In the fast-moving world of online trading, one thing matters more than strategies, indicators, or even profits: clarity. For Indian traders navigating Forex and CFD markets, that clarity often feels frustratingly out of reach.

Regulations appear complex, opinions clash across forums, and every promising broker seems to come with a big question mark.

FP Markets is one such name that keeps popping up in trading communities. Backed by Australia’s strong financial ecosystem, it has attracted the attention of thousands of Indian traders seeking global market access.

But here’s the real question every trader eventually asks: Is trading with FP Markets actually legal in India?

This blog takes you through the regulatory reality, strips away the confusion, and examines how FP Markets fits into the Indian trading ecosystem. From compliance and safety to what Indian traders experience in practice, we’ll break it all down in simple terms.

Whether you’re an experienced scalper chasing tight spreads or a beginner exploring global markets for the first time. Understanding the legal ground you’re standing on is the smartest trade you can make.

Is FP Markets Legal in India?

Founded back in 2005, FP Markets isn’t a newcomer trying to make quick noise in the Forex and CFD space. It’s a seasoned Australian-based global player that has been operating for nearly two decades.

It is an eternity in an industry where many platforms appear overnight and disappear just as fast.

That long track record alone sets it apart from the usual “fly-by-night” names traders often worry about.

What makes FP Markets stand out is how it operates behind the scenes. As an ECN (Electronic Communication Network) broker, it doesn’t act as a middleman setting prices or taking the opposite side of your trades.

Instead, orders are routed directly to a network of major liquidity providers, including large international banks.

For traders, this structure translates into tighter spreads, minimal interference, and fast execution, features that appeal especially to experienced and high-frequency traders.

But this is also where an important question arises: is FP Markets legal in India?

This question comes up often, particularly among Indian traders who come across offshore brokers offering global market access, leverage, and competitive pricing.

The answer, however, is not a straightforward yes or no.

FP Markets operates outside India’s regulatory framework, which places it, much like many international trading platforms, in a legal grey area for Indian residents.

It sits squarely in a regulatory gray zone that every Indian investor should understand before clicking “open account.”

Start with SEBI. In India, the Securities and Exchange Board of India is the only authority that can legally regulate brokers offering trading services to Indian residents. FP Markets is not registered with SEBI.

This means it cannot legally offer currency or derivative trading on Indian exchanges such as NSE or MCX.

So while the platform may look professional and internationally regulated, it does not fall under India’s primary market watchdog.

Then comes the RBI angle. Over the past few years, the Reserve Bank of India has repeatedly warned investors about unauthorised electronic trading platforms.

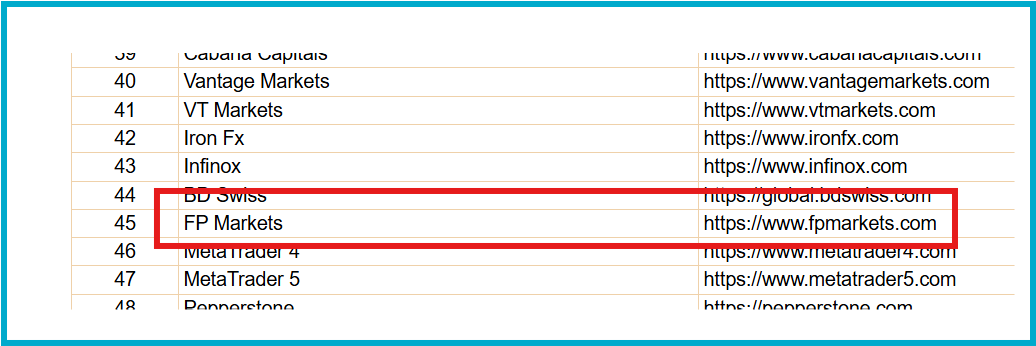

As of late 2025 and early 2026, FP Markets has featured on the RBI’s “Alert List” alongside other offshore brokers.

Being on this list doesn’t mean the website is blocked. But it does signal that the platform is not authorised to solicit or facilitate trading for Indian residents.

While you can physically access the platform and open an account from your smartphone, the most critical question is: Is FP Markets safe for Indian traders within the local legal framework?

Now consider FEMA, the Foreign Exchange Management Act. This is where many traders unknowingly cross a line. Trading in non-INR currency pairs like EUR/USD or GBP/USD through an offshore broker typically involves sending funds abroad for speculative purposes.

Under FEMA, this can be interpreted as a violation, even if many retail traders assume it’s harmless or common practice. If a dispute arises or your funds are restricted, you are essentially on your own.

