You’ve probably seen them: eye-catching reels and flashy ads promising “win in 60 seconds,” “secret color trading hack,” or “double your money fast.”

On the surface, it feels intuitive: predict red or green, place a bet, collect easy money. But let’s step back and unpack what a color trading hack really is and why so many people get burned chasing it.

At its core, a color trading hack refers to any strategy or formula shared online that claims to consistently predict the outcome of color-based prediction games.

These hacks are widely circulated on Telegram, Instagram, YouTube, and even paid groups that promise “insider secrets” or a big small prediction hack AI to beat the system.

Here’s the catch: many of these platforms aren’t trading apps at all. They aren’t regulated, they don’t represent real financial markets, and there’s no evidence that any published hack works reliably.

Instead, they function more like high-speed betting games or unregulated gambling, wrapped in familiar financial terminology to make them seem legitimate.

So, before you follow any hack or trick blindly, consider whether Color Trading is real or fake.

Is a Color Trading Safe?

Reliability is where most claims around color trading hacks begin to weaken.

Color trading apps typically operate on automated systems or algorithms that generate outcomes at fixed intervals. From a user’s perspective, the result may look predictable after a few rounds, but short-term patterns do not necessarily indicate long-term control or accuracy.

Human psychology also plays a role. When outcomes repeat or alternate, the brain naturally tries to assign meaning and logic to them. This can create the impression that a hack is “working,” even when results are driven by chance.

Another important factor is content presentation. Many hack videos are recorded using demo accounts or staged environments where losses are excluded. What viewers see is not a full trading history but a carefully edited highlight.

This doesn’t mean every person sharing a hack is intentionally misleading. Some genuinely believe they have found a working method based on personal experience.

However, belief and consistency are not the same as reliability. So colour trading a scam or not?

Color Trading Scam

Multiple scam review sites and analysts note that color trading apps:

- Are often not listed on official app stores.

- Show small initial wins to hook app users.

- Block or delay withdrawals, sometimes demanding extra fees, “activation charges,” or “security deposits” before letting users withdraw anything, and then disappear without paying.

Even outside color, the underlying playbook, showing fake profits, asking for more money, and then blocking withdrawals, shows up again and again in other recent scams.

For example, multiple news reports describe online trading frauds where victims lose crores after being lured in through social media and fake apps.

Color Trading Scam Complaints

Experienced people in this space, whether cybersecurity researchers or cyber police, point out a few structural reasons:

- Manipulated outcomes: Many color prediction systems don’t use fair randomization, meaning the odds aren’t what they seem.

- Unregulated nature: These platforms aren’t recognised by financial regulators (like SEBI or RBI in India), so there’s no oversight.

- Psychological hooks: Quick rounds, small early wins, and social proof (screenshots of big wins) make users think they’re getting close to unlocking a “hack” or secret system, even when the numbers don’t add up long term.

- Withdrawal barriers: Once users try to take money out, the roadblocks begin — extra charges, forced deposits, frozen accounts, or disappearing customer support.

We have been tracking reports and complaints from users and authorities, and unfortunately, the trends are consistent:

