In the crowded world of online earning apps, countless platforms claim you can make money with just a few taps. One such name that grabbed massive attention was Fiewin.

But behind the flashy promises and quick rewards, there’s a lot more that users need to know.

Fiewin started off as an exciting “play and earn” app, offering mini-games, lucky draws, and daily challenges that promised instant cash. It spread like wildfire across India, especially among students and young job seekers hunting for easy side income.

At first, everything looked convincing. The app had a smooth, attractive interface, and users even received small payouts that made it feel legitimate. To play, people were encouraged to “top up” their wallet balance, and early withdrawals helped build trust.

But as more users joined, serious issues and allegations began to surface, raising important questions about how safe and genuine the platform really was.

Fiewin Review

Fiewin entered the scene with a tempting promise: deposit a little money, play a few quick games, and watch your earnings grow. It felt easy, fun, and almost too good to be true, and as it turns out, it was.

What really powered Fiewin wasn’t gaming skill or luck; it was a pyramid-style referral engine. New users poured in their deposits, and that fresh cash was used to pay the earlier players.

Every time someone referred a friend, they unlocked attractive bonuses, one of the biggest red flags of digital Ponzi schemes.

As the platform exploded with millions of users and crores in deposits, the cracks began to show. Withdrawals suddenly stopped working, accounts were mysteriously frozen, and customer support vanished into thin air.

And the so-called “gaming ecosystem”? It wasn’t where the money was going at all. Behind the curtain, funds were being routed through fake accounts, layered through different channels, and ultimately converted into cryptocurrency, making the money nearly impossible to trace.

Fiewin Real or Fake

If you’ve been asking yourself whether Fiewin is real or fake, you’re definitely not the only one; and the answer is far more serious than most people expect.

Recent investigations have dug deep into how this platform works, and what they uncovered is shocking.

Investigators followed the money trail behind Fiewin, and it didn’t lead to any legitimate company or regulated financial system.

Instead, they found that user deposits were being funnelled into multiple Indian bank accounts owned not by the company, but by individuals acting as “recharge agents.” These agents were paid small commissions just for allowing their accounts to receive money from users.

