As the demand for loans increases, the emergence of loan apps has also increased. These applications promise easy loans and charge lower rates of interest.

If you encounter such an application, you would definitely want to use it because it seems promising. One search app that has emerged is the Dhana Dhan Loan App, offering instant approvals.

But before you click Install or share bank/KYC details, you need to be aware of many things.

The most important of all is safety. Here’s a clear, practical guide to help you decide whether Dhana Dhan is safe or a scam.

What is Dhana Dhan App?

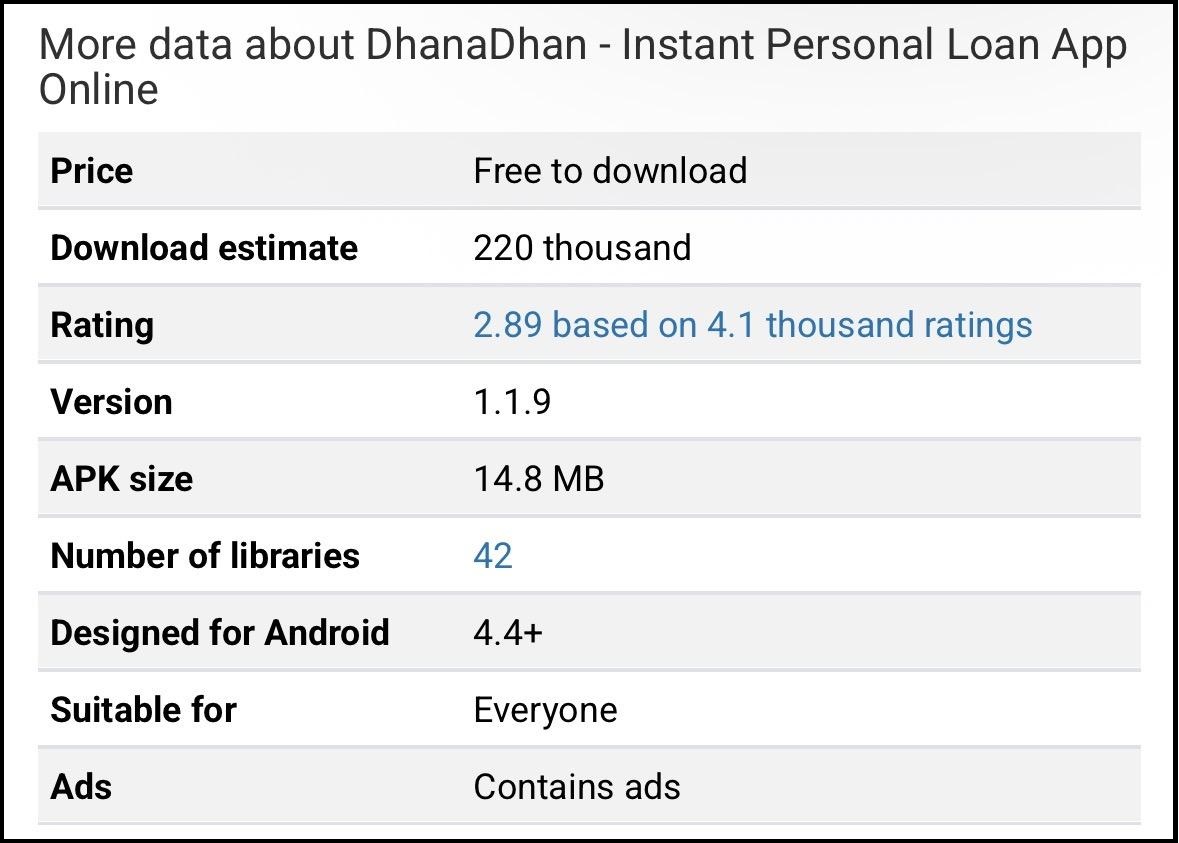

Dhana Dhan loan app is one of several instant mobile loan applications. The app was launched in 2020.

