Seeing ads for the Future Life app promising daily earnings of ₹1,200 to ₹100,000 through “computing power investment”?

Before you download or invest a single rupee, check is Future Life app real or fake.

Is Future Life App Safe?

Well, the platform claims to be an investment platform where users can participate in the technology ecosystem

The app portrays itself as a platform where users can “participate” in this technology ecosystem, mainly through investment-style plans that promise benefits tied to computing power or tech growth.

Let’s dig deeper to understand what the app promises to trap users.

Earn ₹1,200 to ₹100,000 daily through computing power rental services.

Really?

Does it seem legit to you?

Let’s give you a reality check!

According to ScamAdviser, the platform’s domain futuretechnology.life received a low trust score with major red flags:

- Uses free email services (Gmail/Hotmail) instead of business emails

- Hidden website ownership information

- Recently registered domain

Still looking at the positive side.

So, let’s be more practical.

According to what app claims, if one million users earned just the minimum ₹1,200 daily, the company would need to pay out ₹2.4 billion monthly.

Do you think that any legitimate computing business generates such impossible profits?

Of course not!

And hence it proves that Future Lite app is not legitimate and most likely running a classic Ponzi scheme where new investor money pays earlier investors.

Modus Operandi of Future Lite Investment Scam

The Trap Pattern

Stage 1: Small withdrawals work initially (₹500-₹2,000): This builds your trust

Stage 2: You invest more (₹10,000-₹75,000): Encouraged by early success

Stage 3: Large withdrawals suddenly fail: Platform blocks your money

Stage 4: They demand more deposits to “unlock” funds: You pay, but still can’t withdraw

Stage 5: Account lockout

- Password changed without permission

- Money gone forever

Warning from the Federal Trade Commission: Investment scams show fake reports of growing investments while urging victims to invest more.

The company isn’t actually investing your money.

Future Lite App Complaints

While Future Lite advertised itself as a simple way to grow your money, user reviews paint a very different picture.

