When you’re short on cash and bills are piling up, instant loan apps can feel like a lifesaver. Apps like Cash Samosa promise quick money, minimal paperwork, and fast approvals, exactly what someone in urgent need wants to hear.

But here’s the truth: many of these “instant loan” apps are far from safe.

In fact, Cash Samosa is often mentioned alongside other fraudulent digital lending apps that trap users in cycles of harassment, illegal recovery tactics, and extreme mental stress.

So, is Cash Samosa really helpful, or is it a risk you should avoid?

Let’s break it down.

Cash Samosa Loan App Review

Cash Samosa presents itself as a short-term loan app offering quick cash with easy approval.

However, apps like this usually operate without transparency, proper disclosures, or verifiable ties to a registered bank or RBI-approved NBFC.

Most users report that these apps:

- Offer very small loan amounts.

- Hide actual interest rates behind “processing” or “service” fees.

- Push users into extremely short repayment cycles.

These characteristics are commonly seen in illegal and unregulated loan apps operating in India.

Is Cash Samosa App Real or Fake?

Cash Samosa is not associated with any clearly identifiable RBI-registered bank or NBFC.

Legitimate lenders in India are required to follow strict RBI guidelines, including transparent interest rates, clear grievance mechanisms, and ethical recovery practices.

Apps like Cash Samosa often:

- Avoid mentioning their legal entity clearly.

- Do not disclose RBI registration details.

- Operate under changing app names and servers.

This strongly indicates that Cash Samosa is a fake or unverified loan app, not a genuine financial service provider.

Is Cash Samosa App Safe?

In short, no.

The biggest risk comes from the permissions these apps demand. Upon installation, users are often forced to allow access to:

- Contacts

- Photo gallery

- Messages

- Storage and call logs

This data is later misused for harassment and blackmail if repayment is delayed, even by a few hours.

These apps are known for:

- Abusive and threatening calls

- Shaming messages sent to contacts

- Edited photos are used to humiliate borrowers

- Daily harassment even after partial or full repayment

Cash Samosa App Complaints

Several users have reported disturbing experiences, including:

- Loans are being shown as “due” even when no money was credited.

- Threats to send morphed photos to family and friends.

- Harassment continued even after the loan was repaid.

- Repeated calls demanding extra charges and penalties.

Here are some of the complaints reported on the consumer forum:

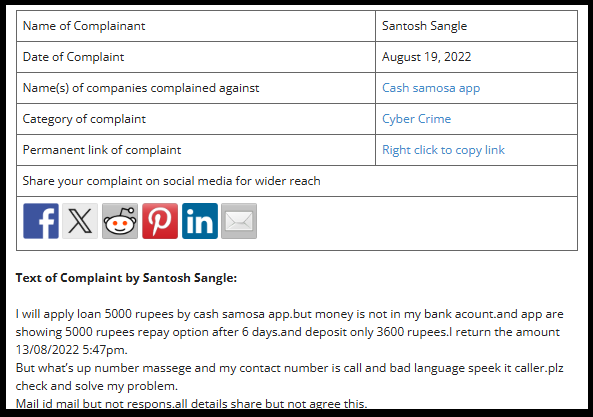

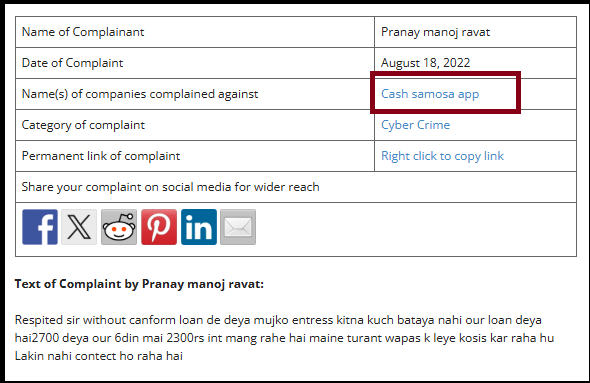

1. Loan Disbursement and Repayment Issue

The complainant stated that he applied for a loan of ₹5,000 through the Cash Samosa app.

However, the full amount was not credited to his bank account, and only ₹3,600 was deposited.

Despite this, the app showed a repayment obligation of ₹5,000 within six days. The complainant stated that he repaid the credited amount on August 19, 2022.

2. Harassment and Lack of Response

The complainant further stated that even after repayment, he continued to receive repeated calls and messages from unknown numbers, during which abusive and threatening language was used.

He also mentioned that he contacted the app’s support team via email and shared all necessary details, but did not receive any response or resolution.

These complaints follow a pattern seen across many illegal instant loan apps operating in India.

How to Complaint Against Online Loan App?

If you have been a victim of such loan app scams, acting fast is crucial.

Here are the steps to report loan frauds in India:

- File a Cyber Crime Complaint: Report the incident on the National Cyber Crime Reporting Portal or call the national cybercrime helpline.

- Inform Your Bank: Notify your bank about any unauthorized transactions or suspicious activity.

- File an FIR: Visit your local police station or cyber cell and register an FIR.

- Report to RBI Sachet Portal: Lodge a complaint against the unauthorized lending app on the RBI’s Sachet portal.

Need Help?

If you are a victim of loan app harassment or digital lending fraud, you don’t have to deal with it alone.

Register with us today, and we’ll guide you through the complaint process and help you take the right steps toward recovery and peace of mind.

Conclusion

Instant loan apps that offer money without proper verification are often a trap. A small cash need should never cost you your mental peace, privacy, or dignity.

Before installing any loan app, always verify whether the lender is RBI-registered and transparent about its terms. Taking a few minutes to check can save you from months of harassment and financial stress.

Stay alert. Think smart. And always verify before you tap “Install.”