Lack of knowledge and awareness often makes it easier for scammers to mislead or manipulate individuals new to trading and investment.

Deepak (name changed) fell victim to one such fraud when a broker manipulated him using a fake app, ultimately causing a significant loss of capital.

However, with our team’s dedicated efforts, Deepak was able to recover ₹1,00,000/- from the scam.

Curious to know how? Continue reading to uncover the full story!

How Did a Broker Mislead Deepak?

Generally majority of brokers provide legitimate services, while some take advantage of investors’ lack of information to manipulate them for profit.

This is accomplished through a variety of deceptive strategies, like restricted trade control, high brokerage fees, fake documentation and KYC, and manipulative trading advice.

Deepak started his journey of losses in 2022 when he opened an account with the stock broker Share Trading (name changed). He was excited to start trading in the stock market.

Initially, everything seemed fine, but soon Deepak noticed an unusual feature of the app that allowed him only to deposit money in the account and prohibited him from executing any orders through the account.

Even after that Deepak continued to use the platform for trading. The broker’s RM, Preeti, told him to follow his recommendations to make profitable trades.

However, due to the lack of features for placing a buy or sell order, Preeti was handling Deepak’s account and instructed him to confirm all the trades she recommended on the call for records.

Deepak, who used to remain busy with his work, followed Preeti’s advice blindly.

One day following Preeti’s advice Deepak bought 1,00,000 shares of Vishesh Infotech at ₹0.75. Although the trade seemed to be risky, still he gave a node to proceed. Soon the share price fell, and Preeti advised to sell at ₹0.50, resulting in losses.

Before making a selling decision, Deepak asked Preeti about the brokerage fees.

At that time he came to know that he had to pay ₹0.25 per share as a brokerage. This means that for the trade in Vishesh Infotech, the brokerage would be ₹50,000. This left him in shock. He then requested the broker to transfer those shares to his Zerodha account.

Pretty obvious broker denied it and asked him to visit the Mumbai office for the same. Simultaneously Preeti insisted Deepak place the order as the price might fall further. Deepak was left with no other option than to follow RM’s recommendation.

He paid 50,000 plus taxes.

Over the next few months, RM started giving him recommendations in F&O trading. Here too he was facing losses. Deepak was frustrated and he asked the broker to stop trading and close his account.

But again, they insisted he should visit their Delhi branch to close his account. Luckily Deepak was in Delhi and he decided to visit the Delhi office.

That’s when Deepak discovered that Preeti, his RM had completed the KYC by forging his signature. She had even provided false details about his family.

Apart from this, he found that in the sell order of Vishesh Infotech, the broker had mentioned the wrong selling value. Instead of ₹0.50, the broker mentioned ₹0.25. However, on checking the stock history, the share price of the company had never hit that low value.

That made it clear that the broker did it to hide high brokerage fees.

Deepak got furious and he decided to take action against the broker. However, he didn’t find any source for the same.

After 2 years of that case, he finally found our platform and decided to escalate the issue further and recover his losses.

How Our Team Helped Deepak in Recovering ₹1,00,000/-?

Since the case happened in 2022, Deepak did not have any concrete proof initially. He reached out to our team only with the details of the scam.

Our team understood the case and asked him to share the DP ID and other account details.

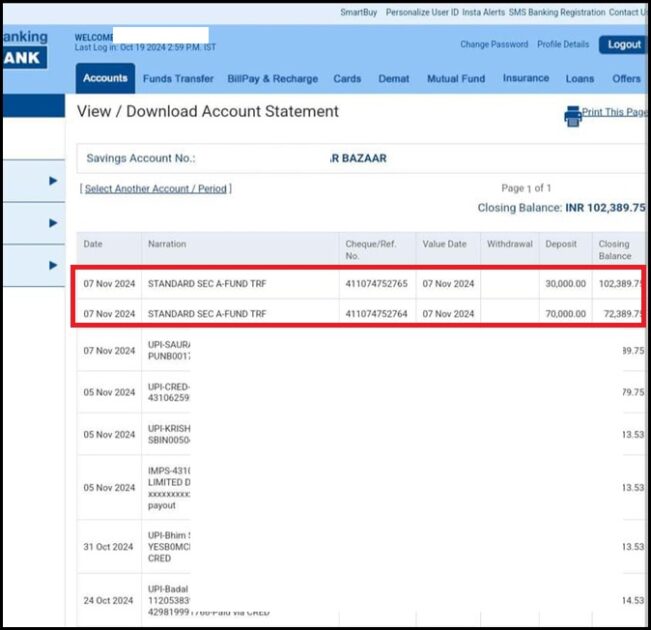

That ID helped our team to uncover the true extent of the fraud. Here’s how the trading scam recovery happened:

- Reporting about the fraud: The team reported the matter on the respective platform first by sending an email to the compliance officer

- Investigation details: Our research discovered that Deepak ultimately paid ₹61,000 for the brokerage, and the broker’s advice resulted in a ₹1,78,000 loss. In all, Deepak suffered a total loss of ₹2,39,000.

- Broker’s reaction: Just within a few days after filing the case, Broker himself called Deepak and agreed to pay ₹1,00,000 after mutual discussion.

Ultimately, the efforts paid off and Deepak was able to recover 43% of his losses with our team’s help.

What Can You Learn From Deepak’s Case?

Every case and story leaves a lesson for others. Here is what you can learn from Deepak’s story.

- Be aware of any broker-controlled platforms: Never trust any platforms where you have no control over executing your orders and the only option you have is to deposit money in such an account.

- Verify broker details: Make sure to do proper research about the broker and check for any fraud cases against him.

- Know about the brokerage fees: Always remember broker will charge fees from you for executing any trades on your behalf. Ask about the brokerage fees and any other associated costs.

- Avoid trusting the Broker’s recommendations blindly: Make sure you do proper research about the broker’s recommendation before relying completely on it.

- Report the fraud immediately: Do not sit and waste your time in regretting what happened, instead take action instantly and reach out for help to report the fraud.

Conclusion

Deepak’s case serves as a strong example of how dishonest brokers may defraud even seasoned investors. However, his perseverance and prompt actions resulted in a partial return of his money.

To prevent becoming a victim of fraudulent schemes like the one Deepak encountered, investors should remain alert, ask questions, and double-check information before making any trades.

Are you facing a similar situation and looking for help? Drop your contact details below and our team will contact you to raise concerns about your issue.