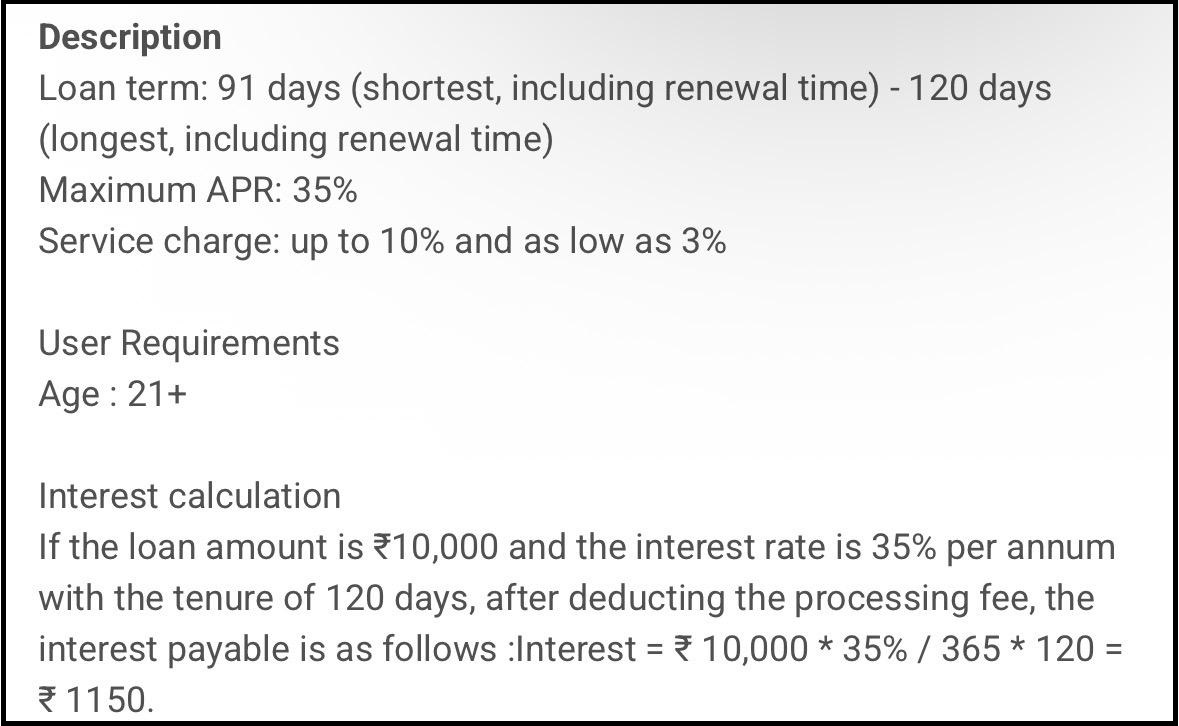

This app is designed to provide very quick, often small, loans directly to your bank account with minimal paperwork. It offers short-term loans ranging from ₹5,000 to ₹20,000.

The app promotes itself as user-friendly, with simple document submission, fast verification, and a high approval rate.

According to its description, Dhana Dhan focuses on low-service charges, unsecured personal loans, which means you don’t need to provide any collateral.

It also highlights having a “professional and experienced team” that aims to understand users’ financial needs and serve them efficiently.

Overall, it presents itself as a convenient option for people looking for quick credit through their phones.

But is this 100% correct?

Is the Dhana Dhan Loan App Real or Fake?

Short answer: Highly suspicious and fake

Wondering on what basis we are making this statement.

There are not one but multiple reasons behind this. Let s open it one by one.

Dhana Dhan Loan App is popular across social media and chat groups, claiming itself as a fast and easy way to get instant personal loans.

It might seem convenient for the users as it promises quick, instant loans without the need for collateral, but behind that polished look lies a series of red flags that prove this app is fraudulent and unsafe.

