When users search for Centrum Broking Limited reviews, they are not just looking for star ratings or marketing claims. They are trying to answer a much deeper question: “If they should trust this broker with their hard–earned money, what are the real risks they are walking into?”

Most investors open an account because a relationship manager sounds convincing, a friend recommends the name, or the brand looks old and established.

Very few people actually stop and ask, “What do complaints, SEBI actions, arbitration records and real user feedback really say about this broker?”

If you have ever felt confused by mixed opinions like “service is good, but something feels off” or “old brand, so it must be safe”, this breakdown will help you cut through that noise.

That is exactly what this blog will help you do, slowly and clearly, without hype and without blind defence of any platform.

Think of this blog as a guided review rather than a quick opinion.

Centrum Broking Limited Details

Centrum Broking Limited is a full–service stockbroker that operates under the larger Centrum Group. It has been active in Indian financial services since the 1990s.

It offers equity and derivatives trading, depository services through CDSL, and also works closely with high-net-worth and institutional clients as part of a broader wealth and investment platform.

The broker is registered with major Indian exchanges such as NSE and BSE and is regulated by SEBI, which means it must follow strict rules on client money, reporting and grievance handling.

It has a client base of 3106 clients.

Public disclosures and rating reports show that Centrum focuses more on advisory and relationship–driven broking rather than pure discount trading.

So, its active client base is smaller compared to mass retail platforms, but ticket sizes and service expectations tend to be higher.

Centrum Broking Limited Complaints

The reviews are not just about star ratings. They tell you where things go wrong, how the broker reacts when they do, and whether regulators have to step in.

So let us go through Centrum Broking Limited reviews.

The first place to look for complaints is official exchange data, because those are tracked and monitored, not just casually posted on social media.

Centrum Broking Limited shows a relatively small number of complaints compared to the size of its active client base.

From an investor’s perspective, the low complaint ratio does not mean problems never happen.

It simply suggests that reported issues are fewer and, in many cases, get addressed without long–drawn escalation.

Once you have crossed the formal data, user feedback helps you understand the day–to–day reality: “Is the relationship manager responsive, are payout delays common, and how is the platform experience for normal clients?”

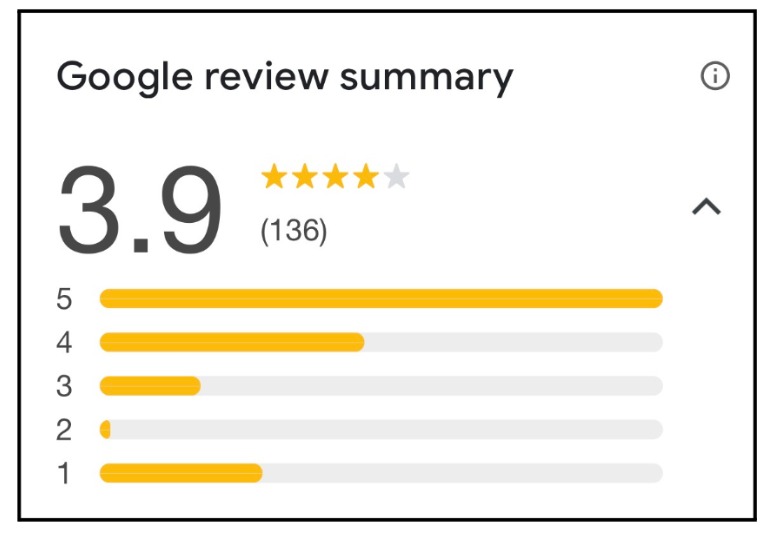

So, to check credibility, if you check Google reviews, you will find reviews showing anger of users regarding slow, unreliable service and poor customer support.

Main issues people faced are associated with broken promises from customer care (like “it will be done by the end of the day”) that never turned into real action, which destroyed trust and made people say they would never recommend the company again.

Independent broker‑complaint sites also show a pattern of service‑quality and grievance‑handling issues around the brand, which matches the tone of these Google reviews.

Centrum Broking Limited SEBI Order

The next important layer is SEBI action, because this shows where the regulator has found violations serious enough to pass a formal order.

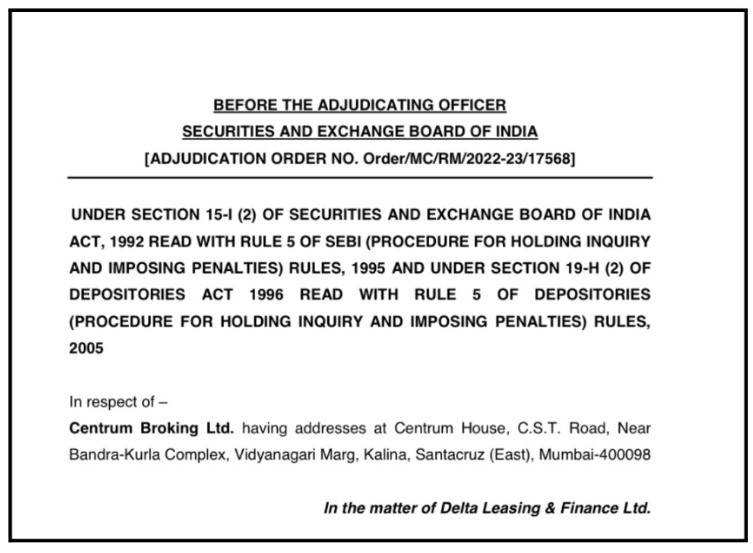

In the case of Centrum Broking Limited, SEBI has passed one adjudication order in 2022 in connection with dealings in the scrip of Delta Leasing and Finance Limited, where certain lapses and non–non-compliance were observed.

