Apps that promise quick cash are everywhere in the digital world of today. Maybe you heard of such an app called Cash Guru.

Before downloading, it is essential to note that search results may indicate multiple apps with the same name.

One version is a “play & earn money” app where you complete tasks to receive virtual rewards that can be exchanged for real money.

Cash Guru App Review

The term “Cash Guru app” is most commonly referred to as a generic term or a brand name for a type of fraudulent and unregulated digital lending platform that uses misleading tactics.

These platforms look real and offer instant loans with minimal paperwork, promising to attract people who are in desperate need of quick money.

Usually, these platforms are not registered with any financial regulator (such as the RBI in India) and are not associated with a licensed Non-Banking Financial Company (NBFC).

Cash Guru App Real or Fake

The app is not available on the Google Play Store, which itself is a major warning sign.

Instead, there is another app with a similar name listed on the Play Store, but it is a gaming app and not a lending platform.

This tactic of using similar or misleading names is commonly used by fraudulent loan apps to confuse users and avoid detection.

Since Google Play applies basic security checks and policy enforcement, apps that operate outside the Play Store often bypass these safeguards.

As a result, such apps pose a significantly higher risk of data misuse, financial fraud, and harassment, making this a serious red flag for users.

Is Cash Guru App Safe?

The scam is a vile, multi-stage operation:

- Exorbitant Fees & Short Tenures: Initially, they lend you a small amount (e.g., ₹5,000), but very quickly they deduct a huge “processing fee” & GST, i.e., the amount you get is much less than the one lent to you. The most important thing is that the loan term, which is being advertised (for instance, 90 days), is actually a repayment period of 7 or 14 days.

- Demanding Excessive Permissions: The application wants to have access to the most private parts of your life: your contact list, photo gallery, camera, and messages. This is the main weapon of their harassment strategy.

- Blackmail and Harassment: If you do not meet the impossible deadline, even if it is by a few hours, this is when the terror starts. They utilise the personal information that they have obtained illegally.

Cash Guru Loan App Complaints

- Victims say that they receive threatening calls and messages.

- They make a fake “Defaulter” message with the borrower’s photo and name, which they send to everyone on the contact list, i.e., family, friends, and colleagues, to publicly shame the borrower and to blackmail the borrower into paying many times the original loan amount.

- There have been cases where the continuous persecution, which is most unfortunate, has driven the victims to commit suicide.

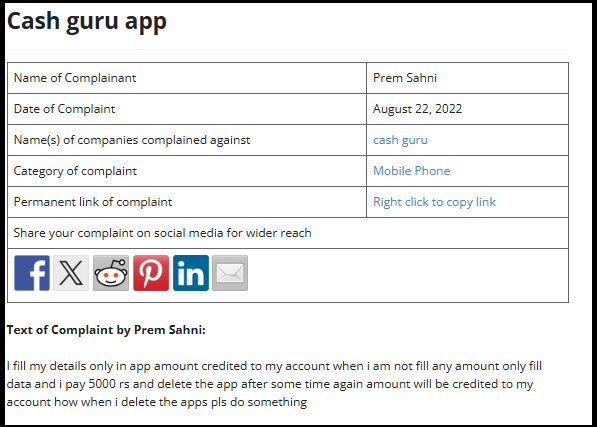

- Here is another serious complaint where the complainant stated that he only entered his personal details in the Cash Guru app and did not apply for or consent to any loan. Despite this, an amount was credited to his bank account without his approval.

He further stated that he paid ₹5,000 and deleted the app. However, after some time, another amount was again credited to his bank account without his consent.

The complainant expressed concern about how funds were repeatedly credited even after deleting the app and requested the concerned authorities to take necessary action and resolve the issue.

How to Report Loan Frauds in India?

If you have been a victim of such loan app scams, you must react immediately.

Follow these steps to file a complaint against online loan app:

- File a cyber crime complaint: The most straightforward method to report an online financial fraud is through the government’s portal or by dialling the helpline number.

- National Consumer Helpline: You may submit a complaint to the National Consumer Helpline (NCH) by either visiting the website or calling their toll-free number.

- RBI Sachet Portal: In case you have a complaint about financial institutions that also include an unregulated loan app, you may lodge it with the RBI Sachet portal. This platform facilitates the transfer of your complaint to the correct authority.

Need Help?

Register with us, keep your evidence ready, and get expert guidance to navigate the process.

You don’t have to face it alone. We have already helped people to face the situation

Conclusion

Instant money apps should be handled with care at all times. Ensure the app is RBI registered and confirm via reviews that it is not a scam.

The ease of getting an instant loan should not be a reason to end up in a debt trap and get harassed.

If you feel that a situation is not right, then the safest step is to stay away from that app and use the proper channels to report and safeguard both yourself and other people from fraud.