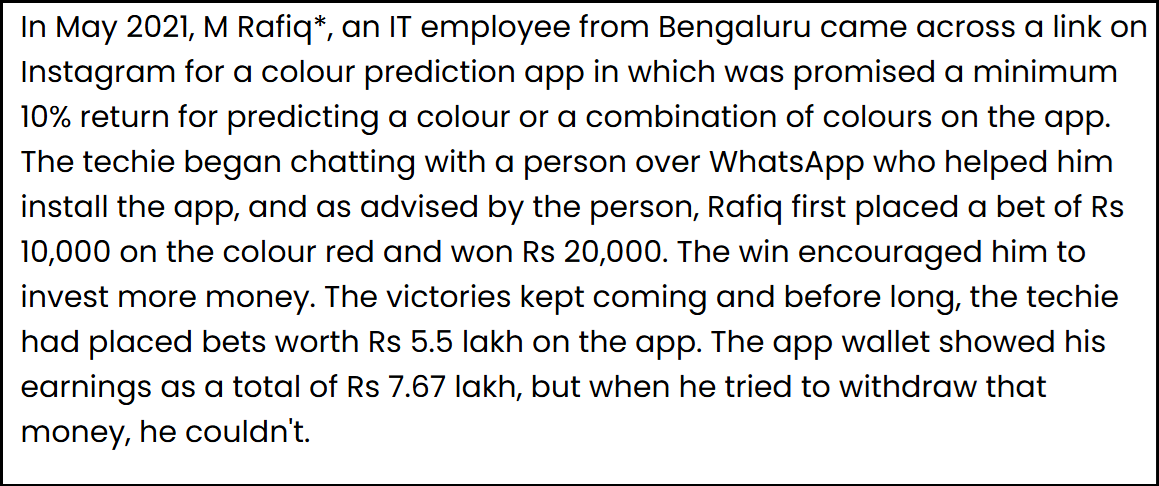

1. Bengaluru IT Worker Lost ₹5.5 Lakh

Rafiq’s story is a textbook example of how these schemes hook you with small wins and then slowly draw you deeper. He clicked on an Instagram link promising easy money and was guided by someone on WhatsApp to install a colour trading app.

What started with a small ₹10,000 bet, which the app showed doubling to ₹20,000, encouraged him to invest more. Over the next few weeks, Rafiq deposited a total of ₹5.5 lakh, watching the app’s digital wallet show a balance of ₹7.67 lakh.

Then things went sideways: when he tried to withdraw his money, the app demanded an extra ₹50,000 “security deposit” first. Rafiq paid it — and the scammers disappeared. The app balance vanished, and his money was gone. He filed a complaint with Bengaluru police, but the case has seen little progress so far.

📉 Broader Scam Rings and Massive Operations

This one isn’t about a single person; it’s about scale. In 2020, police in Hyderabad uncovered a massive ₹1,600 crore operation tied to color prediction apps.

The syndicate involved both Indian and foreign nationals, with money allegedly being routed overseas. Authorities arrested multiple people for their roles in running these platforms and laundering funds.

Should You Follow Color Trading Tricks?

Now, when it comes to following these hacks and predictions, here is what you need to consider:

- Color trading is not the same as regulated financial trading.

- Many apps operate like betting games, not investments.

- If something looks too easy, it probably isn’t what it appears to be.

- Losses can be significant, and recovery is hard without solid evidence and legal support.

And even beyond money lost, there’s another serious concern: these apps often ask for personal details or bank/UPI information, creating data privacy and identity risks that many people don’t realise until it’s too late.

How to Report Color Trading Scams?

If you’ve lost money to a color trading app or a so-called color trading hack, the most important thing is not to panic and not to delay. Many people hesitate because they feel embarrassed or assume nothing can be done. That delay often makes recovery harder.

Here’s what actually helps.

- Step 1: Inform Your Bank or UPI App Immediately

- Step 2: File a Complaint in Cyber Crime

- Step 3: Lodge an FIR in the local Police Station

Need Help?

Recovering money from unregulated color trading apps is difficult, but it’s not always impossible, especially when the case is documented properly.

Many victims struggle not because they did something wrong, but because:

- Complaints are poorly drafted

- Key details are missing

- Banks or authorities don’t receive the full picture

If you’ve been scammed through a color trading hack or prediction app and need guidance with proper drafting, documentation, or navigating the reporting process, we’re here to help.

Register with us for assistance and support.

Sometimes, the first step toward recovery is simply having someone help you take the right next step.

Conclusion

After years of watching scams evolve online, one thing becomes clear: schemes that promise quick, guaranteed profits with little effort are almost always trying to leverage psychology, not legitimate economic value.

Color trading hacks sound smart and simple, but in many cases, they’re just a colorful illusion of control. Treat them with skepticism, and always prioritise safety, regulation, and transparent financial tools over the lure of instant cash.