Before you fall into any trap, have a look at the point given below;

1. The App Operates Without Any Legal Authorization

It is mandatory for every digital loan app in India to be linked with a licensed bank or registered non-banking financial company (NBFC) approved by the Reserve Bank of India (RBI).

Dhana Dhan has no evidence of such registration or partnership.

It does not have any verified NBFC name, company address, GST number, or regulatory disclosure anywhere on the app or its pages. That makes it unauthorized and illegal to offer financial loans in India.

2. Fake Loan Offers and Hidden Traps

Offers such as “instant approval,” “no paperwork,” and “loan within 5 minutes” lure the users to check out the app.

After downloading the app, borrowers are often asked to pay a small processing fee or upgrade to a VIP plan to get their loan approved.

Once the payment is made, your loan never arrives!

Others receive tiny disbursals at first, followed by huge hidden charges and sky-high interest deductions.

3. Repeated Removal by Authorities

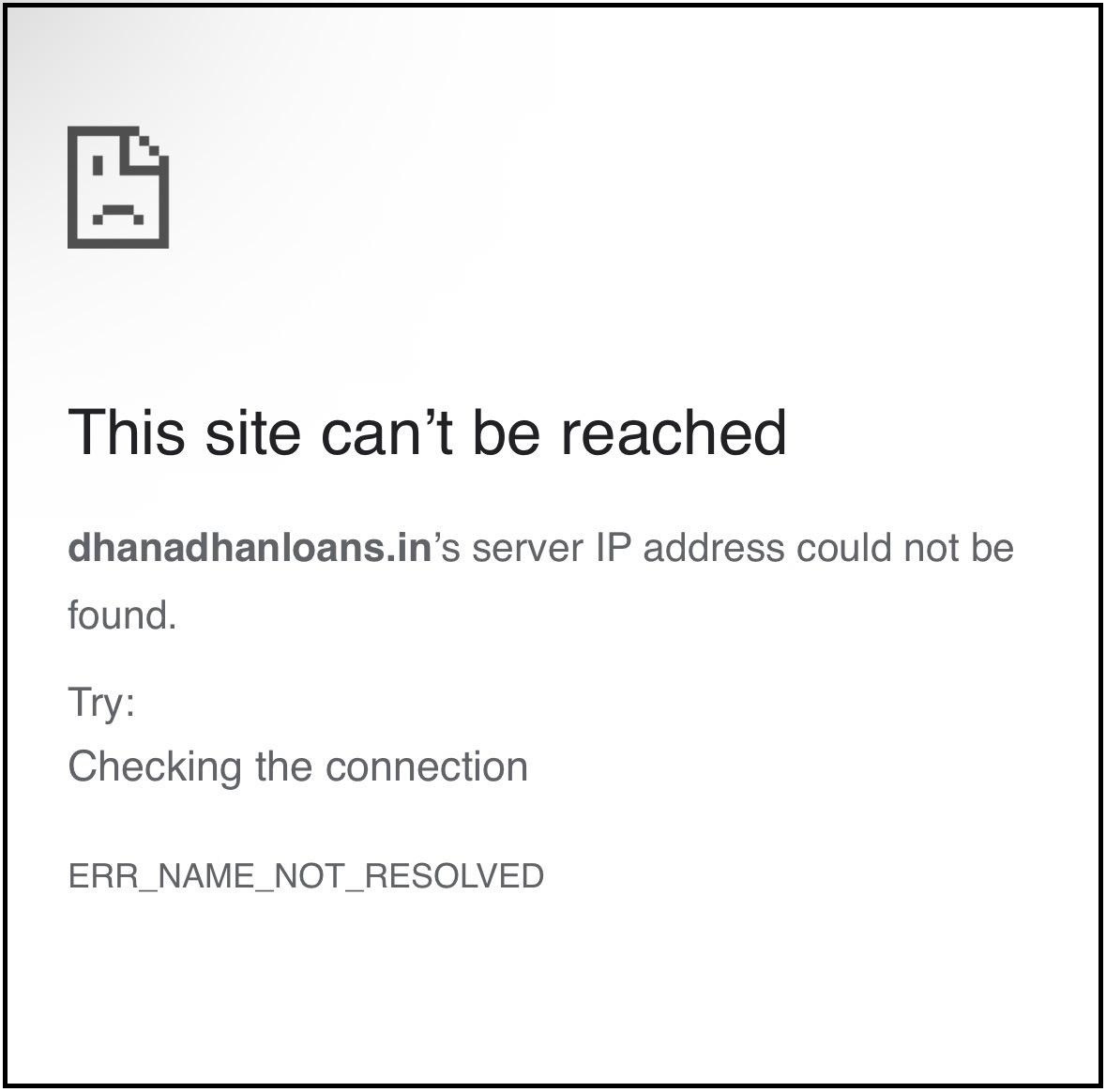

The app was launched in early 2020 and was unpublished from the Google Play Store on 9 December 2020.

This was done due to several consumer complaints and a cyber cell investigation that linked this app as a part of illegal digital lending rackets.

Despite this, it often reappears with different names or APK download links that are circulated on Telegram or on WhatsApp.

Thus, it must be noted that a legitimate financial app always operates through its official app store and company website.

Matches the Pattern of a Classic Digital Loan Scam

Dhana Dhan follows the same pattern seen across those of fraudulent loan apps in India. These include,

- No company verification or registration number

- No official website, and provides apk file to download

- Demands for upfront fees

- Access to personal data without consent

- Threats and blackmail for “repayments.”

- Disappearing customer support once money is paid

These traits match those of digital lending scams that have already caused financial and emotional harm to thousands of people across the country.

Is Dhana Dhan Loan App Safe?

We want you to answer this based on below parameters:

- Offers loans without an RBI-registered partner

- Demands advance payments

- Collects unnecessary data

- Misuses personal data

- Harasses users

- App keeps changing its name or link

- Third-party installation

- Removed from the Play Store

So what do you think?

The app is not legit, collects data, and thus is not safe for use.