In this order, SEBI found that there was no violation done from the broker’s side as they provided relevant proofs.

No monetary penalty was levied on Centrum Broking Ltd., with the order disposed of on June 30, 2022.

It shows that while compliance gaps were found and penalised, SEBI did not treat Centrum as an unfit or banned intermediary at that time.

For an investor, this kind of SEBI action acts as a yellow light rather than a red one. It tells you that the broker has had issues that were serious enough to attract penalties, so you should be more careful, read their risk disclosures, and keep an eye on any future orders.

But it does not automatically classify them as a fraud platform.

Centrum Broking Arbitrations

After complaints and SEBI orders, the next checkpoint is arbitration, where unresolved disputes between clients and brokers are decided by exchange–appointed arbitrators.

Frequent or large arbitration awards against a broker can be a red flag because they show that problems were not solved through normal channels and that the decision often went in favour of the investor.

Centrum does not appear as a broker with a long list of arbitration cases. In several financial years, the data either shows no arbitration cases or very small numbers, and many matters are marked as resolved before or without arbitration.

This does not mean arbitration never happens. It simply means that compared to some high–dispute brokers, Centrum has not built a public track record of large numbers of arbitration awards against it.

For a cautious investor, this is a mildly positive sign, but it should always be combined with complaints, SEBI orders and real user experiences before you decide.

What Does it Mean for an Investor?

So, what should an average investor conclude from all this?

First, the combination of low complaint counts, few visible arbitration cases and the absence of any recent ban–type SEBI order suggests that Centrum is not operating like a typical fly–by–night scam broker. It is a regulated, full–service player with some past compliance issues that have been penalised.

Second, the relatively small and niche client base means that the overall visibility of problems is lower. A discount broker with lakhs of clients will naturally show many more reviews and complaints than a firm that focuses on HNIs and relationship–driven accounts, even if the underlying quality is similar.

Third, these reviews tell investors to always read real customer feedback and check how fast the company actually delivers forex or activates cards before giving them money.

For you as an investor, this means you should not blindly assume “no news is good news”. Instead, you should read the SEBI orders and scan reviews and then decide whether you are comfortable with their style of operations, fee structure and service model.

In simple words, Centrum may be acceptable for investors who like full–service broking and personalised attention and are willing to monitor their accounts actively.

It may not be the best first choice for a complete beginner who wants extreme transparency on pricing and a fully self–service experience.

How To Register a Centrum Broking Complaint?

Centrum Broking Limited offers trading and investment services in India. If you have a dispute with them and don’t know how to move ahead, you can register with us, and we’ll walk with you through the whole complaint journey.

1. Collecting and arranging documents

We help you list and arrange all the proof you have. This includes trade reports, ledgers, contract notes, call recordings, emails, WhatsApp chats, and screenshots, so your complaint rests on solid evidence.

2. Writing a clear complaint

We draft easy‑to‑understand complaints in your name. The format is tailored to what NSE, BSE, SEBI SCORES, and SMART ODR usually expect, so your complaint is clear and less likely to face issues because of poor drafting.

3. Filing on official platforms

We guide you step by step while you submit the complaint on SCORES, SMART ODR, or the exchange portals. You know what to select, what to upload, and what to write in each box, which helps avoid delays and rejections.

4. Escalation when things don’t move

If the broker does not resolve the issue, we will help you move it to the next level. This can mean going to the exchange or preparing for the next stage of the process in the right way.

5. Ongoing case support

After registration, we track the progress of your case with you. We remind you of timelines and help you draft replies whenever the broker, exchange, or regulator asks for more details.

6. Support in counselling or arbitration

If your matter reaches counselling or arbitration, we help you prepare. We assist you in putting your side in simple language and keeping your documents ready, so you feel confident.

When you register with us, you don’t have to struggle with rules, formats, or portals on your own. You focus on getting your money and your peace of mind back, while we handle the technical and procedural heavy lifting.

Conclusion

When you put everything together, the picture that emerges from Centrum Broking Limited reviews is that of a regulated, full–service broker with a modest number of official complaints.

This suggests that Centrum is not an obvious scam operation, but it is also not a “perfect” broker that you can trust blindly without reading the fine print or tracking your own trades.

For you as an investor, the safest approach is to treat every broker as a potential risk point, no matter how big or reputable they appear.

Verify registrations, monitor complaints and SEBI actions, document all communication, and be ready to escalate to SCORES, exchanges and arbitration if required.

If you do that consistently, you will be in a much stronger position, whether you choose Centrum or decide to go with some other platform that better fits your trading style and risk comfort.