If you trade frequently, you already know how even a minor technical glitch, execution delay, or unexpected issue can impact both your performance and confidence.

When such problems occur on a trading platform like Fyers, it naturally makes traders stop and reassess: can I really rely on my broker when it matters most?

This uncertainty is what drives many users to look for real trading experiences, honest reviews, and genuine Fyers complaints before deciding whether to start trading or continue with the platform.

Fyers Review

Fyers Limited is an Indian stockbroking company that’s best known for its modern, trader-friendly platform and low-cost “discount broker” model.

It helps manage your investments online without the heavy brokerage charges that traditional full-service brokers usually charge.

What many traders like about Fyers is its clean interface, strong charting tools, and a platform that feels built for today’s active traders. It’s especially popular among people who prefer doing their own research and placing trades on their own, instead of relying on tips or relationship managers.

At the same time, like any growing broker, the real experience can vary from user to user.

Some traders have a smooth journey, while others may run into issues like app performance during high volatility, order execution confusion, fund/withdrawal delays, or slower-than-expected support responses.

That’s why it’s always smart to understand both the positives and the common pain points before you commit serious money.

If you’re considering Fyers, a good approach is to start small, test the platform during normal and busy market hours, and keep your trade records and communications saved. That way, you trade with more confidence, and you’re prepared if you ever need to raise a concern.

Fyers Review Complaints

Fyers, for many traders, feels like a breath of fresh air. It’s a young, tech-focused discount broker known for its clean interface, advanced charts, and a platform that tries to make trading less complicated.

From equity to derivatives, Fyers operates with the intention to keep things simple and accessible for retail traders who want a smooth, modern experience.

But as the user base grows, so do the questions. Not because the platform is bad, but because every trader wants clarity before trusting their money. Naturally, a few registered complaints show up on public portals, and understanding them helps you decide how the platform fits your needs.

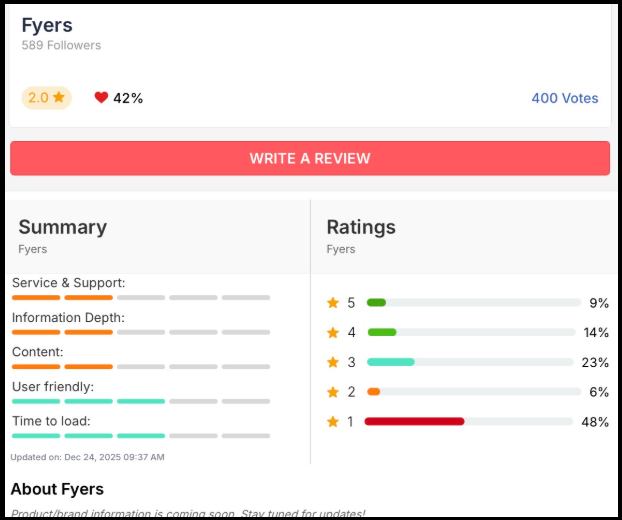

When you look at the public data, you get a clearer picture of how Fyers performs as a growing broker.

However, that doesn’t mean the issues should be overlooked.

Even a small number of complaints can highlight recurring problems that may affect active traders, especially when they involve order execution, platform stability, or customer support.

Understanding these concerns in detail helps traders set realistic expectations and decide whether Fyers aligns with their trading needs.

Fyers NSE Complaints Data

To understand Fryer’s complaints more objectively, let’s have a look at NSE’s broker grievance disclosures. These reports typically show the broker’s active client base, the number of complaints received in a financial year, and the broad nature/category of complaints.

Here’s the snapshot for the last three financial years, as mentioned in the official reports

| Financial Year | Active Client Base | Complaint Received | Percentage of Complaint Received w.r.t. to Active Clients |

| 2022-23 | 222798 | 159 | 0.071% |

| 2023-24 | 222798 | 137 | 0.061% |

| 2024-25 | 238340 | 196 | 0.082% |

| 2025-26 | 2111184 | 81 | 0.003% |

In 2022–23, the organization had about 2.23 lakh active clients and received 159 complaints, which is just 0.071%, already a very small proportion.

The situation improved further in 2023–24, where complaints dropped to 137 while the client base stayed the same, bringing the complaint percentage down to 0.061%. This suggests better service delivery or more effective issue resolution.

