s be honest, the Cash Advance Loan app is not safe.

The safe ones usually work with licensed banks or RBI-registered NBFCs.

They clearly tell you:

- how much you’re borrowing,

- what you’ll pay back,

- and when it’s due.

These apps follow financial rules, so even if they charge high fees, they’re at least operating legally.

The unsafe ones are a different story. Apps like Cash Advance pop up on app stores or through ads and promise instant money with no paperwork.

What they don’t tell you is that they may not be registered with any financial authority. That means if something goes wrong, there’s no real protection for you.

Many of these risky apps also ask for strange permissions, like access to your contacts, photos, or messages.

A genuine loan app doesn’t need all that. When an app asks for it, it’s often because they plan to use that data later to pressure or threaten you if you don’t pay on time.

And even with legal apps, there’s another danger: the debt trap. Because such loans are short-term, people end up borrowing again just to pay off the first loan.

Before they realize it, they’re stuck paying fees every payday.

So before you install and input your details, check whether the Cash Advance Loan app is regulated and RBI-approved.

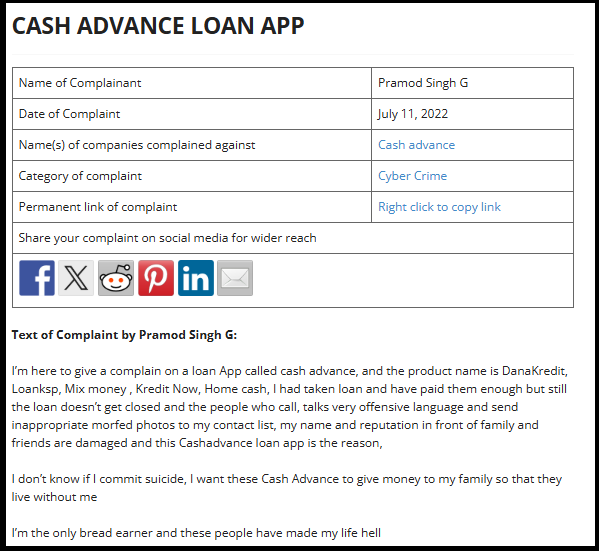

Cash Advance Loan App Complaints

If you look at user reviews and online forums, one thing becomes very clear: people complain about these apps a lot.

One of the most common complaints is hidden charges. Someone thinks they’re borrowing ₹5,000, but when payday comes, they owe far more because of processing fees, service charges, or “tips” that were never clearly explained.

Another big problem is apps that collect data but don’t deliver the loan. Some people install an app, upload their documents, and give permissions, only to never receive any money. After that, they’re stuck getting spam calls and messages.

The most frightening complaints come from victims of the Cash Advance Loan App. When they miss a payment, sometimes even by one day, they start getting abusive calls, threats, and messages.

In extreme cases, scammers contact friends and family from the victim’s phonebook to shame them into paying. This happens because those apps already have access to the user’s contacts.

There are also complaints about no customer support. When something goes wrong, users can’t reach a real human. Emails go unanswered.

Chats are automated. And refunds or corrections never happen.

Even some well-known apps face complaints for misleading users about fees or making it difficult to understand what a loan really costs.

Below is one such reported complaint where the victim mentioned that even after repayment, the loan is still reflected in the app.

How to Report Loan Frauds in India?

If a fake instant loan app is used to target you, please do not lose your cool. Instead of that, you should respond quickly.

Here are some things you can do to assist the police in stopping the fraud and to secure your own safety:

- Contact Your Bank: It is very important that you inform your bank about the fraudulent activity straight away and ask them to block or freeze any unauthorised transactions.

- File a Cyber Crime Complaint: This is the most important step of all. In India, you can file your complaint through the National Cyber Crime Reporting Portal, or you can call the national cyber fraud helpline number.

- Inform the App Store: Notify the app about the Google Play Store or Apple App Store so that they can remove it.

- Preserve Evidence: Keep records of the conversations by taking screenshots; also, keep the app details and any transaction records safe and secure.

- RBI Sachet Portal: This portal is specifically for reporting fraudulent and unauthorised lending entities.

Need Help?

If you’ve been targeted by such loan app scams, don’t worry; you’re not alone.

Register with us to get guidance on how to file a complaint against online loan app and recover your losses.

Our team has helped thousands of victims recover their lost money.

Conclusion

If you need to avail of a real cash advance app for just a short period of time, it may still work as a lifeline. However, the industry is heavily infiltrated by illegitimate players.

So, it is better to always be safe by using only those apps that have the backing of a licensed bank or NBFC (Non-Banking Financial Companies) and are regulated by financial authorities like the RBI in India.

Do not install a program that asks for too many permissions or in which you are requested to pay a fee for the processing of the transaction in advance.

Are you sure you want to leave your financial safety to chance?