FP Market Complaints

When many complaints are there regarding FP Markets withdrawal problems, a closer look at user feedback shows that most complaints around FP Markets don’t stem from trading losses, but from repeated technical frustrations that traders simply can’t ignore.

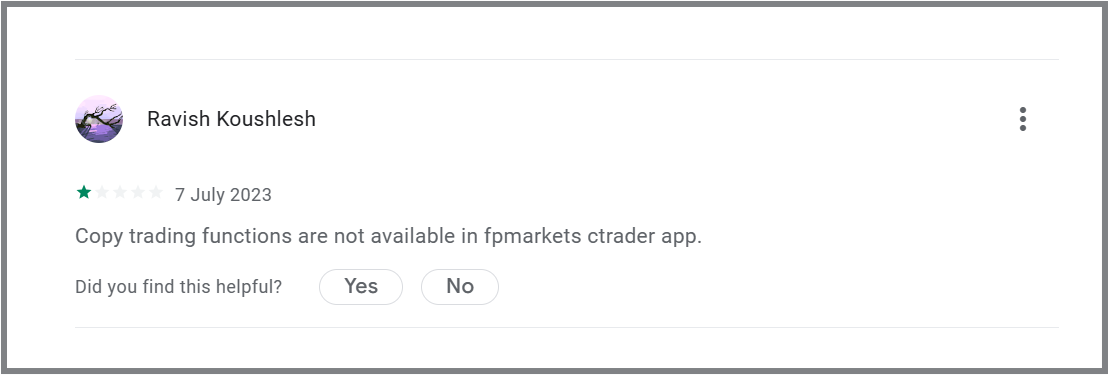

Many users say the cTrader experience doesn’t live up to expectations, especially when it comes to copy trading. Several traders claim the copy trading feature is missing altogether on the FP Markets cTrader app, leaving them confused after signing up specifically for that function.

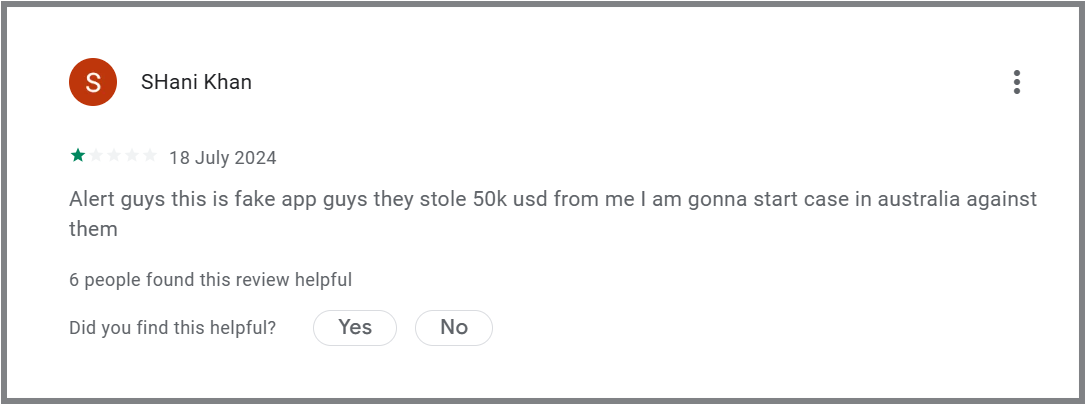

Then there are far more alarming voices. Some users openly accuse the app of being fake, alleging massive losses and even threatening legal action in Australia after claiming their funds were taken.

While such statements reflect individual experiences and allegations, they clearly show the level of anger and distrust felt by affected users.

How to Report a Forex Trading Platform?

If you believe you have been misled or have encountered a “clone” website pretending to be FP Markets, you should act immediately:

- Report illegal collection of money or unauthorised ETPs at the RBI Sachet portal

- File a Cyber Crime complaint.

- File a complaint at the local police station

Need Help?

If you have funds stuck in an offshore platform or believe you’ve fallen victim to a fraudulent “trading guru” claiming to represent a broker, don’t wait until it’s too late.

Register with us. Our expert team will help you.

Conclusion

FP Markets often comes up in conversations about “safe” global brokers, and for good reason. Internationally, it’s well-regulated, widely used, and considered a serious, professional trading platform.

On the global stage, its credibility isn’t really in question.

But here’s where Indian traders need to pause and look closer. While FP Markets may be legitimate worldwide, it isn’t authorised by the Reserve Bank of India. That doesn’t automatically make it a scam. But it does place it in a grey zone for Indian residents.

Use only money you can afford to lose, understand the regulatory gap, and keep yourself updated with the latest RBI circulars.

In markets, information is protection, and informed caution is always smarter than blind confidence.