In 2024–25, despite a 2.38 lakh client base, complaints increased to 196. However, the complaint ratio was still only 0.082%, indicating that the rise in complaints was in line with business growth and not a cause for concern.

The most notable improvement appears in 2025–26. Not only the complaint, but also active clients have reduced.

In 2025–26, there was a reduction in the number of active clients to about 2.11 lakh.

Along with this, complaints declined significantly to just 81. While the lower client base partly explains the drop, the scale of reduction in complaints is much sharper, resulting in an exceptionally low complaint ratio of 0.003%.

Overall, the conversation these numbers tell is a positive one: customer complaints are consistently minimal, and the latest year shows a significant strengthening in customer satisfaction and service quality.

Type I: Non-receipt / Delay in payment

This category is about money that a client expects to receive but doesn’t get on time (or doesn’t get at all). It includes:

- I a: Delay in payment

- I b: Non-receipt of payment

- I c: Delay in refund of margin payment

- I d: Non-settlement of accounts

What this means for you if you’re considering Fyers (or any broker):

- Your payout (withdrawal) could get delayed, which can be stressful if you need funds urgently or want to rotate capital for trading.

- If margin refunds or account settlement timelines stretch, you may feel “stuck” because your money is technically yours but not accessible when needed.

- Even when the delay is procedural (verification, settlement cycles, compliance checks), it still impacts confidence because traders value quick, predictable access to funds.

Type IV: Unauthorized Trading

This is one of the most serious complaint buckets because it deals with trades or fund/securities movement that the client says they did not approve. It includes:

- IV a: Unauthorized trades in the client account

- IV b: Misappropriation of client’s funds/securities

What this means for you:

- If an unauthorized trade happens, you could face sudden losses, unexpected positions, or margin shortfalls.

- Misappropriation allegations are even more sensitive because they relate to trust and the safety of funds/securities.

- For a new trader/investor, the practical takeaway is to keep strong account hygiene. Always use 2-factor authentication, never share OTPs, avoid remote-access apps, and immediately raise a ticket if you see any trade you don’t recognize.

Type V: Service-related

This is a broad category that covers day-to-day service problems that can affect trading experience and cost. It includes:

- V a: Excess brokerage

- V b: Non-execution of order

- V c: Wrong execution of order

- V d: Connectivity / system-related problem

- V e: Non-receipt of corporate benefits

- V f: Other service defaults

What this means for you:

- If you’re charged more than expected (excess brokerage), your profitability drops, especially for high-frequency traders.

- “Non-execution” or “wrong execution” can directly cause losses if an entry/exit doesn’t happen at the right time or happens at the wrong price/quantity.

- Connectivity/system issues matter most during volatile markets, when delays can quickly turn a manageable trade into a big loss.

- Non-receipt of corporate benefits (like dividends/bonuses/rights entitlements) can create confusion and frustration for delivery investors, even if it’s later corrected.

Type IX: Others

This category is basically a “miscellaneous” bucket. It contains the complaints that don’t neatly fit into Types I to VIII.

What this means for you:

- “Others” can include a mix of issues, like some minor, some important, so the details matter more than the label.

- If a broker shows a repeated pattern in Type IX, it’s worth checking what those complaints typically relate to (support delays, documentation issues, KYC, platform communication gaps, etc.), because the category itself doesn’t tell you the root cause.