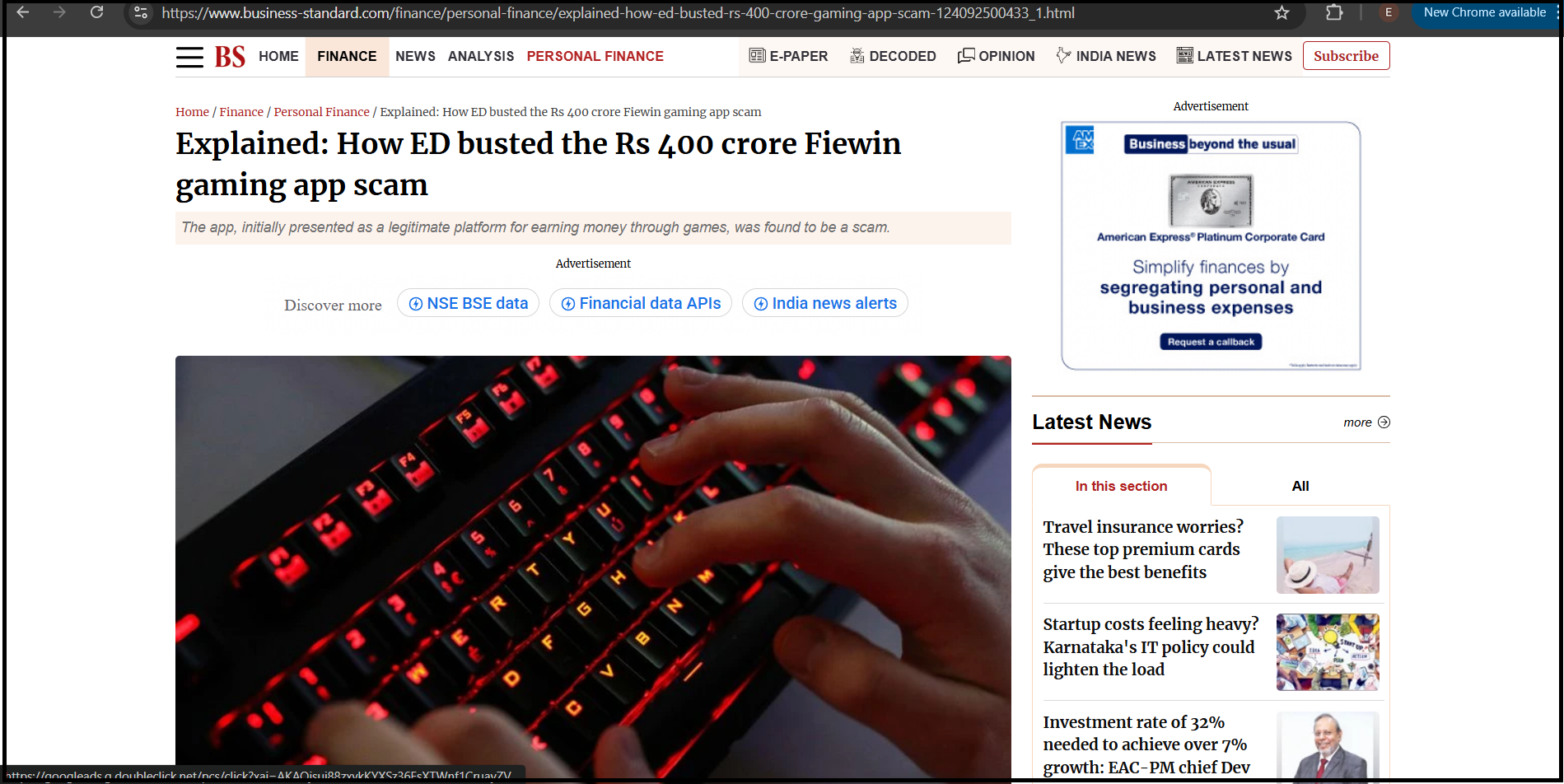

Authorities have uncovered a massive fraud, reportedly amounting to approximately ₹400 crore (or over $47 million), linked to the Fiewin app.

But here’s where it gets even more alarming:

The moment the money landed, it was quickly moved out, shifted through several accounts, converted into cryptocurrency, and then transferred to foreign wallets.

Once it enters the crypto pipeline overseas, tracking or recovering the money becomes nearly impossible.

So if you’re curious about whether Fiewin is safe or legitimate, these findings paint a very clear, and very concerning picture.

Is Fiewin Legal?

When a gaming or earning app becomes popular, the first question everyone should ask is: Is Fiewin legal?

The short answer is: Fiewin is not a legally operating and trustworthy online gaming platform.

The Indian government agency, the Enforcement Directorate (ED), has initiated a major investigation into the Fiewin app, leading to arrests and the uncovering of a massive fraud network.

Funds collected from users were allegedly laundered through a complex cross-border network involving “mule” bank accounts, conversion to cryptocurrency (USDT), and transfer to wallets operated from the Chinese mainland.

Is Fiewin Safe?

In the world of “easy money” and digital gaming, a platform like Fiewin, which gained popularity by promising effortless earnings through mini-games, raises serious security and legitimacy concerns.

Fiewin didn’t fool people overnight. It played a clever psychological game, one that looked harmless in the beginning but turned into a trap for thousands.

It all started with tiny wins.

The app happily allowed small withdrawals at first, making users believe, “This is legit, maybe I should put in a little more.”

Then came the bait.

Referral bonuses, flashy contests, and promises of fast earnings pushed users to deposit higher and higher amounts. And just when someone’s balance became big enough to feel exciting, everything changed.

Suddenly:

- Withdrawals failed for no clear reason

- Accounts were mysteriously frozen

- Customer support became painfully slow or started sending robotic replies

Some victims even received odd messages saying they must deposit more money for “verification” before their withdrawal would be released.

Of course, once they deposited that extra amount, nothing happened; it was another tactic to squeeze out every last rupee.