Dhana Dhan Loan App Complaints

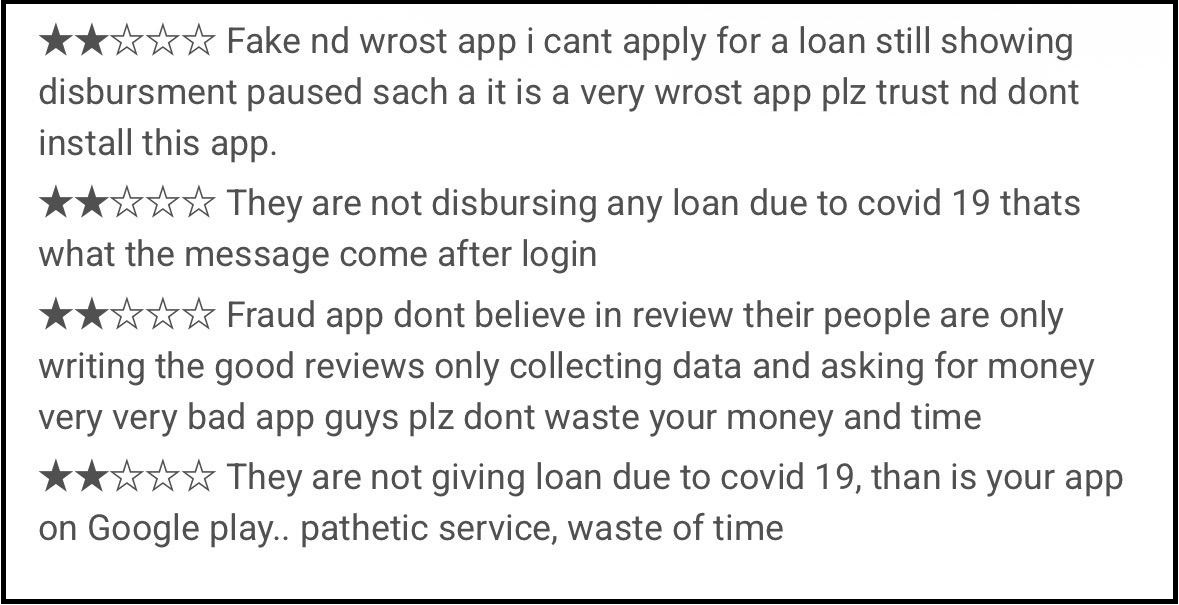

Many users of the Dhana Dhan loan app have reported that once it is installed, the app demands full access to their personal information, such as contact details, photos, and media.

Victims have claimed that they have later faced harassment, calls, and threats from unknown numbers, which pressure them to repay fake loans or service charges.

Such recovery tactics are a hallmark of scam loan apps that may use personal data for extortion.

2.1k users have reported that when they use the app for a loan, it often pops up with messages such as “still showing disbursement paused”, “not disbursing any loan due to COVID-19.” People have warned other users not to fall into the trap of their ratings, as they are often done by their own people, so that they can lure customers to use the app. Negative reviews outweigh the positive ones.

How to Report Loan Frauds in India?

If you have ever come across online loan apps that seem suspicious or turn out to be fraudulent, it’s important to take quick action.

Here are a few steps you can follow to protect yourself and report such fraud effectively:

1. Collect All Evidence

Before you file a complaint, make sure to gather proof of your interaction with the app. You must save,

- Screenshots of chats, calls, or messages from app representatives

- Payment receipts or bank/UPI transaction IDs

- The app’s download link (APK, Telegram, or website link)

- Any harassment messages or phone numbers

The evidence will strengthen your complaint.

2. File a Cyber Crime Complaint

You can file a complaint on the website of the cyber crime department. The steps include:

- Click “File a Complaint”.

- Choose “Report Other Cyber Crime”.

- Log in or sign up with your email/phone.

- Fill in the form with all details, such as app name (Dhana Dhan Loan), how you were scammed, date, and attach screenshots.

- Submit your complaint.

- You’ll receive an acknowledgement number to track your case.

3. Inform Your Bank or UPI Service Provider

In case you’ve made any payments to the app, you must:

- Contact your bank’s fraud department or UPI helpline immediately.

- Ask them to block further transactions or flag the recipient account.

- Share your cyber-complaint number with them.

4. Report to the RBI’s Portal

You can visit the Reserve Bank of India’s official grievance platform for reporting unregistered financial entities or illegal loan apps. The steps for reporting include,

- Go to “File Complaint”.

- Select “Entity Not Registered with RBI”.

- Enter “Dhana Dhan Loan App” as the entity name.

- Describe the fraud briefly and attach supporting documents.

- Submit your complaint.

5. Contact Your Local Police or State Cyber Cell

You can also visit your nearest police station or state cybercrime unit in person. They can file an FIR and coordinate with cyber authorities for investigation. Make sure you provide them,

- All your evidence, such as screenshots and payment details

- Complaint reference from cybercrime.gov.in

- Transaction and harassment details

Need Help?

We understand that it becomes very frustrating when all our hard-earned money just vanishes in seconds. In case you are confused about how to report such loan app scams online, register with us now.

We will guide you with the process and help you in filing your complaint online.

Conclusion

Dhana Dhan is a perfect example of how fraudulent loan apps operate in India.

Their promises such as fast money, instant withdrawals, and no need for collateral might seem luring at first, but it is a scam that comes with hidden costs, data miss, use, and harassment.

If you are unsure about any application, you must read the terms, check the credentials, and protect your data because the risk is not just involved with money. It also involves your privacy and your peace of mind.

So be aware, and don’t get tempted by the luring taglines of money lending apps.