Fyers Complaint on Community Platform

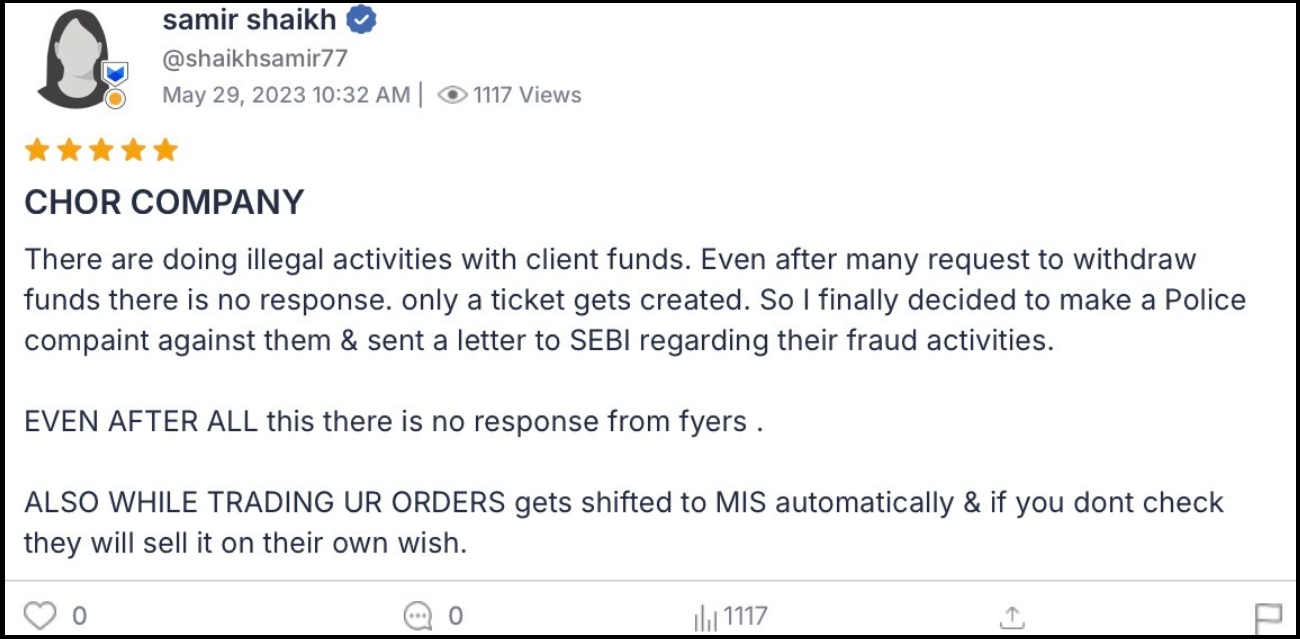

Across multiple review platforms, users have raised serious concerns about delayed fund withdrawals and a lack of response from Fyers. Several complaints suggest that even after repeated follow-ups, users only receive automated tickets without resolution.

In some cases, traders felt compelled to escalate the matter legally or approach regulatory authorities, highlighting frustration over prolonged silence and uncertainty around fund safety.

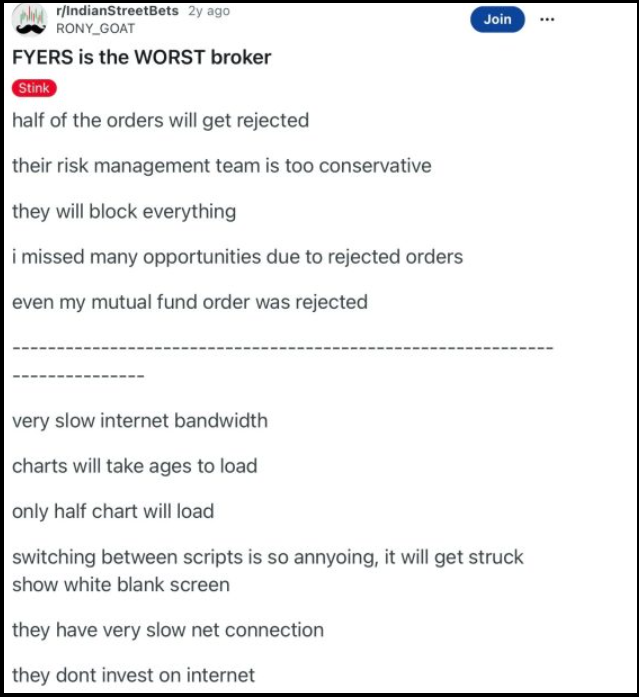

Discussions on trading forums indicate widespread dissatisfaction with order execution and risk management policies. Traders report frequent order rejections, unexpected blocks, and missed opportunities during volatile market conditions.

Many users feel the platform’s conservative controls interfere with active trading, making it difficult to execute even standard trades smoothly.