Fiewin Scam Cases

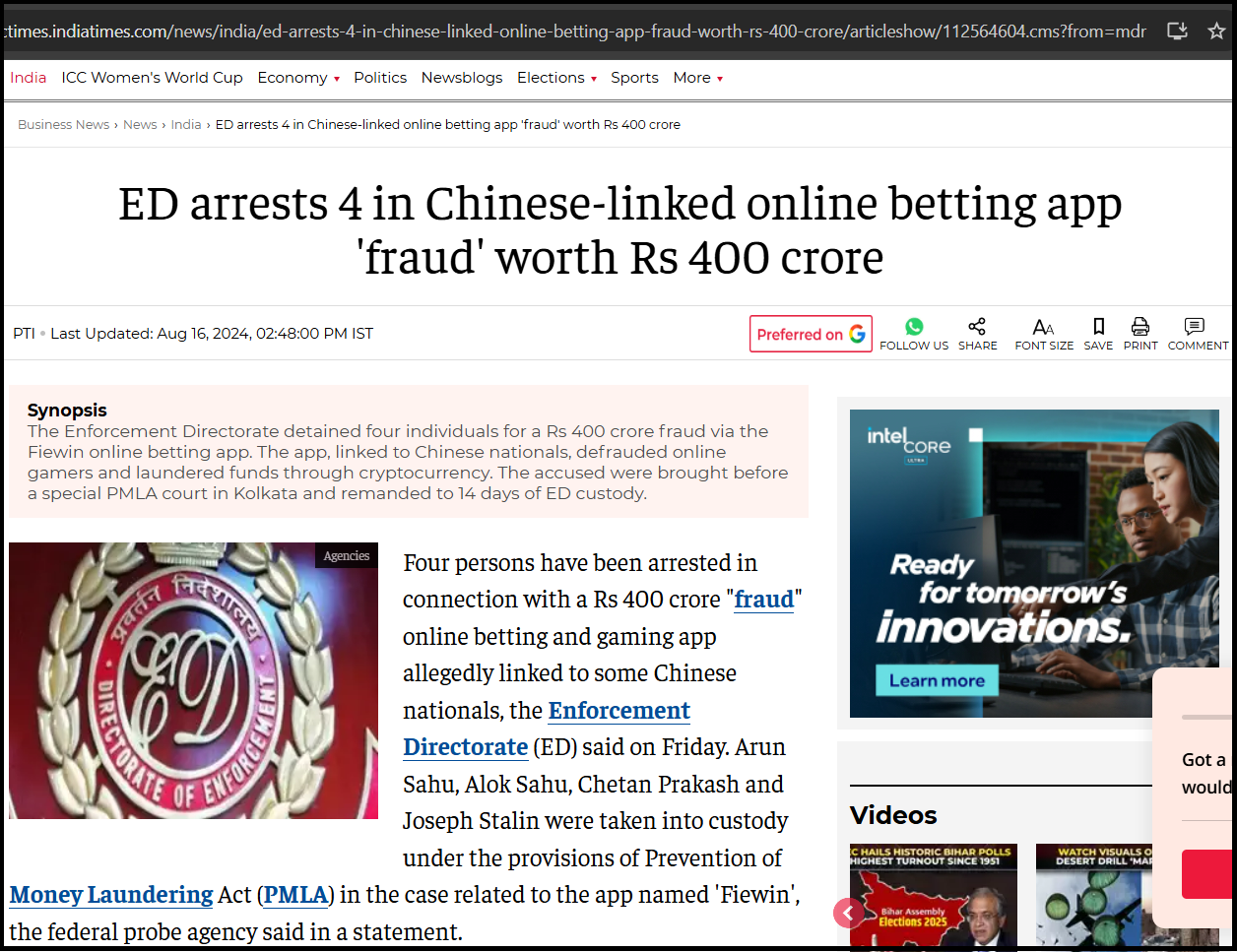

In the case involving the app “Fiewin,” Arun Sahu, Alok Sahu, Chetan Prakash, and Joseph Stalin were arrested in accordance with the Prevention of Money Laundering Act (PMLA).

The agency discovered that Rourkela, Odisha-based Arun and Alok Sahu served as “recharge persons” and converted the money from the app into cryptocurrency in their bank accounts.

According to the report, the two “laundered” and deposited the cryptocurrency obtained from the Fiewin app into Chinese nationals’ wallets on the international cryptocurrency exchange Binance.

Software engineer Joseph Stalin of Chennai assisted Pie Pengyun, a Chinese national from Gansu province, in becoming co-director of his company, Studio 21 Pvt Ltd.