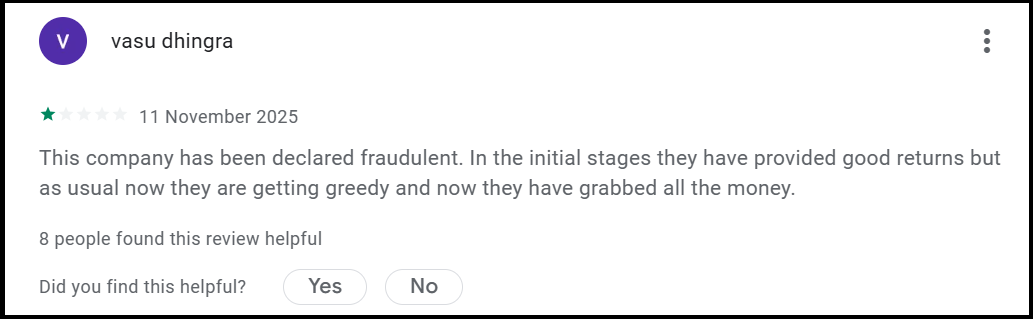

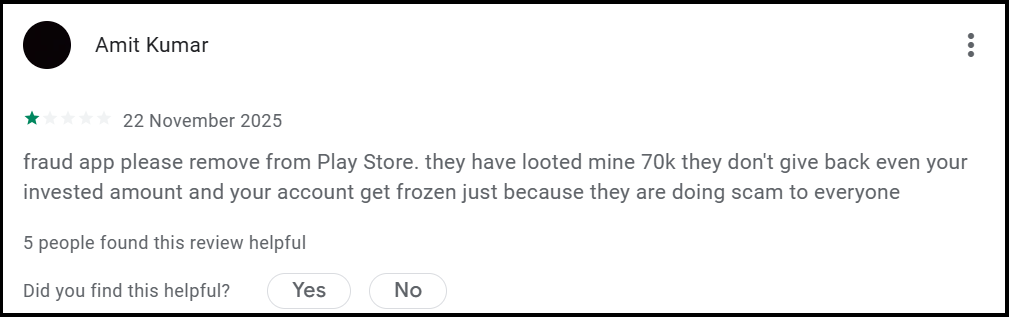

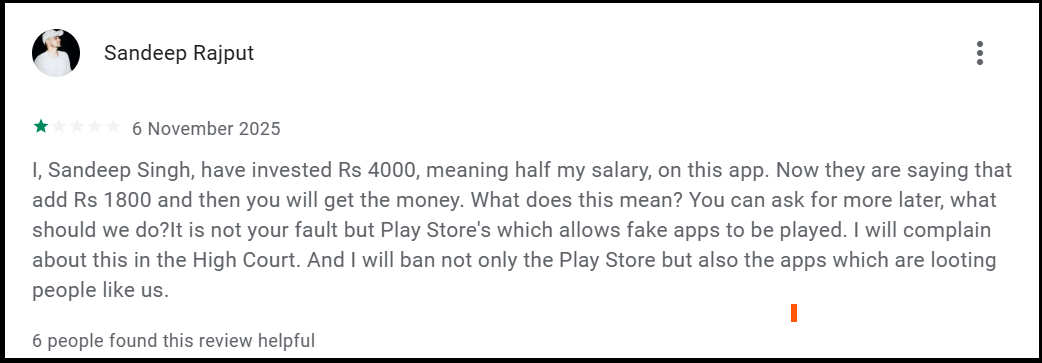

Across November 2025, multiple investors came forward on Google Play with alarming complaints, ranging from frozen accounts to demands for extra payments.

Below is a breakdown of the key complaints and what they reveal about how the platform operates.

- “This company has been declared fraudulent… they have grabbed all the money.”

Vasu’s review highlights a classic pattern seen in scam investment apps:

- Smooth returns in the beginning to build trust

- Followed by delays, silence, and finally

- Complete disappearance of funds

His statement that the company “has grabbed all the money” suggests a pull-out phase, where the operators stop paying altogether once enough deposits have accumulated.

What this indicates

- The platform likely followed a Ponzi-style cycle: pay early users, attract more investors, stop payouts and then vanish.

- Sudden greed and withdrawal blockages are major red flags.

- Declared fraudulent means numerous victims have already reported the platform.

- “Fraud app… they looted 70k… account frozen.”

Amit’s experience is severe — losing ₹70,000, and then having his account frozen after requesting a payout.

What this indicates

- Freezing investor accounts at the time of withdrawal is a typical scam tactic.

- It prevents users from accessing their balance, raising disputes, or withdrawing.

- If multiple users face the same issue, it’s rarely a “technical glitch” — it’s intentional.

Amit’s call to remove the app from Play Store further shows that the problem is systemic, not isolated.

3.“I invested ₹4000… now they want ₹1800 more to release my money.”

This is the biggest red flag of all.

Sandeep reports that Future Lite demanded an extra ₹1,800 as a condition to release his money — a method widely used by fraud apps.

What this indicates

The platform is applying the “unlock fee” scam model:

- First, show users their “profit”

- Then block withdrawals

- Then demand additional charges such as:

- “Tax”

- “Verification fee”

- “Processing charge”

- “Unlock deposit”

- After payment, they ask for more, or simply disappear

Sandeep’s frustration and threat to file a high court complaint show how deeply this scam has impacted victims.

How to Report Investment Scams?

If You’ve Already Invested:

According to the National Cyber Crime Reporting Portal, victims should immediately document all transactions, screenshots, and communication with administrators.

Stop making any further deposits, you won’t recover funds by investing more.

Take Action Now:

- File complaint at cyber crime

- Contact your bank’s fraud department

- Flag the app on the Google Play Store

- Gather all evidence (transaction records, WhatsApp messages, account screenshots)

Need Help?

Register with us now if you’re facing these issues.

Our team will guide you, help secure your evidence, and document your complaint so you don’t lose another rupee to Future Life traps again.

Conclusion

Relationship investment scams build trust over weeks, direct victims to fake websites or apps, and manipulate accounts to appear legitimate.

Future Life follows this exact playbook with unregistered domains, hidden ownership, no regulatory compliance, and mathematically impossible returns that prove it’s a Ponzi scheme.

Real computing power investment platforms have transparent operations, verified regulatory compliance, accessible customer support, and allow easy withdrawals.

Future Life has none of these features. If you haven’t invested, stay away completely.

If you’ve already invested, stop immediately, document everything, and report to authorities; don’t deposit more money chasing lost funds.