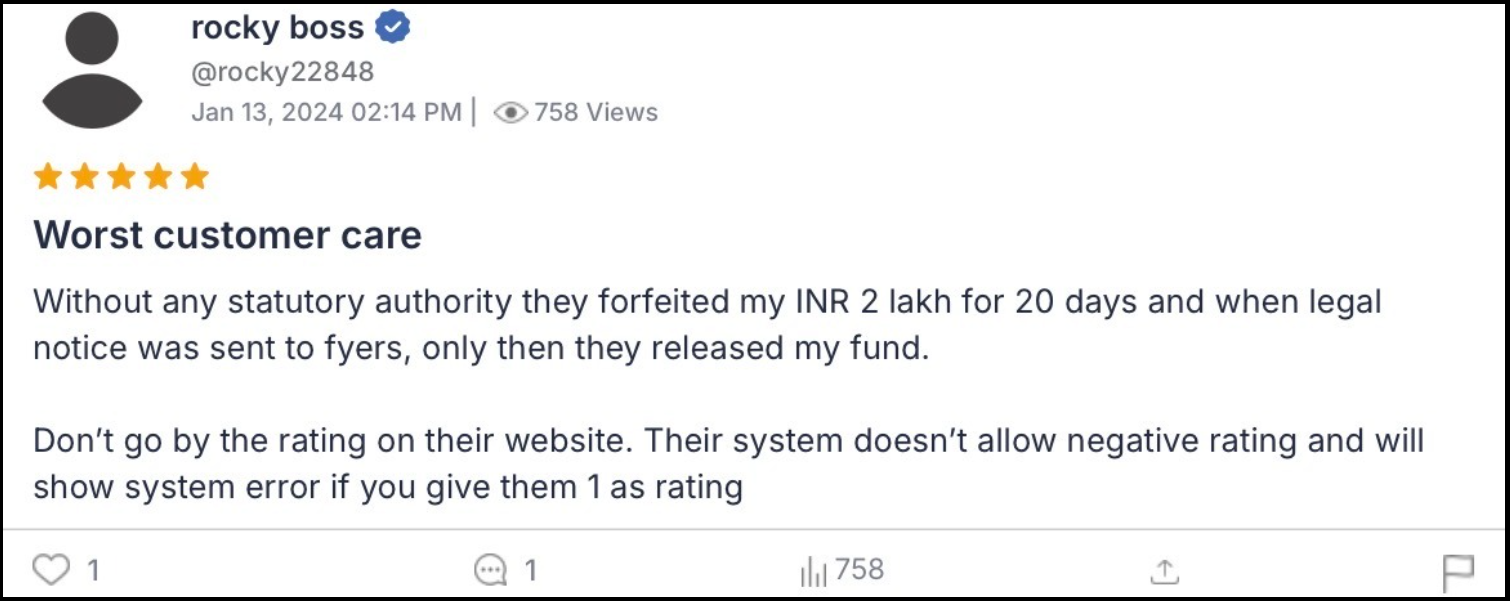

Here is one of the users’ complaints:

This complaint reflects serious allegations related to client fund handling and withdrawal delays. The user claims repeated withdrawal requests went unanswered, leading to escalation through a police complaint and communication with SEBI. Additionally, the user highlights a trading concern where orders allegedly get shifted to MIS automatically, creating a risk of forced square-off if not monitored closely.

The Reddit post focuses on operational and technical issues faced by traders on the platform.

The user reports frequent order rejections, overly restrictive risk controls, and missed trading opportunities. Technical limitations such as slow chart loading, blank screens, and poor platform responsiveness are also highlighted, suggesting infrastructure challenges during active trading hours.

The other reviews describe serious dissatisfaction with support, including complaints about delayed withdrawals or no proper response after raising tickets, and accusations of mishandling client funds (these are allegations shared by users, not verified facts).

In short, the review centers on delayed fund release, where the user claims their money was held for nearly 20 days without statutory authority. The issue was reportedly resolved only after a legal notice was sent. The reviewer also questions the credibility of platform ratings, alleging that negative feedback is restricted or not accepted by the system.