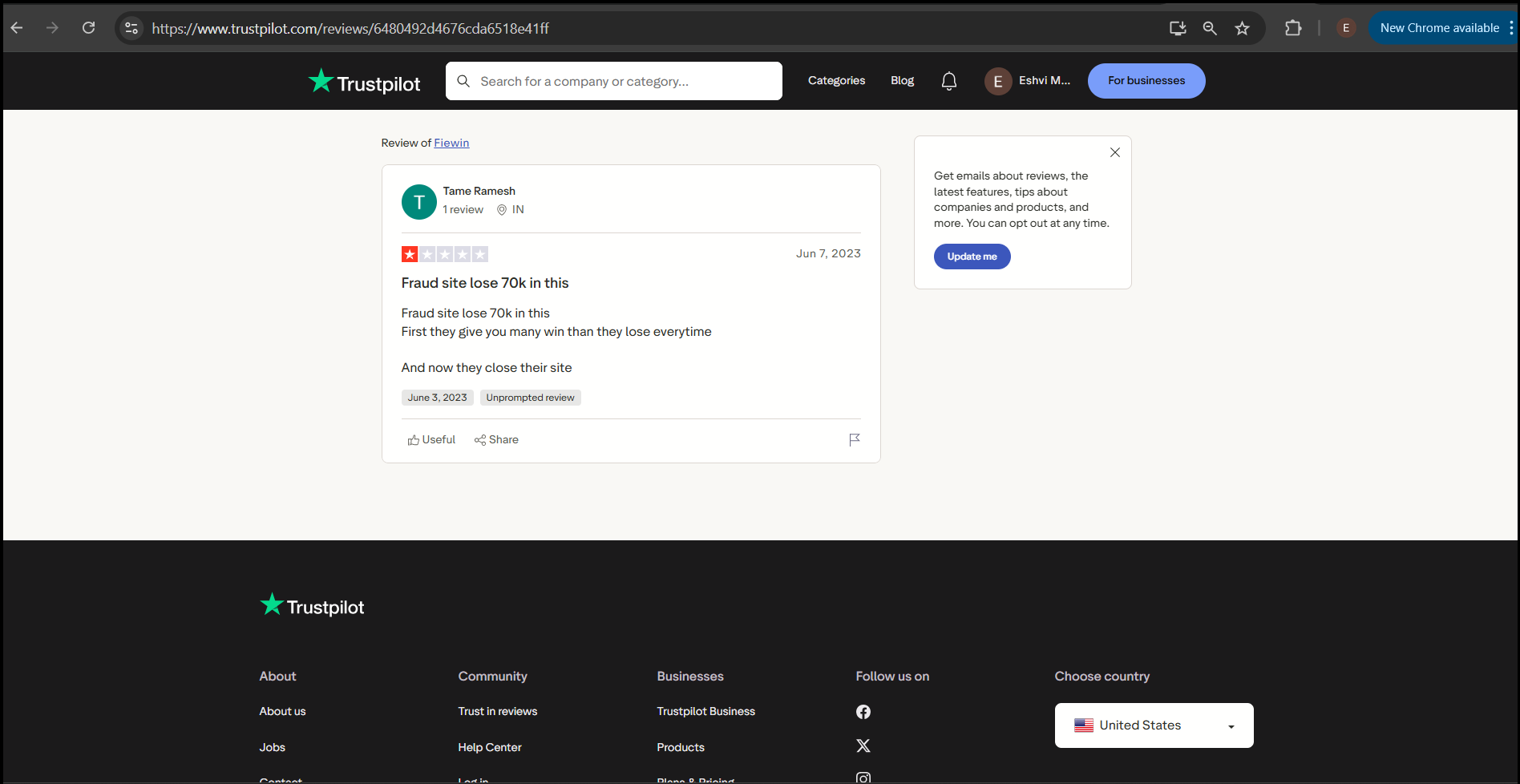

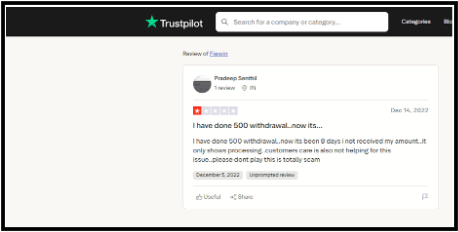

Social media platforms like Telegram, X (Twitter), and YouTube are filled with testimonies from users who lost their savings. Many claimed they were initially paid small rewards before the app stopped working altogether.

Multiple community forums also shared stories of how users were promised “guaranteed returns” or “quick cash” from gaming – only to end up being scammed.

Several videos even showed victims trying to reach the company’s support or trace the domain, which had no valid contact details or office address.

These findings reveal that Fiewin was never designed as a legitimate gaming enterprise – it was a money circulation network masked under the appeal of online entertainment.

These should serve as a checklist for spotting future scams before investing time or money.

How to Register a Complaint Against Fiewin Scam?

If you have lost money on Fiewin or a similar platform, here’s how to take action:

- Collect all evidence: Save screenshots, transaction IDs, chat logs, and app details.

- Report the fraud online: Visit https://cybercrime.gov.in and file a cyber crime complaint under “Online Financial Frauds.”

- Inform your bank: Report the fraudulent transaction and request immediate blocking or reversal.

- File a police report: Contact your nearest cybercrime police station for an official FIR.

Need Help?

If you want step-by-step support in filing your complaint, you can register with us.

We guide victims through documenting evidence and submitting official reports through proper legal channels.

Conclusion

The Fiewin saga serves as a major wake-up call for online users in India. What started as a casual gaming platform turned into a ₹400 crore digital laundering operation, exploiting thousands of unsuspecting players.

The app’s tactics – small early payouts, referral schemes, and crypto transactions – were carefully designed to blur the line between gaming and gambling while quietly draining public money.

It’s a powerful reminder that no legitimate platform promises instant income for minimal effort.

Always research, verify, and think twice before trusting any app with your hard-earned money.

Fiewin wasn’t just a gaming app – it was a sophisticated trap that turned digital play into financial ruin for thousands.