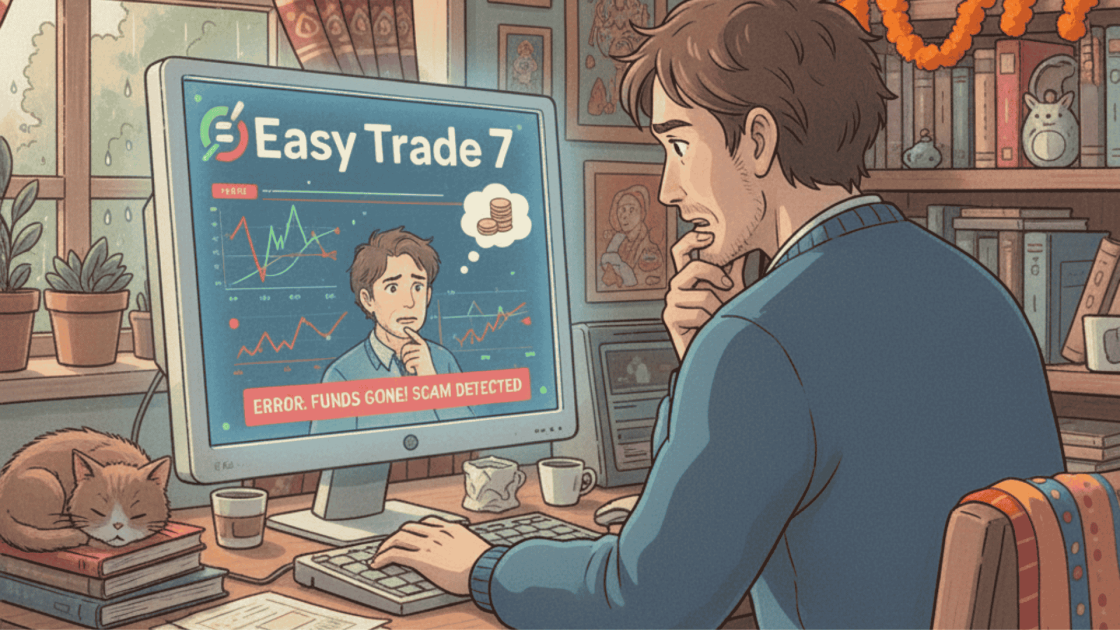

Looking to invest a small amount and make quick profits online? Platforms like EasyTrade or EasyTrade7 promise just that: low investment, zero brokerage, and high returns.

But behind these flashy ads lies a harsh reality: many investors are losing money, facing blocked withdrawals, and falling victim to scams. Many investors wonder, is Easy Trade real or fake?, as complaints and fraud reports continue to rise.

In this Easy Trade review, we’ll dive into what EasyTrade7 offers, identify potential red flags, share real-life user experiences, and guide you on how to report any issues.

Easy Trade 7 Review

EasyTrade7 positions itself as a user-friendly trading platform that caters to both beginners and seasoned investors. Key features include:

- Low Investment Threshold: Start trading with amounts as low as ₹10.

- Zero Brokerage Fees: No charges on trades, making it appealing for cost-conscious investors.

- Diverse Investment Options: Access to stocks, options, and other financial instruments.

- Intuitive Interface: Designed for ease of use, even for those new to trading.

While these features sound enticing, it’s crucial to examine the platform’s legitimacy and user experiences before diving in.

How EasyTrade7 Works?

Here’s the reality behind the platform:

- Aggressive Marketing: EasyTrade7 heavily promotes itself through WhatsApp, YouTube ads, and social media. It shows “success stories” of people making big money fast.

- Small Initial Returns: When you deposit a small amount, you might see some profit, which builds trust.

- Encouragement to Invest More: Once you feel confident, the app pushes you to invest larger sums to earn even bigger returns.

- Withdrawal Issues: When you try to withdraw larger amounts, your funds might be delayed, blocked, or even disappear.

- Fake Profit Display: Charts and balances can be manipulated to make it look like you’re earning, even when the app isn’t trading on real markets.

The pattern is clear: lure users with small wins, build trust, and then make it difficult to take money out. This is a classic strategy of fake trading apps.

Easy Trade Red Flags

Investing in EasyTrade comes with several warning signs:

- Unregulated Platform: EasyTrade7 is not registered with SEBI or any recognized financial authority in India. Without regulation, investors have no legal protection if funds are lost.

- Unrealistic Returns: The platform promises returns far higher than market norms, which is a common tactic to lure unsuspecting investors.

- Withdrawal Problems: Many users report that their deposits don’t reflect in their accounts, or withdrawals are delayed, blocked, or require additional fees.

- Unresponsive Support: Emails, customer service chats, and phone numbers often go unanswered.

- Opaque Operations: Ownership details, company addresses, and other vital information are unclear or unverifiable.

These red flags indicate that EasyTrade is not a legitimate trading platform and should be approached with extreme caution.

Easy Trade Scam: Real Cases

The consequences of EasyTrade’s fraudulent operations are serious and have affected ordinary citizens across India:

- Panchkula, Haryana: A 62-year-old investor lost ₹48.5 lakh after being persuaded to invest through a YouTube advertisement promoting high returns. The platform initially allowed small withdrawals to build trust, but when the investor tried to withdraw larger funds, the money disappeared.

- Delhi: A senior citizen was defrauded of ₹38.5 lakh through a fake trading app. The victim was convinced to transfer funds via UPI and online banking, only to find that withdrawals were blocked and support was unresponsive.

- Other Cases: Professionals, retirees, and first-time investors have reported losses ranging from a few thousand to several lakh rupees. Many experienced delayed transactions, frozen accounts, or outright disappearance of their invested money.

It’s important to note that, as of now, no high-profile individuals or celebrities have been publicly linked to EasyTrade scams.

The primary targets are ordinary investors who are new to online trading and easily attracted by promises of quick profits.

How to Report Fake Trading Apps?

If you or someone you know has been affected by EasyTrade or similar platforms, immediate action is crucial. Here’s how victims can report and seek assistance:

- National Cybercrime Reporting Portal:

- File a complaint at cybercrime.gov.in with all relevant evidence, including transactions, screenshots, and app details.

- Local Police:

- Lodge a First Information Report (FIR) with the nearest police station. Provide all communications, transaction history, and screenshots to strengthen your case.

- SEBI Complaints:

- For unregistered investment platforms, contact SEBI directly by sending an email with all evidence.

Reporting quickly increases the chance of tracing fraudulent transactions and holding the perpetrators accountable.

Need Help?

If you have been scammed in such scams, then register with us now. We will guide you through the process of raising the concern and help you with the recovery process.

Take a quick action now and protect your mental peace.

Conclusion

EasyTrade/EasyTrade7 is a classic example of a fake trading app scam. By promising high returns with minimal investment, the platform lures ordinary people into investing, manipulates data, and blocks withdrawals.

Victims often suffer significant financial losses and emotional distress.

High returns with low risk don’t exist.

Always verify the regulatory status of any trading platform, research before investing, and be wary of aggressive marketing tactics.

If you’ve encountered a scam like EasyTrade, report it immediately and help protect others by raising awareness.

Vigilance and informed decisions are the best defense against such fraudulent platforms.