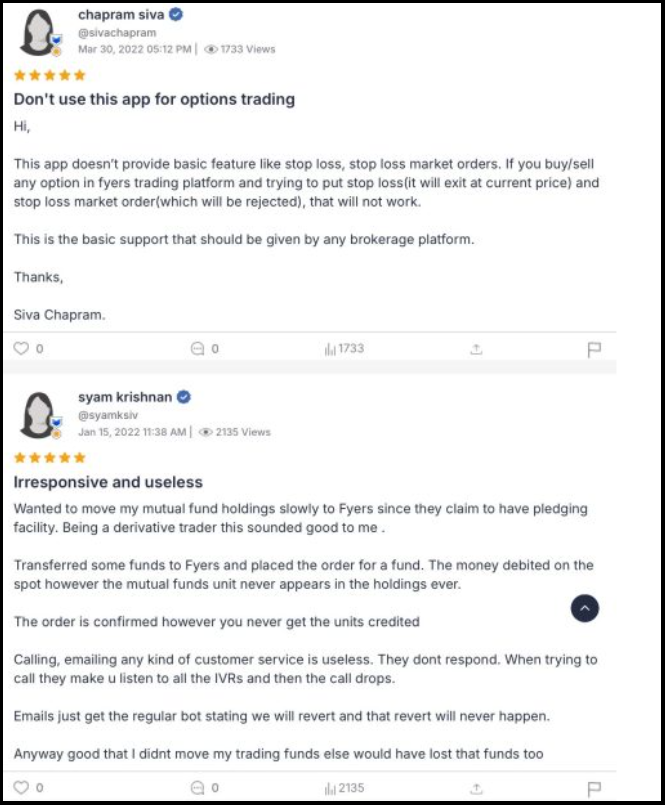

Another complaint specifically addresses the platform’s suitability for options trading. The user points out the absence or malfunctioning of basic order types such as stop-loss and stop-loss market orders. According to the complaint, this limitation exposes traders to execution risks and falls short of what is considered standard functionality in a brokerage platform.

Even the complaint was registered for mutual fund holdings.

The second review above highlights issues related to mutual fund investments and customer support. The user reports that funds were debited for a mutual fund purchase, but the units were never credited to holdings.

Repeated attempts to contact customer support through calls and emails allegedly resulted in automated responses or call drops, raising concerns about post-transaction support reliability.

How to File a Complaint Against Stock Broker?

Handling complaints against brokers, preparing arbitration cases, or navigating platforms like SEBI SCORES or SMART ODR can feel overwhelming.

That’s exactly where we step in. Our goal is to make the entire process smooth, structured, and stress-free for you.

Step 1: Documentation Assistance

We help you gather, organize, and structure every document you need to trade statements, ledger reports, contract notes, call logs, screenshots, emails, and more. Your case becomes stronger because your evidence is complete, clear, and professionally arranged.

Step 2: Drafting Your Complaint

A well-written complaint can make all the difference. Our team prepares clear, accurate, and professionally formatted drafts tailored specifically for NSE, BSE, SEBI SCORES, and SMART ODR.

Step 3: Platform Filing Support

Whether you’re submitting your grievance on SCORES or filing through SMART ODR, we guide you through the entire submission process. Every detail is filled in correctly, so your application isn’t delayed or returned.

Step 4: Escalation Guidance

If your complaint needs to go beyond the broker, we show you the right escalation path, whether it’s approaching the stock exchange, initiating IGRP, or preparing for arbitration. You’re never left guessing what to do next.

Step 5: End-to-End Case Management

Once you register with us, we track your case from beginning to end. We remind you of deadlines, help you prepare responses to regulator queries, and ensure nothing gets missed at any stage.

Step 6: Support During Counseling & Arbitration

If your matter progresses to counseling or arbitration, we help you prepare strong statements, organize your evidence, and get ready with confidence. You’ll know exactly how to present your side clearly and effectively.

When you register with us, you avoid the stress of complicated procedures, confusing paperwork, and drafting errors.

We take over the technical side, so you can focus on your recovery and peace of mind.

Conclusion

Fyers continues to be a popular broker, but like any fast-growing platform, it has a mix of positive user experiences and a few recorded complaints.

Most issues revolve around service delays, technical concerns, payout queries, order execution worries, or a Fyers login issue, things that traders naturally want clarity on before trusting a platform.

The good part is that many complaints get resolved through official channels, and users have a clear path to escalate issues through SCORES, SMART ODR, or Arbitration if needed.

Understanding these complaint patterns helps traders make informed decisions and stay prepared.

In the end, it’s not about avoiding a platform, but about knowing how to protect yourself, track your trades, and use the right channels whenever something goes wrong.